David Tepper, renowned for his investment acumen, is not just your average billionaire. He’s the force behind Appaloosa Management, steering through market ebbs and flows with enviable success. His portfolio reads like a “who’s who” of the market’s finest, with the Magnificent Seven stocks dominating the ranks. Among them, Amazon, Microsoft, Meta Platforms, Nvidia, and Alphabet stand tall.

However, it’s the underdog that often springs the most surprises. Alibaba Group, a Chinese company in the doldrums, reigns as Tepper’s top holding, commanding a 12% stake in his illustrious portfolio. Let’s delve into why this Eastern titan might have caught the eye of the Wall Street maestro.

An Unlikely Bargain

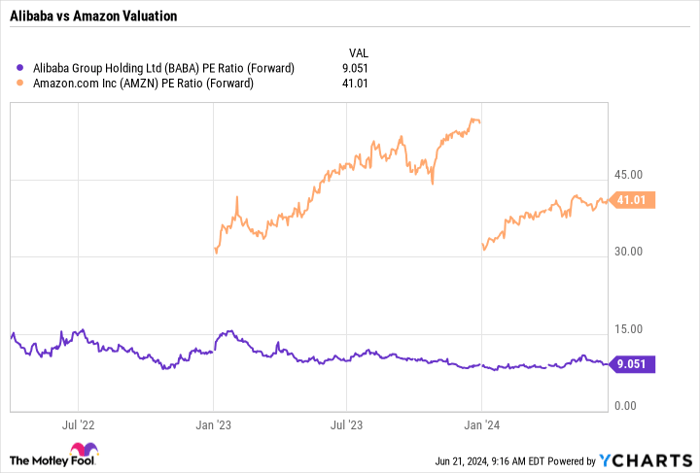

Alibaba Group flaunts a jaw-dropping valuation, trading at a mere forward price-to-earnings ratio of 9. A stark contrast to its U.S. counterpart Amazon, which graces the market stage at 41 times earnings. This discount from historical norms, where Alibaba sported a P/E of 40 or more, makes it a compelling bargain in the eyes of many astute investors.

BABA PE Ratio (Forward) data by YCharts.

A Cash Fortress with Boundless Potential

Alibaba’s vault-like balance sheet, brimming with cash reserves, paints a reassuring picture for shareholders. The company’s formidable cash-generating prowess, with $25.3 billion in operating cash flow and $21.6 billion in free cash flow in fiscal 2024, underscores its financial might. This war chest not only fuels shareholder rewards like buybacks and dividends but also fuels strategic investments in core businesses.

Alibaba’s concerted effort to rejuvenate its core commerce segments echoes a phoenix rising from the ashes. Powered by enhanced product offerings, competitive pricing strategies, and an unwavering focus on service quality, the company aims to revitalize its gross merchandise value growth trajectory amidst a fiercely competitive Chinese e-commerce landscape.

Moreover, Alibaba’s foray into artificial intelligence and cloud computing realms heralds a new era of technological innovation. By harnessing AI-driven solutions and streamlining low-margin operations, the company charts a path towards sustainable growth and profitability.

As international commerce revenues soar and logistics networks expand, Alibaba unfolds a narrative akin to Amazon’s historic growth spurt. Though initial investments may squeeze margins, the promise of robust profitability looms on the horizon.

Image source: Getty Images.

Will Tepper’s Bet Pay Off?

Tepper’s track record speaks volumes, but every gamble carries risk. Alibaba, however, emerges as a dark horse with mammoth potential. With its rock-bottom valuation and a strategic overhaul underway, the stock beckons investors seeking value amidst turmoil. Following Tepper’s lead and embracing Alibaba’s future trajectory could be a prudent move in today’s market landscape.

Is Alibaba Group Your Next Investment?

Think twice before dismissing Alibaba Group as just another stock. The Motley Fool Stock Advisor analysts have placed their bet on its hidden potential. Could this Chinese gem be the missing piece in your investment puzzle?

Insightful Stock Picks Ignored by the Mainstream

When it comes to selecting stocks that have the potential to bring forth substantial returns, the mainstream may not always have their finger on the pulse. Case in point, a recent lineup of the “10 best stocks for investors to buy now” excluded Alibaba Group, leaving investors to ponder the missed opportunity as the selected 10 promise to yield significant profits in the years ahead.

Reflect on Nvidia’s past glory when it found its way onto a similar list back in April 2005. Imagine if you had invested $1,000 based on that recommendation. Your investment would have sprouted into an astonishing $772,627. That’s the kind of financial blessing that bold investors seek!

Stock Advisor, an invaluable resource for investors, offers a clear roadmap to success in the world of stocks. By providing easy-to-follow strategies for portfolio building, regular insights from analysts, and two fresh stock picks per month, Stock Advisor has exceeded the S&P 500’s performance by a remarkable fourfold margin since 2002.*

For those seeking actionable advice and a chance to experience significant growth in their investment portfolios, it’s high time to look beyond the confines of conventional wisdom. The opportunity to discover hidden gems that could pave the way for financial prosperity is within grasp.

Don’t let the oversight of traditional stock recommendations deter you from unlocking the potential that lies within unconventional picks. When innovative selections intertwine with prudent decision-making, the result can be a financial journey laden with exponential returns that defy conventional norms.

Curate your investment strategy with an open mind, embracing the wisdom that lies beyond the mainstream. Just as Nvidia stood as a beacon of success in 2005 despite initial skepticism, there are undiscovered opportunities waiting to be unearthed, transforming prudent investors into heralds of prosperous financial expeditions.

*Stock Advisor returns as of June 24, 2024