A Shift in Sentiment

Recent sentiment towards Advanced Micro Devices (NASDAQ:AMD) has been a bit cool. While the company is poised to benefit from the AI wave, some investors have found its growth trajectory somewhat underwhelming. There is a sense that AMD has not fully capitalized on the AI opportunity.

Identifying Growth Opportunities

In the eyes of investor Insight Analytics, the key to AMD’s resurgence lies in uncovering new growth avenues. One significant area is the data center GPU segment, where Nvidia currently dominates with a lion’s share of the AI chip market. However, a shift is on the horizon towards monetizing AI through inference rather than merely training models, presenting AMD with a chance to expand its market presence.

The emergence of AMD’s MI300X, showcasing superior inference performance over Nvidia’s Hopper in memory-intensive tasks, suggests a potential cost advantage for AMD. Insight Analytics predicts that AMD could possibly capture up to 10% of the data center GPU market by 2027, up from its current 3%. This growth could outpace the market’s anticipated 38% CAGR.

Furthermore, AMD is well-positioned to challenge Nvidia in the gaming realm and capitalize on the growing demand for AI-capable PCs, offering a solid growth opportunity in the CPU market.

A Positive Outlook

Instead of a bearish stance on AMD, Insight Analytics advocates for bullish sentiment, foreseeing a potential stock price surge of up to 50% as enterprises harness the true power of AI technology.

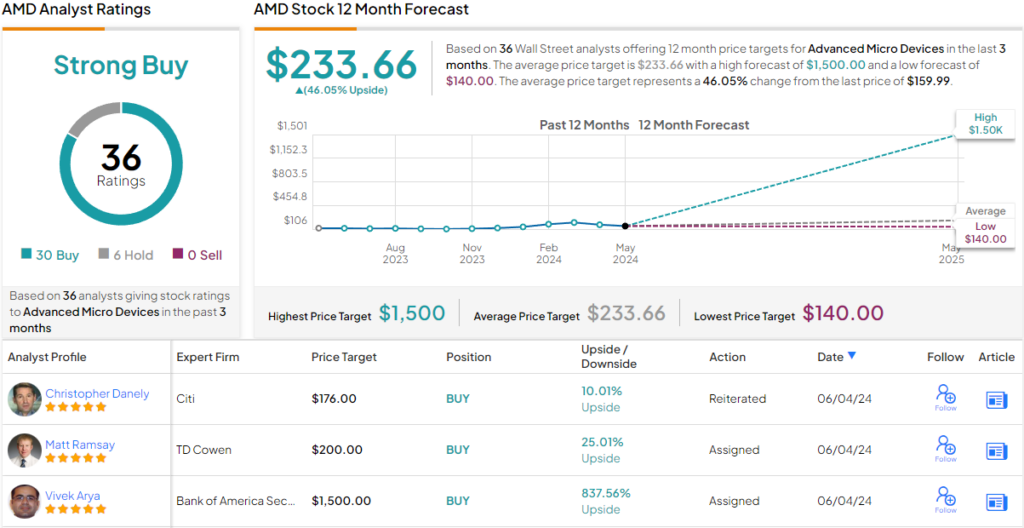

Backing this optimism is a Buy rating from Insight Analytics and a Strong Buy consensus rating among Wall Street analysts. With 30 Buy ratings against 6 Holds, the stock shows an average target price of $233.66, indicating a potential 46% upside over the next year.

To explore more undervalued stocks, investors can visit TipRanks’ Best Stocks to Buy, a tool that consolidates all of TipRanks’ equity insights.

Disclaimer: The opinions presented in this article belong to the featured analysts. Readers are advised to conduct their analysis before making investment decisions.