Apple (NASDAQ:AAPL) has made a strong move to dismiss a lawsuit brought against it by the Justice Department and 15 states in March. The lawsuit claims that the tech giant holds a complete monopoly over the smartphone market, causing harm to smaller competitors and inflating prices.

In a letter addressed to U.S. District Judge Julien X. Neals, Apple emphasized that it is far from being a monopolist and is actively engaged in fierce market competition. Moreover, AAPL argued that the U.S. Department of Justice (DoJ) is relying on a novel “theory of antitrust liability” that has not been acknowledged by any court.

It is expected that the U.S. government will provide a response to Apple’s letter within a week.

Challenging the U.S. DoJ’s Claims

The DoJ alleges that Apple holds an unlawful monopoly over the smartphone market by enforcing contractual restrictions and selectively withholding crucial access to its App Store from developers.

Furthermore, the Justice Department points out that Apple’s iPhones are priced notably high, with costs reaching as high as $1,599, leading to AAPL earning significantly greater profits compared to its competitors. Additionally, the DoJ accuses Apple of levying hidden charges on its partners, such as app developers, credit card companies, and even rivals like Alphabet’s Google (NASDAQ:GOOGL). These actions are said to contribute to elevated prices for the end consumers of Apple’s products.

Apple has vehemently denied these allegations, asserting that dissatisfied consumers or partners have strong incentives to switch to competing platforms that are perceived not to have such limitations.

Analysis of Apple Stock

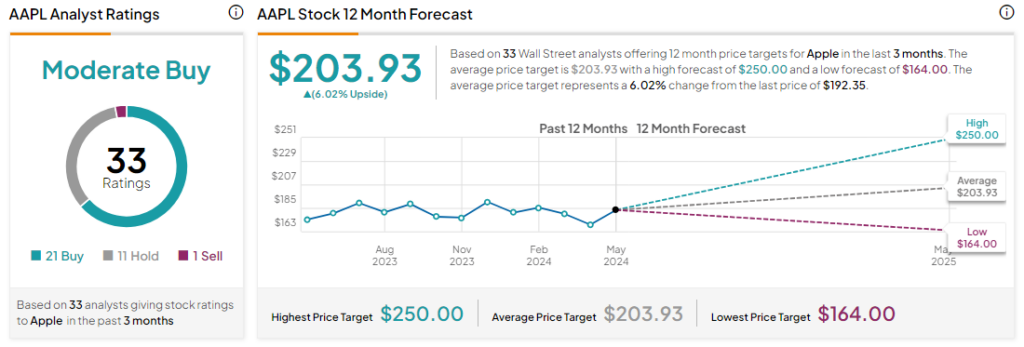

Market analysts maintain a cautiously optimistic outlook on AAPL stock, reflecting a Moderate Buy consensus rating based on 21 Buy recommendations, 11 Holds, and one Sell. Over the preceding year, Apple has recorded a growth of over 10%. The average price target for AAPL stands at $203.93, suggesting a potential upside of 6% from its current price levels.