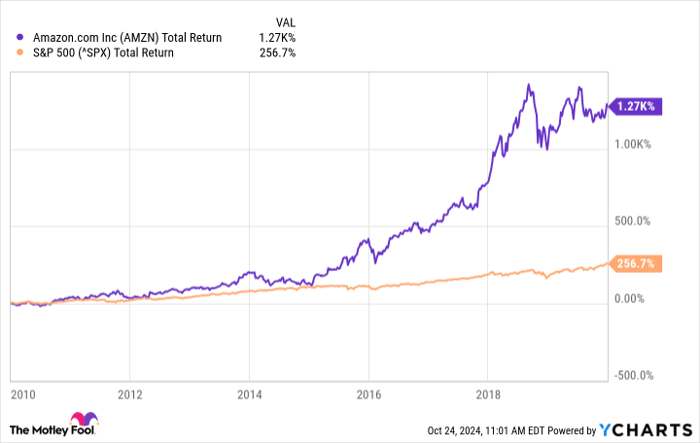

Amazon (NASDAQ: AMZN) has minted a lot of millionaires since its public debut. If you had invested $10,000 in the future e-commerce and cloud leader when it went public on May 15, 1997, your investment would be worth $20 million today.

From 1997 to 2023, Amazon’s revenue had a compound annual growth rate (CAGR) of 37% from $148 million to $574.8 billion. That jaw-dropping growth was driven by the evolution of its e-commerce market from a simple online bookstore into a digital superstore, as well as the expansion of its cloud infrastructure platform Amazon Web Services (AWS).

Image source: Getty Images.

Amazon probably won’t replicate those millionaire-making gains over the next two to three decades. It’s already the world’s fifth most valuable publicly traded company and owns the top e-commerce marketplace and cloud infrastructure platform.

Yet some billionaire investors are still loading up on the stock. In the second quarter of 2024, Bridgewater’s Ray Dalio increased his Amazon holdings by 153% to 2.65 million shares, Citadel’s Ken Griffin boosted his position by 17% to 7.69 million shares, while Tudor’s Paul Tudor Jones raised his stake by 28% to 336,000 shares. Let’s see why these billionaires are bullish on Amazon — and if you should follow their lead.

Amazon’s near-term headwinds are dissipating

Amazon experienced a major growth spurt and a messy slowdown over the past four years. In 2020 and 2021, the pandemic drove more consumers to shop online and prompted more companies to upgrade their cloud infrastructure services. Those trends generated strong tailwinds for Amazon’s e-commerce and cloud businesses.

But in 2022, its growth slowed down as the pandemic-related tailwinds dissipated. At the same time, inflation broadly curbed consumer spending while rising interest rates drove many companies to rein in their cloud spending.

The company also posted a net loss for the year as its investment in the struggling electric-vehicle maker Rivian withered.

|

Metric |

2020 |

2021 |

2022 |

2023 |

First half 2024 |

|---|---|---|---|---|---|

|

North American sales growth (YOY) |

38% |

18% |

13% |

12% |

11% |

|

International sales growth (YOY) |

40% |

22% |

(8%) |

11% |

8% |

|

AWS sales growth (YOY) |

30% |

37% |

29% |

13% |

18% |

|

Total sales growth (YOY) |

38% |

22% |

9% |

12% |

11% |

Data source: Amazon. YOY = Year-over-year.

In 2023, Amazon’s e-commerce businesses stabilized, but AWS continued to struggle. That was worrisome, since the company subsidizes the expansion of its lower-margin e-commerce marketplaces with its higher-margin cloud revenue.

But in the first half of 2024, AWS’ growth accelerated again as more companies upgraded their infrastructure to handle the latest AI applications. Amazon also rolled out more methods for developing new generative AI tools.

Its e-commerce businesses also gradually stabilized as it boosted its delivery speeds, sold more everyday essentials, and expanded into more overseas markets. The expansion of its integrated advertising business complemented that growth.

Does Amazon still have a bright future?

For the full year, analysts expect revenue and earnings to grow 11% and 63%, respectively, as its e-commerce and cloud businesses expand again. For 2025, they expect its revenue and earnings to rise 11% and 22%, respectively.

Based on those expectations, the stock looks reasonably valued at 32 times forward earnings and three times next year’s sales. Its top-line growth is impressive for a company of its size, and it’s been aggressively cutting costs to boost its margins.

Amazon has some near-term challenges. Its e-commerce platform faces intense competition from cheaper cross-border marketplaces like PDD‘s Temu and Shein. And Microsoft remains a fierce competitor in the cloud infrastructure and AI services market.

However, management could still leverage its scale to launch more products, retain its pricing power, and stay at the top of the booming e-commerce and cloud infrastructure markets.

Is it the right time to buy Amazon?

Amazon probably won’t generate millionaire-making gains over the next few years, but it’s easy to see why its billionaire investors are buying more shares. Its core business is strong, its headwinds are dissipating, and its valuations are attractive.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $865,595!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Leo Sun has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.