When pondering the decision to invest in a stock, it’s common for investors to turn to brokerage recommendations for guidance. The impact of these recommendations, often influenced by media reports, raises the question – do they truly hold weight in the investing world?

Before delving into the reliability of brokerage recommendations and how investors can leverage them to their advantage, let’s peek at the sentiments expressed by Wall Street veterans about Progressive (PGR).

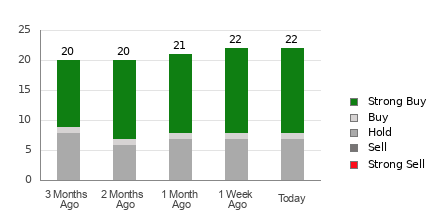

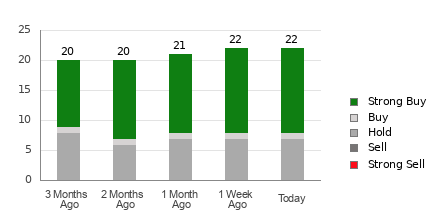

The current Average Brokerage Recommendation (ABR) for Progressive stands at 1.68, falling between Strong Buy and Buy on a scale of 1 to 5. A total of 22 brokerage firms contribute to this rating, with 14 Strong Buy recommendations and one Buy rendering an overall positive outlook.

Insight into Brokerage Recommendations for PGR

The recommendation to buy Progressive seems enticing, yet making investment decisions solely based on this data may not be prudent. Research suggests that brokerage recommendations often lack success in steering investors towards stocks with optimal price appreciation potential.

Why the skepticism? Brokerage firms, owing to their vested interests in covered stocks, frequently exhibit a positive bias in their ratings. Statistics reveal that for every “Strong Sell” recommendation, there are five “Strong Buy” ones – highlighting the disparity in projections.

Hence, these recommendations might serve better as a validation tool for personal research or as a supplement to more reliable indicators that forecast stock price movements accurately.

Distinguishing ABR from Zacks Rank

It’s crucial to differentiate between the ABR and Zacks Rank despite both being scored on a 1-5 scale. While the ABR hinges solely on brokerage recommendations, with decimal ratings like 1.68, the Zacks Rank operates as a quantitative model relying on earnings estimate revisions and is depicted with whole numbers.

Analysts from brokerage firms often lean towards optimistic ratings due to organizational influences, whereas the Zacks Rank’s foundation lies in earnings estimate revisions which manifest a strong correlation with short-term stock price movements.

The Zacks Rank maintains balance across its five ranks, universally applying grades to all stocks with current-year earnings estimates put forth by brokerage analysts. This approach ensures timely reflections of changing business trends and subsequent price predictions.

Assessing Progressive’s Investment Potential

For Progressive, Zacks Consensus Estimate for the current year displays a 3.4% increase over the past month to $13.31. Analysts’ collective positive sentiment towards the company’s earnings outlook, evident in the upward revisions of EPS estimates, signifies a potential uptrend in the stock’s value.

With recent changes in consensus estimates and factors linked to earnings predictions, Progressive secures a Zacks Rank #1 (Strong Buy) designation. This rank substantiates the viability of Progressive as a promising investment.

In conclusion, analyzing brokerage recommendations like the ABR for Progressive sets the stage for well-informed investment decisions. It serves as a complementary tool to validate research and a prelude to further analysis for investors seeking fruitful ventures in the financial markets.