Investors have flocked to artificial intelligence (AI) stocks this year, and as a result these technology players have led gains in the S&P 500, helping the index climb more than 21%. Why such an interest in AI? Because it has the potential to transform many industries, making companies more efficient and profitable — and even resulting in major discoveries like life-saving new medicines or high-performance autonomous vehicles.

Today’s AI market already is worth more than $200 billion, and analysts predict this will expand to more than $1 trillion by the end of the decade. Companies that are developing AI tools or using AI to improve their businesses should be the first to benefit, and they will share the win with investors.

This hasn’t escaped the attention of billionaire investors, who have been heavily investing in AI companies. But they aren’t buying all AI players right now, and at this stage of the story, are making key decisions about which companies have the most to gain in the months ahead. Billionaire Paul Tudor Jones of Tudor Investment is the perfect example. He recently sold his entire Palantir Technologies (NYSE: PLTR) stake and piled into an AI player that completed a stock split this year — and has a huge catalyst on the horizon. Let’s find out more.

Image source: Getty Images.

Paul Tudor Jones’ multimillion-dollar win

First, a quick note on why investors closely watch Jones’ investing moves. Not only has he built a fortune since the founding of his firm back in 1980, but this top investor made headlines when he shorted the market ahead of Black Monday in 1987 — this bet against stocks generated a $100 million profit.

In more recent times, the top investor has spoken about the great potential of AI. The technology will drive a productivity boom that should push stocks higher for years to come, Jones said last year in a CNBC interview. So, it’s no surprise that Jones is investing in many top names involved in AI, from Microsoft to Amazon.

And in the second quarter, Jones sold all of his shares in one of the year’s best-performing AI stocks, Palantir, and added to a position of another AI giant. This player’s stock rose so much over the past five years — 2,700% — that it completed a stock split back in June, lowering the per share price to make it more accessible to a broader range of investors. I’m talking about AI giant Nvidia (NASDAQ: NVDA).

Jones sold 126,594 shares of Palantir and increased his position in Nvidia by 853% to 273,294 shares. We don’t know the exact reason behind the investor’s decision, but it’s true that as Palantir stock climbed, valuation exploded higher — reaching levels that look pricey today at 122x forward earnings estimates.

The valuation problem

Though Palantir’s long-term story still looks strong, today’s valuation could limit gains in the near term as investors turn to companies trading at more reasonable levels. Nvidia, too, has soared this year, but trading at 49x forward earnings estimates, the stock could have room to run — especially since a huge catalyst lies just ahead.

Nvidia plans to launch its new architecture, Blackwell, and fastest chip ever in the coming weeks. The company says it will ramp production in the fourth quarter and even generate billions of dollars of revenue during that period. Demand already has surpassed supply, supporting Nvidia’s revenue predictions.

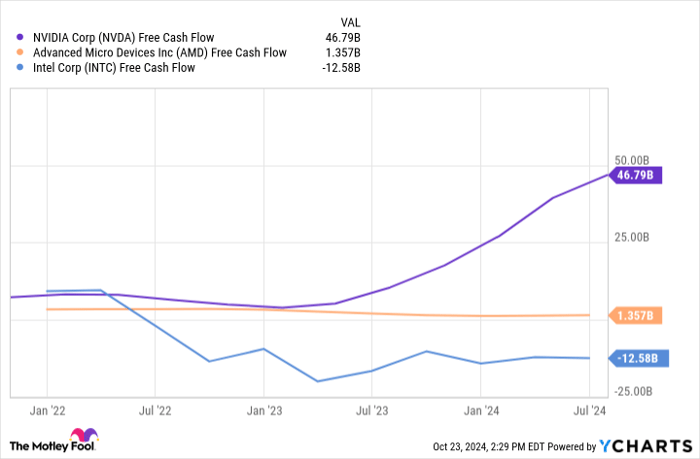

Today, Nvidia is the world’s No. 1 AI chip player, and its broad range of related products and services as well as its focus on innovation should keep it in the top spot well into the future. The company has reported several quarters of triple-digit revenue growth, bringing revenue to record high levels — $30 billion in the latest quarter.

And, importantly, extremely strong margins have accompanied this growth, and Nvidia forecasts this will continue. Gross margin last quarter was 75%, and Nvidia predicts margin in the mid-70% range for the coming quarter and full year.

All of this suggests that Jones — and others who recently bought Nvidia shares — could reap the rewards in the coming months as the Blackwell launch unfolds and over the long term too.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 822% — a market-crushing outperformance compared to 170% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of October 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.