Deciphering the Brokerage Recommendations

Wall Street analysts’ recommendations wield significant influence over investor sentiments, often swaying stock prices based on their ratings. These recommendations, symbolized by a complex dance of numbers and acronyms, are key to discerning the fate of a stock like Netflix (NFLX).

Unveiling the ABR Trend for NFLX

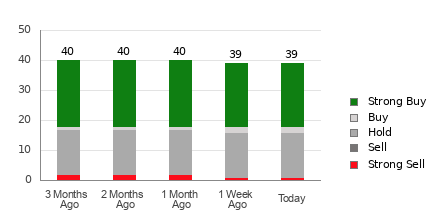

The average brokerage recommendation (ABR) for Netflix stands at 1.91, a figure derived from the amalgamation of ratings provided by 39 brokerage firms. While this number paints the picture of a stock worth betting on, investors must proceed with caution.

The Pitfalls of Blindly Trusting Brokerage Recommendations

Brokerage recommendations, while informative, often veer into murky waters due to inherent biases. Analysts, driven by vested interests, tend to shower stocks they cover with overly optimistic ratings, creating a misleading facade of skewed positivity. In such a landscape, prudence is paramount before plunging into investment decisions based solely on ABR data.

The Zacks Rank: A Beacon in the Stock Market Storm

Enter the Zacks Rank, a proprietary tool meticulously scrutinizing stock performance categories from Strong Buy to Strong Sell. This tool, in stark contrast to ABR, hinges on earnings estimate revisions rather than subjective analyst opinions, offering investors a more grounded approach to decision-making.

Netflix: A Glint of Promise Amidst the Sea of Stocks

With the Zacks Consensus Estimate for Netflix showing a 7.5% surge over the past month, coupled with a Zacks Rank #1 (Strong Buy) designation, the streaming giant emerges as a substantial candidate for lucrative returns. Analysts’ rallying behind Netflix’s earnings potential echoes a sentiment of optimism that investors may find hard to ignore.