Advanced Micro Devices (NASDAQ: AMD) has seen its stock drop by 11% in the last quarter after a remarkable 147% surge since the beginning of 2023. Riding on the wave of the artificial intelligence (AI) boom, AMD hoped to emulate the success of its rival Nvidia in the AI chip market. However, lackluster earnings and Nvidia’s outstanding performance have posed challenges for AMD. The critical question now is whether it’s the right time to consider a long-term investment in AMD amid its recent downturn or explore alternative opportunities within the same sectors.

AMD’s Recent Earnings Performance in Review

AMD released its Q1 2024 earnings on April 30, reporting a 2% year-over-year revenue growth to $5 billion, surpassing analysts’ projections by $20 million. While the data center and client segments flourished with an 80% and 85% revenue surge respectively, AMD suffered substantial setbacks, with more than 40% revenue declines in its gaming and embedded divisions. Although the company managed to beat revenue and earnings-per-share estimates, Nvidia outshined with a staggering 262% year-over-year revenue surge in the same quarter, overshadowing AMD’s performance.

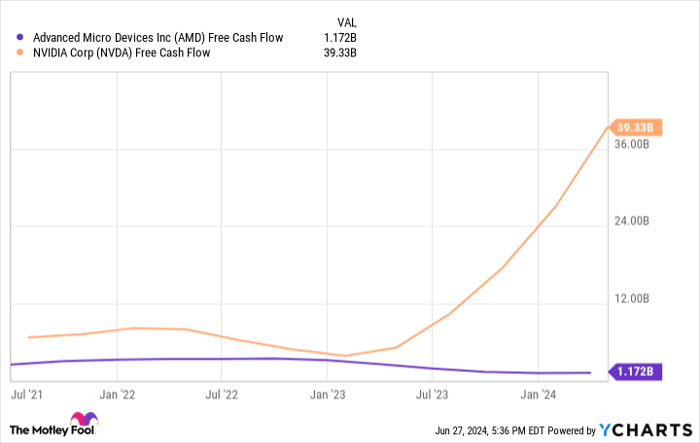

Discrepancies in the growth trajectories of AMD and Nvidia have caused AMD’s free cash flow to plummet by 52% since 2021, while Nvidia’s soared by 490%. This financial gap highlights Nvidia’s significant advantage over AMD in terms of financial resources, potentially enabling it to sustain its market dominance and chip business expansion.

Despite AMD’s strong presence across various tech domains, such as PC gaming, consoles, data centers, and consumer electronics like laptops, the looming shadow of Nvidia demands that AMD distinguish itself in the industry to entice customers with compelling product offerings.

Challenges for AMD in the AI Competition

Nvidia currently commands a substantial share (estimated at 70% to 95%) of the AI GPU market, leaving little space for rivals like AMD to carve out their space. Historical trends indicate Nvidia’s stronghold in the GPU market, where its share has climbed from 65% to 88% over the last decade, while AMD’s share dwindled from 35% to 12% by Q1 2024.

In the central processing unit (CPU) industry, AMD faces an uphill battle against Intel, despite gaining market share with its Ryzen processors. While AMD’s CPU share rose from 18% to 33% since 2017, Intel still holds a dominant 64% stake in CPUs in 2024, showcasing the difficulty of wrestling market dominance away once established. This trend suggests that Nvidia is likely to maintain its lead in the AI chip domain, creating a challenging environment for AMD to achieve significant growth.

Moreover, AMD struggles to differentiate itself from competitors. While Nvidia excels in GPUs and Intel expands into AI chip production, positioning itself as a key player in AI chip fabrication, AMD is yet to identify a niche to dominate in AI, focusing on developing chips to contend with offerings from Nvidia and Intel.

When considering the comparative value, AMD falls short as its stock exhibits a higher price-to-earnings ratio than its peers, making it less appealing in terms of investment value. Given these factors, it might be prudent for investors to explore better-valued options in the market.

Final Thoughts: Making the Investment Decision

Given the current landscape, investing in Advanced Micro Devices at this juncture may not offer the most favorable prospects. Competitors like Nvidia and Intel seem better equipped to capitalize on the evolving AI market dynamics, potentially yielding stronger returns for investors.

Before committing to AMD stock, investors should weigh the available data carefully and consider alternative opportunities within the sector to ensure optimal investment outcomes.

*Stock Advisor returns as of June 24, 2024