Netflix’s Stellar Performance in Q1 2024

The Raging Success of the Streaming Giant

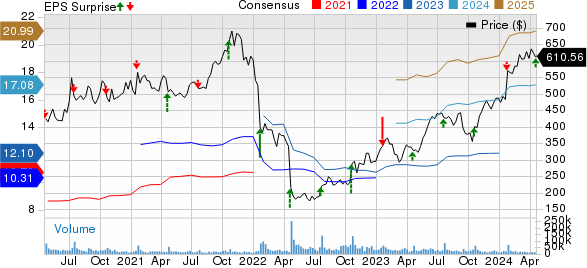

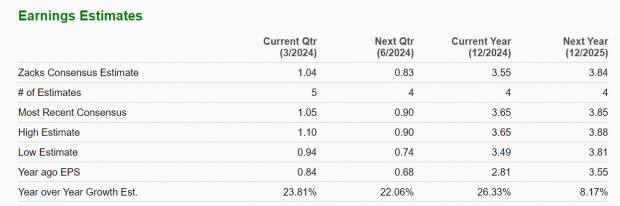

Netflix reported exceptional first-quarter 2024 earnings of $5.28 per share, outperforming the Zacks Consensus Estimate by a staggering 17.07%. This marked a remarkable 83.3% surge from the preceding year, reflecting the company’s undeniable prowess in the streaming industry.

The streaming behemoth saw revenues soar to $9.37 billion, showcasing a robust 14.8% year-over-year growth that surpassed the consensus expectations by 1.18%. The surge can be attributed to a strategic combination of revenue initiatives, such as cracking down on password-sharing, introducing an ad-supported tier, and implementing recent price hikes on select subscription plans.

The Growth Engine: Subscriber Momentum

Netflix ended the first quarter with a solid user base of 269.6 million paid subscribers spanning over 190 countries globally, depicting a commendable 16% annual increase. The company experienced a considerable influx of new customers, with a strong presence noted in the United States and Canada.

The quarter saw a substantial uptick of 9.33 million paid subscribers worldwide, accompanied by a 1% increase in average revenue per membership (ARM) on a reported basis and a robust 4% growth on a foreign-exchange neutral basis. This impressive performance follows the addition of 1.75 million paid subscribers in the corresponding period last year.

In a bid to diversify its content offerings, Netflix attributed its success to exclusive intellectual property like original series, including critically acclaimed titles like “Griselda,” “3 Body Problem,” “Avatar: The Last Airbender,” “Love Is Blind Season 6,” “American Nightmare,” and “Dave Chappelle: The Dreamer.”

The platform also noted significant viewership of U.K. content and original Korean titles, underscoring the global appeal of its diverse content library.

Expanding Horizons and Strategic Shifts

In a bold move to solidify its dominance in the streaming landscape, Netflix is venturing into new territories such as live events. The company recently secured a groundbreaking $5 billion deal to exclusively stream WWE’s flagship wrestling show, “Raw,” disrupting traditional broadcast paradigms that have stood unchallenged for over three decades.

Furthermore, Netflix forged a strategic partnership with Rockstar Games’ “Grand Theft Auto” franchise, signaling its foray into the lucrative video game sector—a move that is poised to redefine the boundaries of entertainment convergence.

A surprising announcement by Netflix detailed its decision to discontinue reporting paid quarterly membership and revenue per subscriber starting Q1 2025. This strategic pivot aims to shift investor focus towards long-term trends rather than short-term fluctuations influenced by transient factors like programming changes and economic volatility.

While tech titans like Apple and Amazon maintain secrecy around their streaming subscriber figures, Netflix’s transparent approach sets it apart in an industry where data privacy often trumps transparency.

Shares of Netflix have exhibited extraordinary resilience, delivering a robust 25.4% YTD return that eclipses the performance of industry stalwarts like Apple, Amazon, and Disney.

Unveiling Netflix’s Segmental Revenue Landscape

Breaking down its regional revenue streams, Netflix’s United States and Canada segment boasted revenues of $4.22 billion, representing a commendable 17.1% year-over-year increase and accounting for 45.1% of total revenues. The ARPU in this segment rose by 6.9% from the prior year.

The European, Middle Eastern, and African market witnessed revenues of $2.95 billion, marking a 17.5% annual upsurge and contributing 31.6% to the company’s overall revenues.

In the Latin American region, revenues amounted to $1.16 billion, with an 8.9% year-over-year increase and a subscriber base of 47.72 million.

The Asia Pacific segment recorded revenues of $1.02 billion, showing a strong 9.6% growth, underscoring the company’s burgeoning presence and subscriber base in this lucrative market.

Netflix’s Financial Report for Q1 2024

Netflix’s Financial Performance Shines with Steady Growth