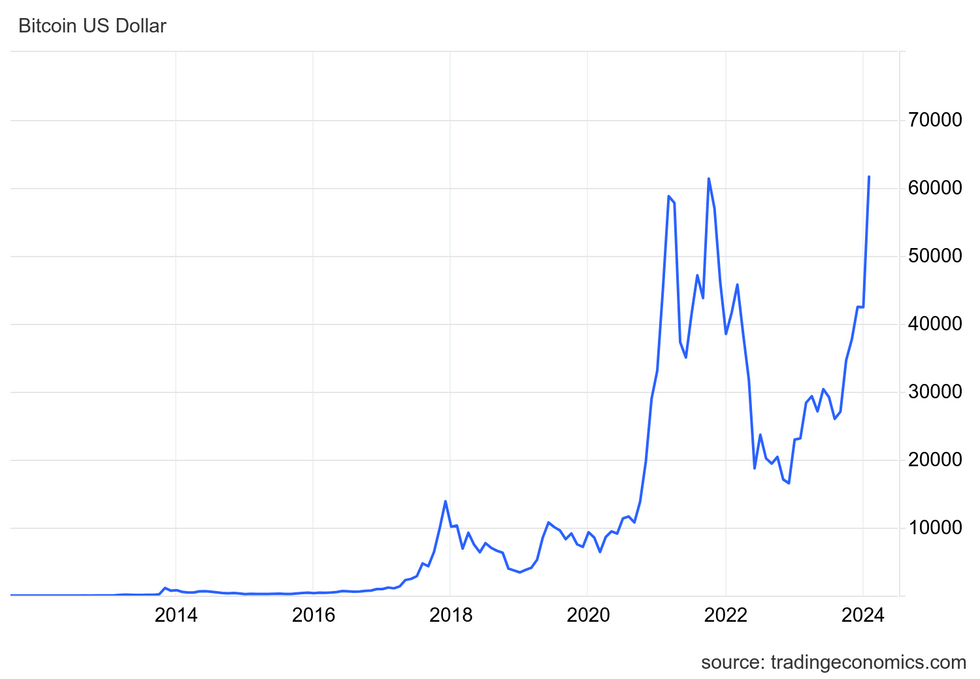

A story akin to an unpredictable rollercoaster ride, Bitcoin has captivated a loyal flock of enthusiasts with its phenomenal growth trajectory. Heralded as the reigning champion of cryptocurrencies, Bitcoin’s trajectory borders on the sensational, and in 2024, its upward climb seems poised to surpass all previous records.

From its humble origins, Bitcoin, the cryptocurrency that needs no introduction, spearheaded the emerging asset class, culminating in an extraordinary high of US$68,649.05 on November 10, 2021. Empowered by market liquidity and investor fervor, Bitcoin’s price skyrocketed by over 1,200 percent between March 2020 and November 2021, only to face turbulence in the subsequent year.

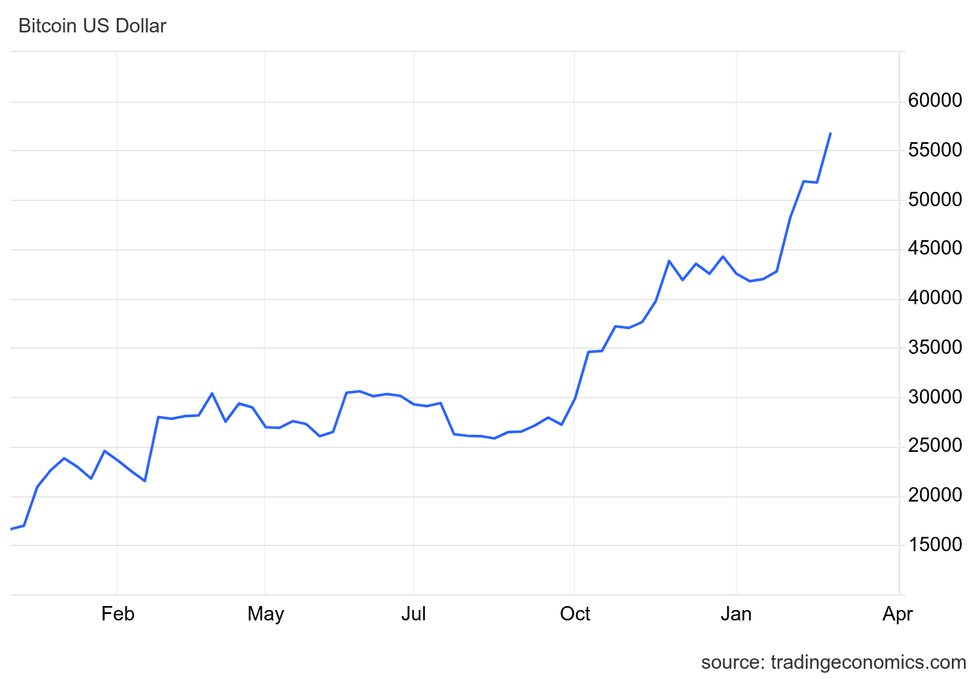

For the current year, 2024, Bitcoin embarked slightly above the US$44,000 benchmark, surging to a trading point of US$61,113 as of February 29, 2024.

The Genesis: What is Bitcoin?

Conceived in response to the cataclysmic 2008 financial crisis, Bitcoin endured tumultuous market swings, soaring to US$19,650 in 2017 before languishing beneath the US$10,000 threshold for an extended period. Introduced in late 2008 through a groundbreaking white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” authored by the enigmatic pseudonymous figure(s) Satoshi Nakamoto, it outlined a visionary framework for a digital currency revolution.

Secured through cryptography, this decentralized payment system aimed at transparency and resistance to censorship, leveraging blockchain technology to establish an unalterable ledger deterring fraudulent activities. Bitcoin’s early adopters were lured by its potential to dismantle the dominance of traditional financial institutions, particularly in the wake of the far-reaching fallout from the 2008 financial meltdown.

The Limited Supply: How many Bitcoins are there?

Differing from conventional fiat currencies empowered to expand through printing, Bitcoin boasts a finite supply of 21 million units. Currently, 19,144,112 Bitcoins are in circulation, leaving marginally under 2 million awaiting mining. This scarcity, ingrained in Bitcoin’s algorithm, serves as a bulwark against inflationary pressures.

A new Bitcoin is birthed when a miner utilizes specialized software to finalize a block of transaction verifications on the Bitcoin blockchain. Approximately 900 Bitcoins are daily unearthed, with the issuance rate automatically halving after every 210,000 blocks – a phenomenon that transpires every four years post the 2012 initiation. The upcoming halving is anticipated in mid to late April 2024.

The Pandemic Challenge: How did COVID-19 impact the Bitcoin price?

Commencing a sustained ascent from January 1, 2016, Bitcoin’s value surged from US$433 to US$959 by year-end, representing a 121 percent hike within 12 months. The subsequent year heralded the mainstream embrace of Bitcoin, witnessing a meteoric 1,729 percent escalation in its value from US$1,035.24 in January to US$18,940.57 by December.

While this record-setting zenith proved unsustainable, Bitcoin’s volatility gradually eroded its meteoric gains. Despite the downturn, the digital currency managed to evade further slumps below the US$3,190 mark since that period. The year 2020 acted as a litmus test for Bitcoin’s resilience amid economic turmoil; commencing at US$6,950.56, a significant selloff in March momentarily plummeted its worth to US$4,841.67 – registering a 30 percent decline.

However, this nadir unveiled a buying opportunity that catalyzed Bitcoin’s rebound by May, positioning it as a quasi-safe haven akin to the venerable metal gold, predominantly appealing to the Millennial and Generation Z cohorts. The rally persisted throughout 2020, concluding with the digital asset commanding US$29,402.64 by year-end – a noteworthy 323 percent surge year-over-year and a staggering 507 percent surge from its March nadir.

The Zenith and Beyond: What was the highest price for Bitcoin?

Maintaining its upward trajectory, Bitcoin continued its ascent in 2021, culminating in an unprecedented high of US$68,649.05 in November, reflecting a formidable 98.82 percent growth from January. Although the digital asset subsequently retrenched, concluding the year at US$47,897.16 – yet securing a notable 62 percent annual increment.

The all-time high of 2021 stemmed from various price-propelling factors. Notably, the growth was attributed to a surge in risk-on investor sentiment and Tesla’s notable acquisition of US$1.5 billion worth of Bitcoin. The narrative was further enriched by Tesla’s proclamation of accepting Bitcoin as payment for its electric vehicles – a development that heralded a robust rise in Bitcoin’s demand. However, the aftermath of this move, Tesla reversed course on accepting Bitcoin as a payment method following sustainability concerns, jolting the market temporarily.

The Bitcoin Rollercoaster: A Deep Dive into the World of Cryptocurrency

Bullish News for Bitcoin

Despite facing criticism from investors and environmentalists, the electric car maker initially halted the use of Bitcoin for car purchases, citing concerns over renewable energy use in mining. However, the tides seem to be turning as Elon Musk, the company’s influential CEO, declared in September of 2023 that the renewable energy threshold in the cryptocurrency industry had been met.

The surge in money supply due to the pandemic also gave a boost to Bitcoin, attracting investors seeking portfolio diversification. The success of Bitcoin amid the tumultuous market conditions of 2020 and 2021 paved the way for increased interest and investment in cryptocurrencies. The emergence of non-fungible tokens (NFTs) in 2021 signaled a new era in digital assets, with the NFT market ballooning to over US$40 billion that year.

Despite a sharp decline in the NFT market value by November 2023, the figures have rebounded significantly, reaching a staggering US$58.71 billion by February 28, 2024.

The Bitcoin Price Wild Ride

Bitcoin’s journey has been a rollercoaster of highs and lows, with its notorious volatility on full display since 2021. The cryptocurrency faced significant market uncertainty in 2022, with prices dropping below US$20,000 in the second quarter of that year. By the year’s end, Bitcoin values had plummeted further, settling below US$17,500.

Despite these dips, Bitcoin’s resilience shone through in 2023 as prices rallied across various milestones. Notable events, such as the rally in March and BlackRock’s filing for a Bitcoin exchange-traded fund, propelled Bitcoin’s price above US$30,000. The approval of 11 spot Bitcoin ETFs by the SEC in early 2024 further bolstered Bitcoin’s value, pushing it to US$61,113 per BTC by the end of February.

The Future Outlook

The increasing institutional interest in Bitcoin, driven by the anticipation of SEC-approved spot Bitcoin ETFs, has injected fresh momentum into the cryptocurrency space. As businesses warm up to accepting Bitcoin as a form of payment, its mainstream adoption could act as a catalyst for sustained price growth. The burgeoning market for digital assets, including the surging NFT space, further augments the potential for cryptocurrency growth in the coming years.

Chart via TradingEconomics.com.

Bitcoin price in US dollars, January 1, 2023 to February 29, 2024.

FAQs for Prospective Bitcoin Investors

What is a Blockchain?

A blockchain serves as a decentralized ledger for all cryptocurrency transactions, constantly expanding as new blocks are added in chronological order. Beyond cryptocurrencies, blockchain technology finds applications across diverse industries like banking, cybersecurity, supply chain management, and more.

How to Invest in Bitcoin?

Bitcoin can be acquired through various crypto exchange platforms and peer-to-peer trading apps, with the purchased coins stored in a digital wallet. Popular platforms for buying Bitcoin include Coinbase Global, BlockFi, and Binance.

Understanding Coinbase

Coinbase Global functions as a secure online cryptocurrency exchange, enabling users to buy, sell, transfer, and store various cryptocurrencies with ease.

The Evolving Landscape of Bitcoin and Crypto in the Financial World

Exploring the Impact of Cryptocurrency on Banking

As cryptocurrencies like Bitcoin continue to captivate the imaginations of investors, the banking industry finds itself at a crossroads. Crypto, often associated with the younger demographic aged 18 to 34, is alluring due to its decentralized nature and the promise of lower transaction fees compared to traditional banking systems. Banks, recognizing the popularity of digital currencies, are increasingly investing in blockchain technology and crypto assets, signaling a shift towards embracing this disruptive force. The allure of privacy and reduced reliance on centralized authorities are driving forces behind the crypto revolution.

Bitcoin’s Response to the Banking Crisis

In the wake of the recent banking crisis, Bitcoin has emerged as a safe haven for concerned investors. The collapse of prominent banks like Silicon Valley Bank and Signature Bank has caused a ripple effect of uncertainty in the industry. Analysts warn that the crisis may not be over, suggesting ongoing turmoil in the regional banking sector. Bitcoin’s historical resilience and detachment from conventional financial systems position it as an alternative investment avenue during times of economic uncertainty.

The Journey of Bitcoin: From Humble Beginnings

Bitcoin, birthed in 2009, saw its first recorded transaction at a meager value of US$0.001 per coin. The cryptocurrency, born in the midst of the 2008 financial crisis, symbolizes a departure from the norms of centralized banking. Its value has since fluctuated dramatically, reacting to market sentiment and regulatory developments. The journey of Bitcoin mirrors the tumultuous landscape of modern finance, offering both promise and peril to investors venturing into this digital frontier.

The Investment Conundrum: Bitcoin’s Volatility

Investing in Bitcoin remains a double-edged sword. While the cryptocurrency has shown remarkable resilience and value appreciation in recent years, its volatility is a well-known trait that can lead to substantial gains or losses. Investors seeking high-risk, high-reward assets may find solace in Bitcoin’s potential, but those averse to wild price swings may look elsewhere for stability. The investment landscape, punctuated by the ebbs and flows of Bitcoin’s value, demands careful consideration and risk assessment from market participants.

Insights from Market Influencers: Cathie Wood and Warren Buffett

Visionaries like Cathie Wood have hailed Bitcoin as a transformative asset with the potential to reach astronomical valuations in the coming years. Wood’s optimism reflects a broader sentiment among crypto enthusiasts who see Bitcoin as a harbinger of financial innovation. In contrast, stalwarts like Warren Buffett have expressed skepticism towards cryptocurrencies, citing their speculative nature and lack of intrinsic value. The clash of perspectives between traditional investment gurus and crypto proponents underscores the evolving dynamics of the financial ecosystem.

The Enigmatic Figures in the Bitcoin Ecosystem

The cryptic founder of Bitcoin, Satoshi Nakamoto, remains a mysterious figure with a vast fortune potentially tied to the cryptocurrency. Elon Musk, the tech mogul with a penchant for market-moving tweets, has dabbled in Bitcoin and Dogecoin, demonstrating the influence of individual personalities on digital asset markets. While Musk’s foray into cryptocurrencies has been met with both admiration and skepticism, his impact on shaping narratives within the crypto sphere cannot be understated. As Bitcoin continues to capture the imagination of investors worldwide, the enigmatic personas surrounding the digital currency add layers of intrigue to its evolving narrative.

This article offers a snapshot of the dynamic landscape of Bitcoin and cryptocurrency, highlighting the interplay between traditional finance and disruptive digital assets.