Investors often lean on analyst recommendations to make stock decisions, but should these be gospel truth? Let’s delve into the numbers behind the brokerage recommendations for SM Energy (SM) and decipher how to wield this information wisely.

Understanding Brokerage Recommendation Landscape for SM

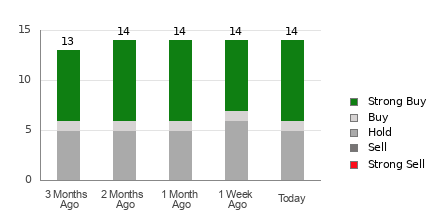

SM Energy currently boasts an average brokerage recommendation (ABR) of 1.79, painting a picture between Strong Buy and Buy. Of the 14 recommendations driving this metric, eight stand as Strong Buy, constituting 57.1%, while one sits at Buy, comprising 7.1% of all suggestions.

Although the ABR may signal a golden invitation, it’s prudent not to base investment decisions solely on this number. Research indicates brokerage recommendations might not hold the Midas touch in steering investors toward stocks with the most pronounced price upticks.

Brokerage firms, due to their vested interest in covered stocks, often exhibit a strong bias towards positivity, with a glaring tendency to shower favorable ratings on them. This could mislead retail investors, painting an overly rosy picture at times. Hence, it’s advisable to corroborate this data with other reliable indicators.

Deciphering Zacks Rank vs. ABR

While both ABR and Zacks Rank command a 1-5 scale, they stand as different yardsticks entirely. Broker recommendations fuel ABR, usually adorned in decimals, exemplifying analysts’ collective sentiment. Conversely, the Zacks Rank leverages earnings estimate revisions, presented in whole numbers from 1 to 5.

Brokerage analysts, swayed by their firms’ interests, often cloak stocks in unwarranted positivity, potentially steering investors off course. On the flip side, Zacks Rank correlates near-term stock movements with earnings estimate trends, backed by robust empirical evidence.

What sets Zacks Rank apart is its balance; all stocks with current-year earnings estimates receive proportionate grades across its five tiers. This model, rooted in earnings estimate revisions, swiftly captures shifting market dynamics, offering a more timely view of future stock prices.

Is SM Energy a Smart Bet?

Latest figures reveal a 0.3% dip in the Zacks Consensus Estimate for SM Energy’s current year to $7.06 over the past month. Amid analysts’ dimming outlook on the company’s earning potential, mirrored in consensus estimate downtrends, the stock clinches a Zacks Rank #5 (Strong Sell).

Given this downgrade and the alignment of other factors, it might be judicious to approach SM Energy’s Buy-equivalent ABR with caution.

Curating the Best Options for Future Growth

Unearth 7 premium stocks handpicked by the experts from Zacks Rank #1 Strong Buys, deemed as “Most Likely for Early Price Pops.” Since 1988, this exclusive curation has outperformed the market twofold with a remarkable +23.7% average annual gain. Don’t let these premier picks slip under your radar!

Avoid getting swept up in the hype; always pair broker recommendations with robust research to craft a winning investment strategy.