$200 billion. A behemoth sum in Apple’s coffers, courtesy of iPhone sales. While the masses view this as the carrot that makes the tech giant the world’s most valuable company, the reality is far more intricate.

Delve deeper into Apple’s financial ecosystem, and one stumbles upon a realm where the company channels substantial resources into a business often overlooked by investors.

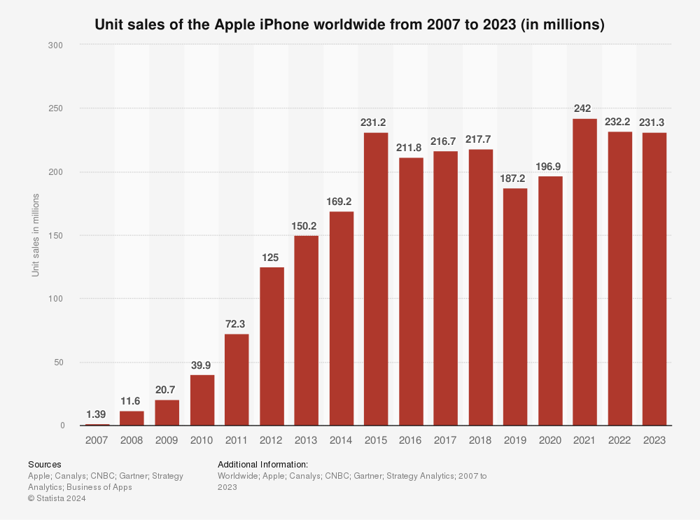

When it comes to Apple, the common instinct is to associate it solely with iPhones. As previously acknowledged, these smartphones indeed rake in colossal revenue for the company. However, there’s a catch: Apple’s iPhone sales have stagnated for nearly a decade.

Image source: Getty Images.

The shining star in Apple’s recent growth narrative is its services segment. This unit draws revenue from diverse streams like the App Store, AppleCare+, advertising, and subscriptions to apps such as iCloud+, Apple Fitness, and AppleTV+.

What’s more, to the delight of Apple and its shareholders, the services division boasts a significantly higher profitability margin than the product segment. While Apple garners a gross profit of approximately 33% from its products, the services arm flaunts an impressive 75%.

The implication is that Apple is zealously nurturing its services domain, recognizing it as the primary driver of value within the organization.

So, why did Apple splurge $20 billion on a realm seemingly invisible to the masses?

Apple’s $20 Billion Bet on Apple TV+ Productions

Apple remains reticent about divulging the nitty-gritty of its services division’s earnings and expenditures, leaving investors dependent on conjectures.

Reports from Bloomberg unveil that Apple funneled over $20 billion into Apple TV+, morphing into a player vying against industry behemoths like Netflix, Amazon, and Disney in the fierce ‘streaming wars’ battleground.

However, the extravagant outlay seems to have yielded underwhelming returns. While Apple clinched a Best Picture accolade in 2022 for “Coda,” other high-budget endeavors faltered to propel Apple TV+ viewership. According to sources, Apple TV musters a monthly audience equivalent to Netflix’s daily viewership.

Speculation alludes to Apple’s management tightening the purse strings and axing budgets for its streaming ventures, pivoting attention towards fresh artificial intelligence (AI) tools to amplify services revenue further. AI investments, although steep, herald a future where Apple’s splurging days on Apple TV could be history.

Apple ventured into streaming’s treacherous waters, draining coffers that might have cascaded into AI. Yet, the realization dawns that this resource misallocation has not gone unnoticed by Apple, with pragmatic steps being taken to curtail lavish streaming expenditures. Consequently, Apple’s strategic focus has veered towards bolstering its services and AI enterprises: the former propelling its current growth trajectory, the latter carving pathways to its future.

Should you invest $1,000 in Apple right now?

Before diving into Apple’s shares, ponder this:

The Motley Fool Stock Advisor analyst consortium has pinpointed what they discern to be the subterranean gems hiding in the tech giant’s labyrinth.

Unlocking Investment Potential Beyond Apple

Investors seeking growth in their portfolios often fixate on tech giant Apple. However, the allure of lesser-known stocks could hold massive potential. Highlighting a set of 10 innovative stocks poised to yield substantial returns, this investment strategy stands to diversify and enhance investment opportunities.

The Nvidia Example: A Glimpse into Monumental Growth

If historical data serves as any indication, consider Nvidia’s inclusion on this exclusive list back in April 15, 2005. A mere $1,000 investment at the time of the recommendation would have burgeoned into an eye-watering $792,725. Such monumental growth accentuates the profound opportunities lurking in the stock market beyond conventional choices.

Stock Advisor: Nurturing Financial Success

For investors craving a surefire roadmap to financial success, Stock Advisor emerges as a guiding light. Boasting an easily navigable blueprint, it expounds on piecing together a robust portfolio, furnishing regular updates from acclaimed analysts, and debuting two fresh stock picks each month. Remarkably, the Stock Advisor service has eclipsed the S&P 500 returns by more than fourfold since its inception in 2002, showcasing its remarkable track record.

Experience the Journey to Financial Expansion

Delve deeper into this exciting venture and acquaint yourself with the 10 handpicked stocks, meticulously curated to amplify your investment portfolio. Embrace this opportunity to witness the birth of potential investment growth that transcends beyond the confines of mainstream selections.

*Stock Advisor returns accurate as of August 22, 2024

Embark on this journey, devoid of the Apple-centric echoes, and unveil a realm of unprecedented financial growth. By contemplating the uncharted waters of investment avenues, investors may unearth hidden gems that promise exponential returns in the long run.