Tech Stocks’ Market Leadership

Tech stocks have maintained their market leadership in the New Year, building on last year’s standout performance. This momentum has been driven by a combination of favorable macroeconomic developments, particularly growing confidence in the Fed’s policy easing, subdued inflation, and sustained economic stability.

Optimism in the Tech Sector

The Tech sector is optimistic about the impact of artificial intelligence (AI), with echoes of the late 1990s and a growing sense of overcoming Tech spending headwinds. This optimism has contributed to the improved earnings outlook, driven by effective cost controls that stabilized margins and suggested positive revisions and impressive stock market momentum.

AI and Big Tech Earnings

The market awaits insight into business spending trends, particularly on the cloud side, as Tech companies prepare to report their December-quarter results. The potential of artificial intelligence (AI) is creating anticipation, with direct revenue impact already visible and productivity-enhancing potential on the horizon. Companies like Nvidia and Microsoft are at the forefront, and the stock market is watching keenly for signs of viable business models and the monetization of AI capabilities.

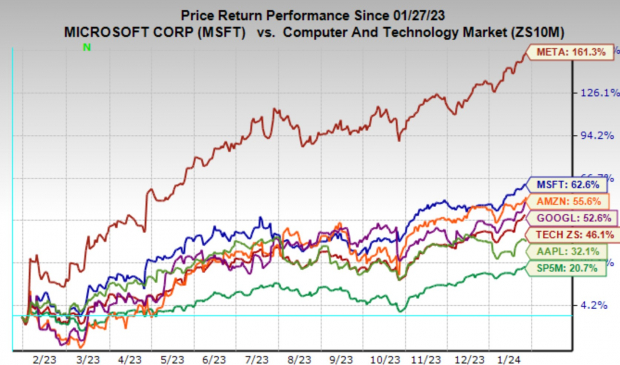

Performance of ‘Big 7 Tech Players’

This week, five of the ‘Big 7 Tech players,’ including Alphabet, Microsoft, Meta Platforms, Amazon, and Apple, are set to report December-quarter results. Their strong stock market performance is evident, with the Technology sector and major companies seeing significant gains in the past year, outpacing the S&P 500 index.

Impact on AI Monetization

All of these companies are significant players in the AI space, with particular attention on the rivalry between Microsoft and Alphabet. Given the initial excitement around AI applications, the focus has now shifted to monetizing AI capabilities through new and existing business models. It is expected that these companies will outline their AI plans extensively during their Q4 earnings calls.

Expectations for Earnings and Revenue Growth

Consensus expectations for the ‘Big 7 Tech Players’ indicate a substantial increase in earnings and revenues compared to the previous year. However, much of the anticipated growth is contingent on the macroeconomic picture unfolding favorably and business leaders’ strategic decisions.

Rebounding from Pandemic Challenges

The phenomenal growth of the past year reflected pulled-forward demand from future periods that got adjusted in 2022. It is anticipated that the ‘Big 7 Tech Players’ will shift back to a regular growth model, dependent on macroeconomic factors and global trends.

Overall Sector Performance

The big picture view of the ‘Big 7 players’ and the overall sector reflects a shift away from the growth challenges seen in recent quarters. With profitability levels expected to exceed those of 2021, significant gains are anticipated in the current year and the next.

Insight into Earnings and Growth Rates

The earnings and revenue growth rates achieved in the preceding four quarters, and current earnings and revenue growth expectations for the S&P 500 index in 2023 Q4 and the following quarters, will provide a comprehensive perspective for investors.

Spotlight on Q4 Earnings Season

Q4 Earnings Season Scorecard

With the arrival of Q4 earnings season, financial enthusiasts found themselves navigating through a mixed bag. Reflecting on the previous coruscating quarter, 2023 Q4 earnings are expected to ascend by +1.1% with a buoyant +2.4% surge in revenues. This uptick follows the robust +3.8% earnings growth illustrated in the preceding period (2023 Q3) and three successive quarters of diminishing earnings before that. The arithmetical representation in the annual earnings chart delineates a compelling storyline.

As of Friday, January 26th, Q4 results from 124 S&P 500 members, accounting for 24.8% of the index’s full membership, have been disclosed. This week, over 300 companies, including 106 S&P 500 members, are set to unveil their results. The lineup encompasses illustrious names such as Boeing, Pfizer, International Paper, Starbucks, Exxon, Chevron, and a multitude of others.

Perceptive investors may discern that the total Q4 earnings for 124 index members that have divulged their financials are regrettably down by -0.4% from the corresponding period last year. Simultaneously, revenues have scaled a praiseworthy +3.4%, with an impressive 79% surmounting EPS estimates and 69.4% surpassing revenue estimates. A juxtaposition of the Q4 earnings and revenue growth rates propels observers to contextualize their interpretation within a historical framework.

5 Stocks Set to Double

A dazzling selection of 5 remarkable stocks, meticulously curated by a Zacks expert, has materialized as prime contenders to yield a mammoth +100% or more gain in 2023. Historical surges of +143.0%, +175.9%, +498.3%, and +673.0% from previous recommendations inject an intoxicating allure to these selections. The majority of these stocks are stealthily evading the gaze of Wall Street, touting an entrancing prospect to embark on the ground floor of this promising ascent.