Big-money investors have taken a confident stance on Fair Isaac (FICO).

For retail traders, this insight is crucial.

A peek into publicly available options history by Benzinga reveals notable trading patterns.

Large moves like these often signal informed anticipation of future events.

So what exactly did these investors do?

Today, Benzinga’s options scanner identified 10 unconventional options trades for Fair Isaac.

This is no typical occurrence.

The sentiments among these noteworthy traders are evenly split between a bullish and bearish stance.

Out of the unique options unveiled, 3 are puts amounting to $88,960, while 7 are calls totaling $324,042.

Anticipated Price Shifts

Based on recent trades, it appears significant investors are eyeing a price range of $970.0 to $1930.0 for Fair Isaac in the coming few months.

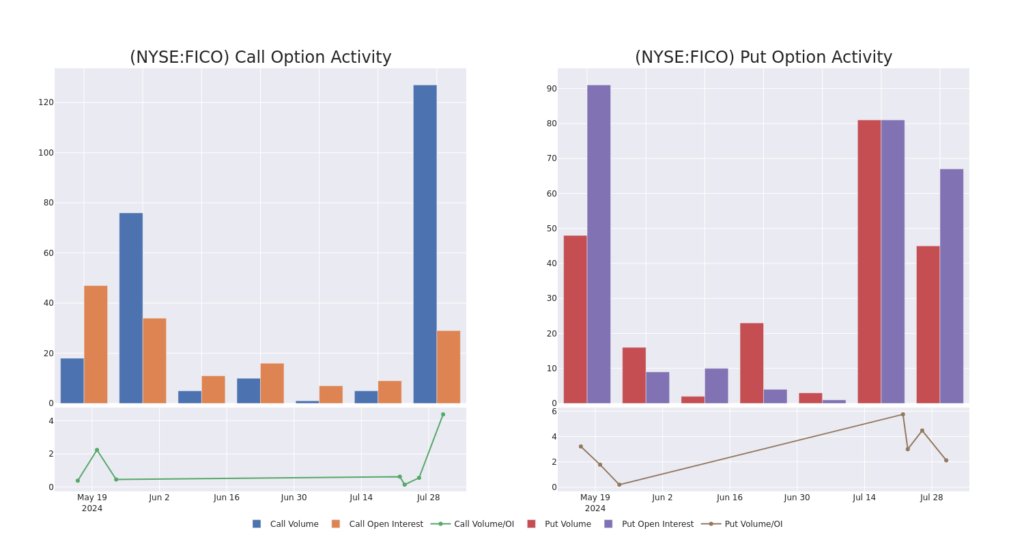

Trends in Volume & Open Interest

Monitoring volume and open interest provides valuable insights when trading options. These metrics help gauge the liquidity and demand for Fair Isaac’s options at various strike prices. Here, we track the evolution of both calls and puts for all substantial trades involving Fair Isaac within the $970.0 to $1930.0 strike price range over the past 30 days.

Fair Isaac’s Options Volume And Open Interest Over Last 30 Days

Notable Options Transactions

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FICO | CALL | TRADE | BEARISH | 12/20/24 | $700.0 | $690.8 | $691.51 | $970.00 | $69.1K | 1 | 1 |

| FICO | CALL | TRADE | BEARISH | 08/16/24 | $65.0 | $57.5 | $60.05 | $1590.00 | $60.0K | 6 | 0 |

| FICO | CALL | TRADE | BULLISH | 08/16/24 | $80.0 | $76.0 | $80.0 | $1530.00 | $56.0K | 10 | 10 |

| FICO | CALL | TRADE | BULLISH | 08/16/24 | $90.0 | $88.3 | $90.0 | $1590.00 | $45.0K | 6 | 15 |

| FICO | CALL | TRADE | BULLISH | 01/17/25 | $337.2 | $333.0 | $337.2 | $1340.00 | $33.7K | 5 | 0 |

Exploring Fair Isaac’s Background

Established in 1956, Fair Isaac Corporation is a prominent analytics company renowned for its FICO credit scores, a key yardstick for assessing individual creditworthiness. The bulk of Fair Isaac’s profits stem from their credit scoring operations, encompassing both B2B and B2C services. Apart from scores, the company also offers software catering to financial institutions for analytics, decision-making, customer workflows, and fraud prevention.

Given the recent options activity tied to Fair Isaac, it’s imperative to delve into the company’s current standing.

Current Market Position of Fair Isaac

- Trading at $1600.0 and a trading volume of 178,719, FICO has seen a marginal 0.0% decline.

- Present RSI levels suggest the stock is perched in a neutral zone, straddling between overbought and oversold territories.

- The upcoming earnings release is slated for 97 days ahead.

Insights from Industry Experts on Fair Isaac

In the past month, 3 analysts proffered ratings on Fair Isaac, pegging the average target price at $1641.67.

- RBC Capital’s analyst maintains a Sector Perform rating for Fair Isaac with a price target of $1500.

- Baird’s analyst sustains a Neutral rating for Fair Isaac alongside a $1700 price target.

- Wolfe Research, taking a more cautious stance, downgrades its outlook to Outperform, setting a price target of $1725.

While options pose higher risk compared to stock trading, they come with amplified profit potential. Seasoned options traders mitigate these risks through continual education, strategic entry and exit strategies, monitoring multiple indicators, and keeping abreast of market developments.

To stay abreast of the latest options plays featuring Fair Isaac, be sure to explore Benzinga Pro for real-time alerts.