The Reality Behind Brokerage Recommendations

Before investors are tempted to bank on Enphase Energy (ENPH), it’s crucial to understand the true worth of brokerage recommendations. Analyst endorsements are pervasive, often causing ripples in the stock market. But can their words be seriously weighted? The answer is a resounding perhaps.

Deciphering Brokerage Ratings for ENPH

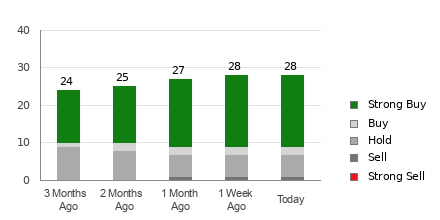

Enphase Energy boasts an average brokerage recommendation (ABR) of 1.88, suggesting a consensus between “Strong Buy” and “Buy.” This rating is constructed from the collective counsels of 33 brokerage firms, with a significant 54.6% pushing for “Strong Buy” and a further 6.1% vouching for “Buy.”

Brokerage endorsements can be likened to a chef’s secret recipe—inviting but not always the recipe for success. Academic inquiries have found these ratings to be subpar in guiding investors towards stocks with the most promising price escalations. The rosy disposition of these recommendations may be due to the vested interests of brokerage firms in the stocks they cover.

The Power of Zacks Rank

Mirroring the stars guiding a ship through a tempest, Zacks Rank provides a strong sense of direction amidst the volatility of the stock market. Its reliance on earnings estimate revisions makes it a beacon of hope for discerning investors, unlike the potentially distorted lens of ABR.

Fresh and timely, the Zacks Rank is a breath of certainty amidst the smokescreen of brokerage recommendations. Whereas ABR may lag, the Zacks Rank tracks closely and reflects the ever-changing tides of the stock market.

Unveiling the ENPH Verdict

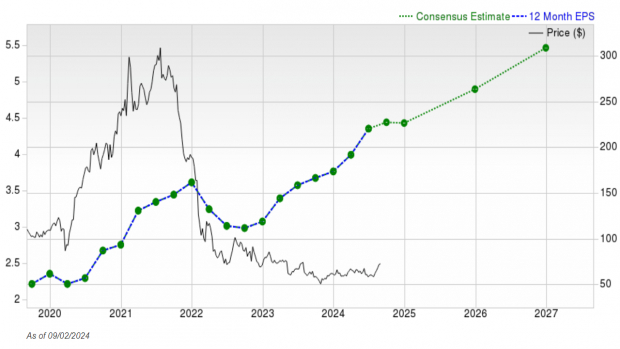

Despite the alluring ABR, the Zacks Rank holds a stern determination, assigning a #4 (Sell) rating for Enphase Energy. The ring of pessimism from analysts, manifested in a 22.2% decline in the Zacks Consensus Estimate for this year, casts a looming shadow over ENPH’s future.

The judicious investor would be wise to take the Buy-equivalent ABR for Enphase Energy with a pinch of skepticism. The Zacks Rank insists on a sober assessment, signaling potential stormy seas ahead.