The cryptocurrency market is abuzz with excitement as the upcoming Bitcoin halving event draws near. This scheduled occurrence reduces the mining rewards for successfully mined blocks. For investors, comprehending the intricate nuances and potential impacts of the Bitcoin halving is indispensable for making well-informed decisions and managing their portfolios effectively.

By delving into the historical outcomes of past halvings and scrutinizing current market trends, investors can adequately equip themselves for the imminent halving and strategically position themselves in the ever-changing cryptocurrency realm.

Unveiling the Bitcoin Halving Process

Bitcoin originates from a process known as mining, where miners engage in competitive efforts to solve complex algorithmic problems. Upon solving a problem, a new block enters the blockchain, and the miner responsible receives a set amount of freshly minted Bitcoin. Initially, when Bitcoin debuted in 2009, the reward stood at 50 Bitcoin per mined block.

The Bitcoin halving recurs roughly every four years or after 210,000 blocks are mined; it does not adhere to a specific time frame, with slight variations in duration owing to fluctuations in mining difficulty and network hash rate. This year’s halving is anticipated around April 20, 2024, reducing the reward from the current 6.25 Bitcoins to 3.125 Bitcoins per block.

Embedded within Bitcoin’s network, the halving diminishes block rewards, decelerating the pace of new Bitcoin creation. This controlled supply aims to counteract inflation, sustaining Bitcoin’s value over time. As halving events unfold, the influx of new coins will gradually diminish until the full 21 million Bitcoins are in circulation.

Impact on Bitcoin Miners

The Bitcoin halving profoundly influences the cryptocurrency’s mining arena and supply dynamics due to the intricacies of the mining process. The duration of the mining process, referred to as block time, typically spans around 10 minutes. To uphold consistency in block creation, the Bitcoin network adjusts mining difficulty based on hash rate, which gauges computational power expended in mining Bitcoin and processing transactions. An upsurge in power signifies heightened miner competition, prompting a more challenging problem. Conversely, reduced miner competition simplifies the puzzle. This mechanism ensures consistent block creation, irrespective of competing miners.

Traditionally, hash rate upticks in the lead-up to halving events but experiences a decline post-halving as inefficient miners are phased out. Eberle elucidated, emphasizing how miners utilizing outdated and energy-inefficient equipment face challenges post-halving due to reduced rewards.

The existing record-high hash rates stem from large mining entities integrating faster, superior equipment while concurrently utilizing older, potentially obsolete machinery. This efficiency enhancement proves advantageous for investors as miners continuously sell Bitcoin to offset operational costs and generate profits when production costs undercut selling prices.

Bitcoin Price Impact Post-Halving

Bitcoin frequently witnesses price surges pre-halving, although with only three such events in history, pinpointing definitive price trends poses challenges.

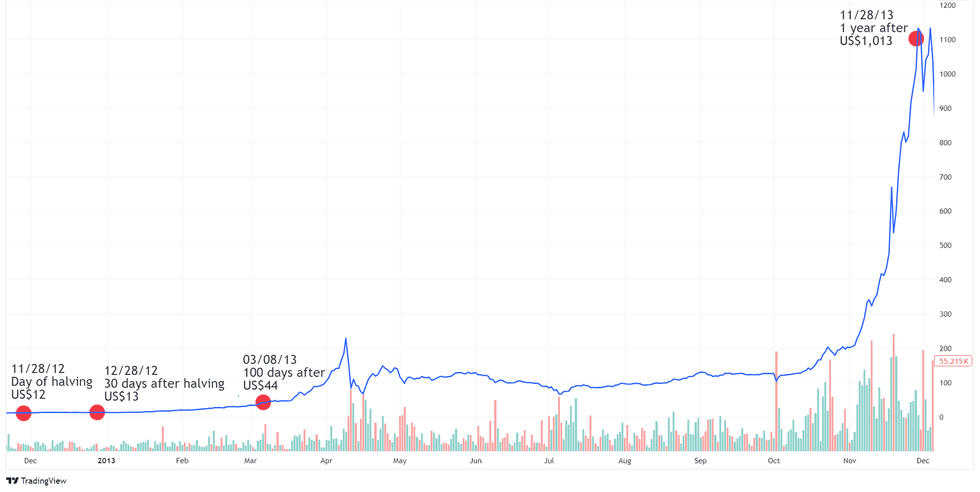

Chart via TradingView

Bitcoin USD price chart 11/21/2012 to 12/05/2013

The inaugural Bitcoin halving on November 28, 2012, halved the mining reward from 50 to 25 Bitcoins. Despite Bitcoin’s nascent status, it had started gaining mainstream traction, partly attributed to economic turmoil in Europe. During this period, Bitcoin’s value surged from around US$5.50.

The Unwavering Surge of Bitcoin: Navigating Halving Events and Market Momentum

Bitcoin’s Rollercoaster Ride in the Cryptocurrency Market

From the early days of Bitcoin, with its volatility akin to a stormy sea, the cryptocurrency has weathered various highs and lows. Its price, symbolizing the ebb and flow of investor sentiment, tells a tale of gradual ascents and abrupt descents.

The Bitcoin Halving: A Catalyst for Price Fluctuations

The Bitcoin halving events, like cosmic phenomena marking shifts in the crypto universe, have left indelible imprints on Bitcoin’s valuation. With each halving, the coin’s value danced like a flame in the wind, flickering between moments of astonishing growth and disappointing declines.

By the time the second Bitcoin halving arrived in July 2016, Bitcoin’s value had clawed its way back up to US$648. The ensuing year witnessed a mesmerizing surge, with Bitcoin breaching the US$2,500 mark on June 3, 2017, propelled by a perfect storm of excitement and FOMO among investors.

The Dawn of Mainstream Recognition and Regulatory Roadblocks

The year 2020 emerged as a transformative period for Bitcoin, overshadowed by the shadow of a global pandemic and economic uncertainty. As traditional markets quivered and moaned, Bitcoin stood tall as an emblem of stability and resilience and won the favor of seasoned investors.

Bitcoin hurdled past obstacles and defied gravity, closing 2020 above US$28,000 and striking a staggering US$56,000 one year after the halving. As the world embraced decentralized finance and digital currencies, Bitcoin shone as the undisputed “gold standard,” drawing attention from industry giants like PayPal and Square.

Peering into the Crystal Ball: The Next Bitcoin Halving

As the cryptocurrency landscape evolves and reshapes itself, the eagerly anticipated halving in 2024 looms on the horizon, beckoning with promises of renewed fervor and market splendor. The recent approval of spot Bitcoin ETFs heralds a new era, allowing cautious investors to dip their toes in Bitcoin’s tumultuous waters without fear of drowning.

With crypto undergoing a renaissance post-2022, marked by legal victories and the promise of spot Bitcoin ETFs, faith in the industry has reignited like a phoenix rising from the ashes. The recent surge in Bitcoin prices, reminiscent of the 2021 highs, ignites optimism and speculation about the untapped potential waiting to be unleashed.

The Bitcoin Halving: Opportunity Knocks for Investors

Anticipation Surrounding Bitcoin Halving

With the upcoming Bitcoin halving scheduled for the end of February, market observers are carefully watching for potential impacts on the cryptocurrency landscape. Speculation abounds regarding the effect of Exchange-Traded Funds (ETFs) absorbing the supply typically added by miners upgrading their equipment before halvings. This time around, the absorption by ETFs could signal a departure from the norm, potentially leading to impressive gains in the future.

Investment Insights and Projections

Analyst Peter Brandt has raised eyebrows with his bold prediction of Bitcoin reaching as high as US$200,000 by September, a notable increase from his earlier estimate of US$120,000. Meanwhile, industry experts like Eberle foresee new all-time highs in the making, propelled by retail FOMO once ETF accessibility drives prices to remarkable levels. While projections vary from US$75,000 to US$150,000 within the next 12 to 18 months, the overarching sentiment remains positive, aiming for renewed market confidence and optimism.

Navigating Bitcoin Investment in Portfolios

For investors looking to incorporate Bitcoin into their portfolios, Eberle advises a strategic approach to balance investments. By integrating Bitcoin into a standard 60/40 equity bond portfolio and rebalancing quarterly, investors can harness the asset’s volatility to enhance overall performance. Studies suggest that a modest allocation of 3 to 5 percent in Bitcoin can reduce portfolio volatility and increase expected returns, a valuable proposition for those seeking diverse and resilient investment strategies.

Recognizing the psychological impact of volatility, Eberle emphasizes the importance of maintaining a proportionate allocation, highlighting that discomfort often stems from oversized exposures rather than asset fluctuations. By aligning allocation sizes with individual risk tolerances, investors can navigate market volatility with greater confidence and peace of mind.