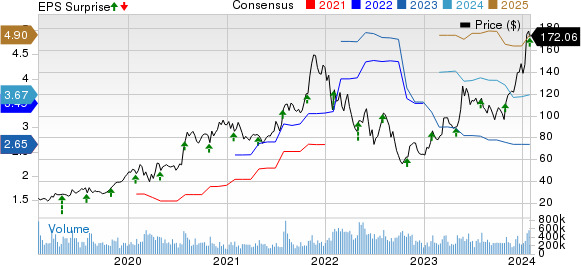

Advanced Micro Devices (AMD) reported fourth-quarter 2023 non-GAAP earnings of 77 cents per share, in line with the Zacks Consensus Estimate. The figure jumped 11.6% year over year. Revenues of $6.17 billion beat the Zacks Consensus Estimate by 0.88% and increased 10.2% year over year. The positive top-line performance was fueled by solid client growth, specifically in the Data Center and Cloud segment.

Strong Data Center Revenues

Data Center revenues surged 38% year over year to $2.28 billion and accounted for 37% of total revenues. Sequentially, revenues increased 43%, driven by the strong adoption of fourth-generation AMD EPYC CPUs and AMD Instinct GPUs. In cloud, server CPU revenues increased year over year as North American hyperscalers expanded fourth Gen EPYC Processor deployments.

Amazon, Alibaba, Google, Microsoft MSFT, and Oracle ORCL brought more than 55 AMD-powered AI, HPC, and general-purpose cloud instances into preview or general availability in the reported quarter. Exiting 2023, AMD had more than 800 EPYC CPU-based public cloud instances available.

Surge in Client Segment Revenues

The Client segment revenues soared 61.8% year over year to $1.46 billion, benefiting from strong Ryzen 7000 Series CPU sales. In contrast, the Gaming segment revenues decreased 16.8% year over year to $1.37 billion due to lower semi-custom revenues, and the Embedded segment revenues were $1.06 billion, down 24.3% year over year. Both segments accounted for a combined 39.3% of total revenues.

Mixed Operating Margin and Cash Flow

Non-GAAP gross margin contracted 30 basis points (bps) on a year-over-year basis to 50.8%. Non-GAAP operating expenses increased 7.8% year over year to $1.73 billion while the non-GAAP operating margin contracted 40 bps on a year-over-year basis to 22.9% in the fourth quarter. Operating cash flow was reported at $381 million compared with $421 million in the third quarter of 2023, and free cash flow was $242 million in the fourth quarter of 2023 compared with $297 million in the third quarter of 2023.

Guidance and Future Outlook

AMD expects first-quarter 2024 revenues to be $5.4 billion (+/-$300 million). The company anticipates a mixed demand environment with strong growth in its Data Center and Client segments, offset by declines in the Embedded and Gaming segments.

Stock and Sector Analysis

Currently, AMD has a Zacks Rank #3 (Hold). Silicon Motion Technology SIMO is a better-ranked stock that investors can consider in the broader Zacks Computer & Technology sector, sporting a Zacks Rank #1 (Strong Buy) at present. Silicon Motion Technology shares have declined 1.4% in the past six-month period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research