Every investor seeks the golden egg, the stock that will hatch into a golden goose and lay consistent streams of lucrative dividends. The hunt is on for stocks with exceptional growth potential, and for those looking to strike while the iron is hot, three contenders grace the list for today, June 12th:

Powell Industries (POWL): Hailing from the hallowed halls of metal-working, Powell Industries supports the very heartbeat of petrochemical facilities. With a robust Zacks Rank #1 (Strong Buy), this firm has witnessed its Zacks Consensus Estimate for current year earnings sprout by 19.9% over the past 60 days.

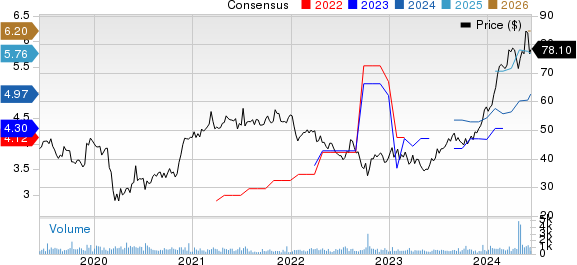

Price and Consensus Crossing Paths

Powell Industries boasts a tantalizing PEG ratio of 1.30, a tad lower than the industry’s 1.44. Moreover, the company flaunts a Growth Score of A, a signal of its potential to outshine its peers.

Powell Industries Navigating Its PEG Ratio (TTM)

Gaze upon the terrain of Powell Industries’ PEG ratio (TTM) standing at 1.30, showcasing its prowess amidst industry rivals.

AZZ: In the pantheon of metallurgical greatness stands AZZ, a stalwart global provider of metal coating services and welding solutions. Their expertise shines bright with a Zacks Rank #1 and a 5.5% surge in Zacks Consensus Estimate for this year’s earnings over the bygone 60 days.

Tracking AZZ’s Price Trajectory

AZZ displays a commendable PEG ratio of 1.12, eclipsing the industry’s 1.44. Coupled with a Growth Score of B, the horizon seems promising for this industrial maestro.

Deciphering AZZ’s PEG Ratio (TTM)

A deep dive into AZZ’s PEG ratio (TTM) at 1.12 illuminates its competitive edge and potential for amplified growth within the sector.

The ODP Corporation: Enter the realm of business services with The ODP Corporation, a provider of digital workplace solutions catering to businesses of all sizes. Boasting a coveted Zacks Rank #1, the company has witnessed a robust 5.6% surge in Zacks Consensus Estimate for current year earnings over the past 60 days.

Unveiling The ODP Corporation’s Price Trajectory

The ODP Corporation basks in the glow of a dazzling PEG ratio at 0.46, outshining the industry average of 0.96. With a Growth Score of B, this corporation showcases potential for considerable growth.

Delving into The ODP Corporation’s PEG Ratio (TTM)

The ODP Corporation’s PEG ratio (TTM) gleams at 0.46, underscoring its efficiency in utilizing earnings to fuel growth and outperform industry benchmarks.

Opportunities beckon with these spirited stocks, each offering a unique blend of promise and potential. As investors tread the path to wealth accumulation, these stocks stand out as beacons of hope in a tumultuous sea of market fluctuations.

Marvel at these top performers leading the charge towards prosperity and growth in the stock market yard. The battle cry echoes loud – fortune favors the bold.