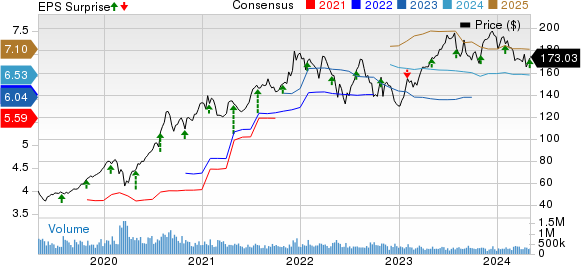

Apple AAPL just twirled and shone like a bright star in the sky with its reporting of second-quarter fiscal 2024 earnings of $1.53 per share. This beat the Zacks Consensus Estimate by 1.32% and tickled up 0.7% year over year. Earnings soared with the wind beneath its wings, courtesy of buoyant strides in services gross margin.

Net sales moonwalked down by 4.3% year over year to $90.75 billion, but sashayed past the Zacks Consensus Estimate by 0.85%. A gust of unfavorable forex winds hurt net sales by 140 basis points (bps).

Shares pirouetted up by 7.51% in pre-market trading after Apple CEO Tim Cook’s jazzed-up comments about plans to magnify the usage of AI in the company’s devices, not to mention the record-breaking $110 billion share repurchase declaration.

Despite a few stumbles, with shares of the iPhone sage dipping by 10.1% year to date, lagging behind the Zacks Computer & Technology sector’s return of 8.5%, Apple’s performance coasts through rough waters like a seasoned skipper on a stormy sea.

iPhone Sales Declines Offset By Services Growth

As iPhone sales dipped by 10.5% from the year-ago quarter to $46 billion, accounting for 50.6% of total sales, it faced some turbulent skies with stiff year-over-year comparisons. Snug in Apple’s earnings boat, the waters were calmed by the revelation of nearly $5 billion in one-time revenues from a year ago. Excluding this, iPhone revenues would have surged year-over-year in the fiscal second quarter.

Despite the dip, services revenues were the shining knights, galloping onward with a 14.2% growth from the year-ago quarter to $23.87 billion, riding high at 26.3% of total sales. This valiant figure might have missed the consensus mark by 1.2%, but Apple now boasts over 1 billion paid subscribers across its Services portfolio, a figure that has doubled in just four years.

Geographic Details

Like diverse landscapes under a vast sky, America’s sales tiptoed down by 1.4% year over year to $37.27 billion, Europe’s sun rose by 0.7% to $24.12 billion, Greater China’s winds of change dipped by 8.1% to $16.37 billion, the rest of the Asia Pacific whispered away 17.2% to $6.72 billion, and Japan’s cherry blossoms wilted by 12.7% to $6.26 billion.

Mac Sales Up, iPad & Wearables Decline

Navigating through the waves, non-iPhone revenues, which include iPad, Mac, and Wearables, decreased by 7.4% year over year. Mac sales, the sturdy mast of the ship, rose by 3.9% to $7.45 billion, steered by the MacBook Air and expanding enterprise adoption. Meanwhile, iPad sales dipped by 16.7% to $5.56 billion, and Wearables, Home, and Accessories sales, like forgotten treasures, declined by 9.6% to $7.91 billion.

Operating Details

The ship’s gross margin spread its sails far and wide, expanding by 230 basis points year over year to 46.6%. Though the products’ gross margin dipped by 280 bps sequentially to 36.6%, the services’ gross margin waved high at 74.6%, climbing 180 bps sequentially.

While the operating expenses rose by 5.2% year over year to $14.37 billion, the battle flags of research & development expenses and selling, general & administrative expenses climbed 6% and 4.3% respectively. Operating margin, like a lighthouse guiding the way, expand by 90 bps year over year to 30.7%.

Balance Sheet

As of Mar 30, 2024, cash & marketable securities played hide and seek at $162.34 billion, compared to $172.58 billion as of Dec 30, 2023. Term debt, as of Mar 30, 2024, dwindled down to $102.59 billion from $106.04 billion as of Dec 30, 2023.

Guidance

Apple’s crystal ball reveals a low-single-digit growth in revenues during the June quarter, with a 2.5% expected revenue hit from unfavorable forex. For the Services segment, expected double-digit growth rates stand akin to the first half of fiscal 2024, while pleasant surprises await as iPad revenues set sail for a double-digit growth spurt.

Zacks Rank & Stocks to Consider

In the vast realm of stocks, Apple currently basks in a Zacks Rank #3 (Hold). Other promising stars in the sky include Arista Networks ANET, NVIDIA NVDA, and Dell Technologies DELL, each holding a Zacks Rank #2 (Buy).