Has the charm of the “Magnificent Seven” faded in 2024, revealing pricey facades beneath? The stocks that once ruled the market with an iron fist are now facing skepticism due to their inflated valuations. But is the entire cohort truly overpriced?

Let’s embark on a journey to dissect this illustrious group of seven and determine if there are hidden gems or if the entry price is indeed a weighty toll to pay.

The Shifting Fortunes of the Magnificent Seven

The elite “Magnificent Seven” ensemble comprises:

- Microsoft (NASDAQ: MSFT)

- Apple (NASDAQ: AAPL)

- Nvidia (NASDAQ: NVDA)

- Alphabet (NASDAQ: GOOG, GOOGL)

- Amazon (NASDAQ: AMZN)

- Meta Platforms (NASDAQ: META)

- Tesla (NASDAQ: TSLA)

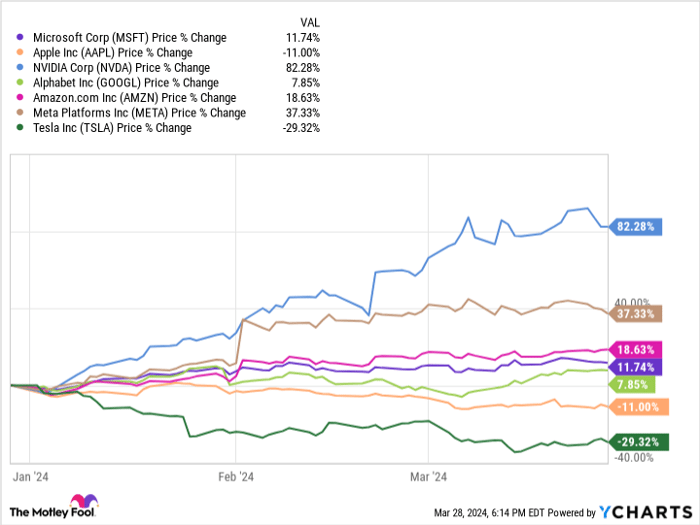

The triumph of 2023 lauded these stocks, celebrating staggering returns, with even the “worst” performer, Apple, delighting investors with almost a 50% upswing. However, the tone of 2024 sings a different tune, with each stock marching to its own drumbeat in terms of performance.

Valuation disparities have emerged, painting a picture of reluctance among investors to pay a premium for ownership of these esteemed companies.

Given their growth-oriented nature, I have conjugated revenue expansion and forward price-to-earnings (P/E) ratios in my valuation appraisal. This dual prism provides a holistic perspective, acknowledging that while cost efficiencies can bolster earnings, sustainable advancement necessitates top-line growth.

Tesla faces a tumultuous period, shedding almost a third of its value this year. The waning charm stems from decelerating electric vehicle (EV) sales growth and squeezed margins amid heightened competition. Its forward P/E ratio of 55 reflects the deflated enthusiasm among investors.

Apple’s saga chronicles a similar narrative, an extended phase of stunted growth. Throughout 2023, the tech titan grappled with either dwindling or modest 2% quarterly revenue hikes year-on-year, casting shadows upon its perceived growth trajectory. Even at a forward P/E of 26, Apple’s valuation appears stretched given its performance.

The Tale of the Remaining Five

Alphabet and Meta Platforms emerge as beacons of moderation in a sea of fluctuation. Google’s umbrella, Alphabet, navigated PR tribulations tied to its generative AI deployment. Yet, the thriving ad apparatus positions Alphabet as a resolute contender trading at a modest 22 times forward earnings.

Meta Platforms echoes a similar tune, with a gentle 25.5 forward P/E ratio. Monetizing through advertisement propagation across diverse social media platforms, Meta is riding the high wave of ad resurgence, shaping a promising trajectory.

Nvidia, contrary to expectations, reveals a blend of priciness and future potential. With a forward P/E of 38, Nvidia’s vigour in the AI realm via groundbreaking GPUs justifies its premium.

Amazon, swathed in ambiguity, grapples with profit optimization nuances, skewing its forward earnings multiple. At 42 times earnings, it stands as the second costliest within the cohort. Nevertheless, the ascending gross profit margin heralds a forthcoming epoch of buoyant profits, promising a prospective rectification in valuation.

Microsoft, the colossus reigning over the group, flaunts a regal yet pricey crown. Commanding a lofty 37 times forward earnings valuation, Microsoft’s accolades emanate from AI mastery and burgeoning cloud computing market dominance. Despite a stout 18% growth, the valuation verges on exorbitance.

Given this enthralling saga, how do these luminaries fare in terms of affordability?

Decoding Valuation Hierarchies

Mere ranking by forward price-to-earnings (P/E) multiples belies comprehensive assessment, for some falter in growth while others soar. The rankings will integrate not just metrics but a nod to current performance and prospects awaiting.

Hence, behold the ranking of the Magnificent Seven from most affordable to most dear:

- Alphabet

- Meta Platforms

- Amazon

- Nvidia

- Tesla

- Microsoft

- Apple

Labeling Alphabet and Meta as paragons of frugality is elementary, while Amazon and Nvidia’s growth potential allays the sting of their high valuations. The enigma of Tesla remains, shadowed by the uncertainty of EV demand, potentially defining a bargain.

Unveiling the True Colors of Tech Stock Investments

The Dynamics of Tech Stock Evaluation

Entering the realm of stock investing, one is met with the daunting task of evaluating tech giants. Among the titans stand Nvidia proudly, displaying impressive growth. In a league of its own, Nvidia is carving a path wrought with opportunities for the discerning investor.

Tales of Microsoft and Apple

Microsoft and Apple don’t fall far from the tech tree, yet their allure is steeped in their high prices, especially for their growth prospects. Apple finds itself in the hot seat, barely showing signs of substantial growth, leaving investors to ponder its value.

Nvidia in the Limelight

And then, there is Nvidia. A beacon of hope in the tech landscape, Nvidia beckons with promises of growth and resilience. With its strategic positioning and innovative products, Nvidia stands out as a prime contender for investment, offering investors a chance to ride the wave of technological evolution.

Historical Context: The Evolution of Tech Stocks

Reflecting on the history of tech stocks, from the dot-com bubble to the current era of exponential growth, Nvidia emerges as a testament to adaptability and foresight. In an ever-changing market, Nvidia’s consistency shines through, making it a favorable choice for investors seeking stability and potential.

Investment Considerations

Amidst the frenzy of the stock market, the decision to invest in Nvidia rests in the hands of individual investors. While opinions vary, it is prudent for investors to conduct thorough research and analysis before diving into the tumultuous waters of stock investments.

Guidance from Stock Analysts

Seeking guidance from stock analysts can provide valuable insights into market trends and potential opportunities. With expert advice and comprehensive research, investors can navigate the complexities of the stock market and make informed decisions regarding their investment portfolios.

Final Thoughts

In a landscape dominated by tech giants, Nvidia stands out as a beacon of innovation and growth. As investors tread cautiously in the turbulent waters of the stock market, Nvidia presents itself as a promising contender, beckoning with opportunities for those willing to take the plunge into the world of tech stock investments.

*Stock Advisor returns as of March 25, 2024