The clash of e-commerce titans, Amazon (NASDAQ: AMZN) and Shopify (NYSE: SHOP), epitomizes the divergent paths within the digital marketplace. While both companies thrive within the e-commerce realm, their operational divergence underscores a fascinating investment juxtaposition.

Comparing E-commerce Pioneers

Amazon, the e-retail pioneer that transformed from a humble online bookstore into the versatile “everything store,” dominates the U.S. retail landscape. On the contrary, Shopify’s forte lies in providing a versatile software platform empowering merchants of all sizes to showcase and sell their wares in the online sphere.

With its protracted history since its inception in 1994, Amazon’s meteoric rise propelled it to a colossal market capitalization nearing $1.9 trillion, dwarfing Shopify’s market cap of around $100 billion established since its 2006 inception.

Financial Odyssey of Amazon and Shopify

Amazon’s $575 billion revenues witnessed a 12% escalation in 2023, principally buoyed by its high-margin ancillary ventures outshining its conventional online retail segment. Contrarily, Shopify’s revenue soared to $7.1 billion, marking a robust 26% annual growth. This trajectory culminated in Shopify registering a net income of $132 million in 2023, exhibiting a significant turnaround following its struggles marked by a $3.5 billion loss in 2022.

Despite Amazon’s formidable growth trajectory, Shopify’s fiscal fortunes showcase a resilient spirit, underpinned by its strategic divestiture of its logistics arm, propelling it toward profitability. Shopify’s accelerating revenue projections are poised to catalyze sizable earnings accretions, underscoring its eminent position in the stock market pantheon.

Amazon or Shopify: An Investor’s Conundrum

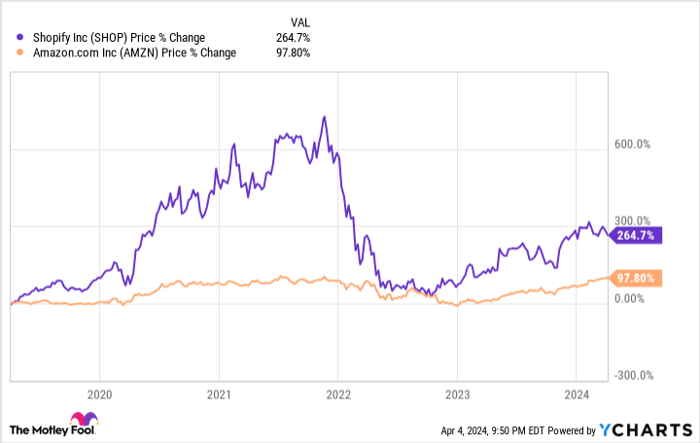

Both Amazon and Shopify exude an aura of resilience, beckoning shrewd investors to partake in their upward trajectory. Risk-averse stakeholders might gravitate toward Amazon’s steadiness, while the adventurous cohort may find solace in Shopify’s bold growth narrative.

Shopify’s agile ecosystem, fortified by a transformative profit outlook and an expanding merchant base, augurs well for future growth prospects, potentially outpacing Amazon in the future trajectory of profitability.