Warren Buffett may be saying goodbye to a chunk of his Bank of America Corp BAC shares, but the charts signal a strong outlook for the stock. With the stock up 23.75% year-to-date and a solid 55.43% over the past year, BAC stock is still riding a bullish wave, even as Buffett’s Berkshire Hathaway Inc quietly steps back.

Buffett’s Selloff: Timing Or Trend?

In a move that has raised some eyebrows, Buffett’s Berkshire Hathaway sold off 9.5 million shares of Bank of America over just three days last week at around $40 per share, raking in $380 million. This latest sale means Berkshire no longer holds a 10% stake in BAC, removing the need for immediate reporting on future trades.

This isn’t the first time Buffett has trimmed his BAC holdings—he’s been selling since mid-July. When asked about the legendary investor’s sell-off, Bank of America’s CEO, Brian Moynihan, seemed unfazed. “Life will go on,” Moynihan said, and indeed it has for BAC stock, which jumped 5% on Friday despite the news.

Bulls Are In Control: Charts Point To More Upside

Buffett may be heading for the exit, but the stock charts suggest the bulls aren’t done yet.

Chart created using Benzinga Pro

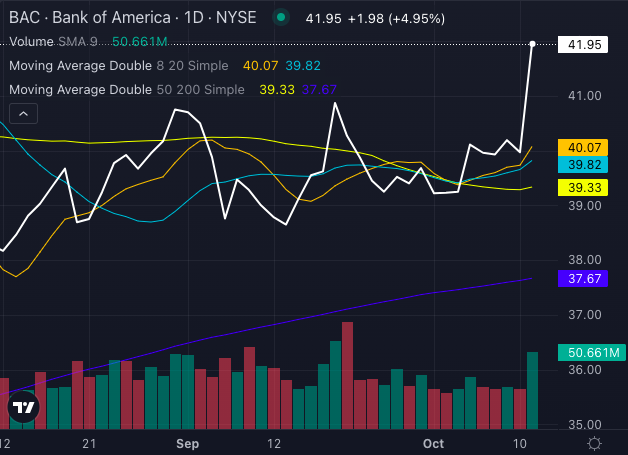

BAC stock closed at $41.95, well above key indicators like its eight-day and 20-day simple moving averages, which sit at $40.07 and $39.82, respectively.

The stock also comfortably outpaces its 50-day and 200-day moving averages, hinting at continued upward momentum.

Chart created using Benzinga Pro

The buying pressure is real, with the MACD indicator showing a positive trend at 0.26. At the same time, BAC’s relative strength index (RSI) is nudging into overbought territory at 68.28, so investors may want to watch for a potential cooldown.

However, the stock is still firmly above its Bollinger Bands range of $38.31 to $41.02, suggesting there’s more room to run.

Can Q3 Earnings Fuel More Gains?

With third-quarter earnings set to drop Tuesday before the market opens, investors are watching closely.

Analysts expect earnings per share (EPS) of 77 cents and revenue around $25.28 billion. If Bank of America beats those estimates, the stock’s bullish run may get an extra boost, despite Buffett’s retreat.

As Buffett trims his position, Bank of America’s stock remains resilient, consistently flashing bullish signals. With momentum still on the side of the bulls, upcoming earnings have the potential to drive >BAC stock even higher.

Read Also: JP Morgan And Wells Fargo Report Better Than Expected Q3 Results That Reflect Resilient U.S. Consumers

Photo: Shutterstock