Apple (AAPL) is gearing up to unveil its fiscal Q2 2024 earnings this Thursday following the market close. The tech giant finds itself in a precarious position, ranked as the second-worst performer among the “Magnificent 7” stocks for the year, tailing behind Tesla (TSLA), which staged a recovery post its late April earnings announcement.

Despite the challenges, there is a flicker of hope shrouding Apple’s upcoming report, reminiscent of Tesla’s experience. As Tesla defied dismal projections in its Q1 disclosure, could Apple replicate a similar feat? The answer lies in dissecting Apple’s earnings projections and how it aligns with the prevailing market sentiment.

Apple Earnings Projections for Fiscal Q2

Market analysts anticipate Apple to reveal revenues of $90.6 billion in fiscal Q2, reflecting a 4.5% decline year-over-year. While Apple managed to surpass revenue estimates with a 2% uptick in the December quarter, this marked a stark deviation from its uncharacteristic trend of revenue declines over the past four consecutive quarters.

During the Q1 earnings call, Apple hinted at anticipating revenues similar to the prior year. Adjusting for the $5 billion pent-up demand surge witnessed in the same quarter of the previous year, Apple’s Q2 revenue projections appear closely aligned with the company’s own guidance.

Amid the fervor surrounding iPhone sales, China emerges as a critical concern. The onslaught of competition from Huawei, fueled by technological breakthroughs, poses a formidable threat to Apple’s market share in China. Coupled with the deceleration of the Chinese economy, the landscape presents a challenging terrain for iPhone sales.

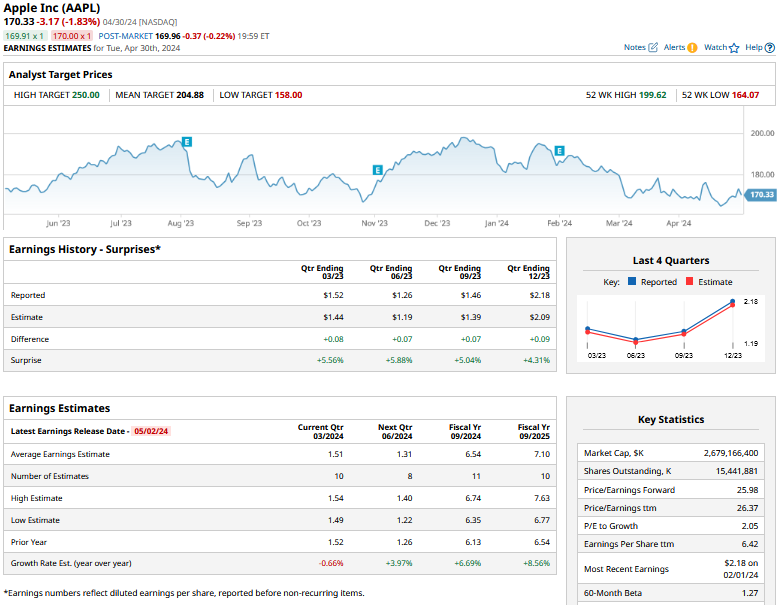

Furthermore, Apple’s earnings per share (EPS) is poised to decrease by approximately 0.66% in the recently concluded quarter. While tech counterparts like Alphabet (GOOG), Meta Platforms (META), and Amazon (AMZN) have been aggressive in pursuing cost-cutting strategies, Apple’s more conservative approach has restrained its profit margins compared to its peers.

Key Dynamics to Monitor in Apple’s Earnings Call

Investors will be closely monitoring Apple’s commentary on its China operations and the iPhone sales forecast during the earnings call. The performance of the Vision Pro, released in February, and Apple’s foray into artificial intelligence (AI) constitute pivotal areas warranting attention, especially after CEO Tim Cook teased upcoming AI initiatives in the previous earnings call.

With the anticipation of AI revelations coinciding with the Worldwide Developers Conference (WWDC) in June, investors are eager for insights on Apple’s AI integration strategies. As the tech sphere centers its focus on AI advancements, Apple’s roadmap in this domain carries significant weight in shaping future consumer engagement.

Investment Implications: The Case for AAPL Stock

Prior to Apple’s fiscal Q2 earnings release, Bernstein upgraded the stock rating from “market perform” to “outperform,” affirming the opportunity presented by Apple’s recent dip in share value. While concerns loom over stagnant iPhone sales and growth limitations, the advent of AI-enabled devices could catalyze a significant upgrade cycle.

Analysts project a potential surge in iPhone upgrades driven by AI innovation, reminiscent of the 5G-driven surge witnessed in the past. As tech peers like Alphabet pivot successfully in the AI domain, the precedence set underscores the untapped potential awaiting Apple in embracing AI integration.

Apple, a key player in the tech landscape, has yet to fully explore the AI frenzy that has gripped the industry. Despite its subdued performance last year, Apple remains an attractive investment proposition due to its conservative valuations and the promise of a post-earnings upswing in light of the overly pessimistic market outlook for 2024.