Market Dynamics: Tech Giants Leading the Pack

The current stock market landscape is akin to a vast ocean dominated by the Mega Caps. These tech juggernauts have been at the helm of driving remarkable gains, with a select few powerhouse performers basking in the limelight of success.

Staying the Course: The Enduring Appeal of Amazon

As the allure of the Mega Caps dazzles investors, the question arises – should one shift focus to explore new opportunities beyond these giants? Wolfe analyst Shweta Khajuria unequivocally affirms the steadfast reliability of one prominent titan – Amazon (NASDAQ:AMZN).

Unveiling Amazon’s Strengths

Khajuria eloquently outlines Amazon’s key advantages, citing its dominant leadership positions across Retail, Digital Advertising, and Cloud Computing – all within the realm of trillion-dollar markets. A differentiated value proposition, coupled with a foray into new growth avenues like Video, Groceries, Health Care, and Amazon Business, positions Amazon for sustained success.

Bullish Outlook: Unpacking Amazon’s Growth Potential

Khajuria’s optimistic forecast is underpinned by various growth catalysts – increased consumption patterns, price optimization strategies, GenAI product adoption, and favorable long-term trends set to propel revenue growth in AWS. Moreover, significant margin expansion avenues abound, fueled by extended server lifespans, enhanced retail operating efficiency, and regionalization efforts.

Competitive Edge: Amazon’s AI Prowess

Underscoring Amazon’s competitive moat in the AI landscape, Khajuria emphasizes the company’s superiority in GenAI capabilities. While rivals like Google and Microsoft intensify their AI investments, Amazon’s strategic focus and track record in large language models position it favorably for long-term success.

A Glimpse into the Future

Looking ahead, Khajuria anticipates Amazon reaping the rewards of its sizeable AI investments to drive efficiencies across Retail and AWS domains. With a robust CapEx allocation towards AI initiatives, Amazon is primed to enhance automation, fulfillment speeds, and customer service offerings.

Financial Projections: Green Lights Ahead

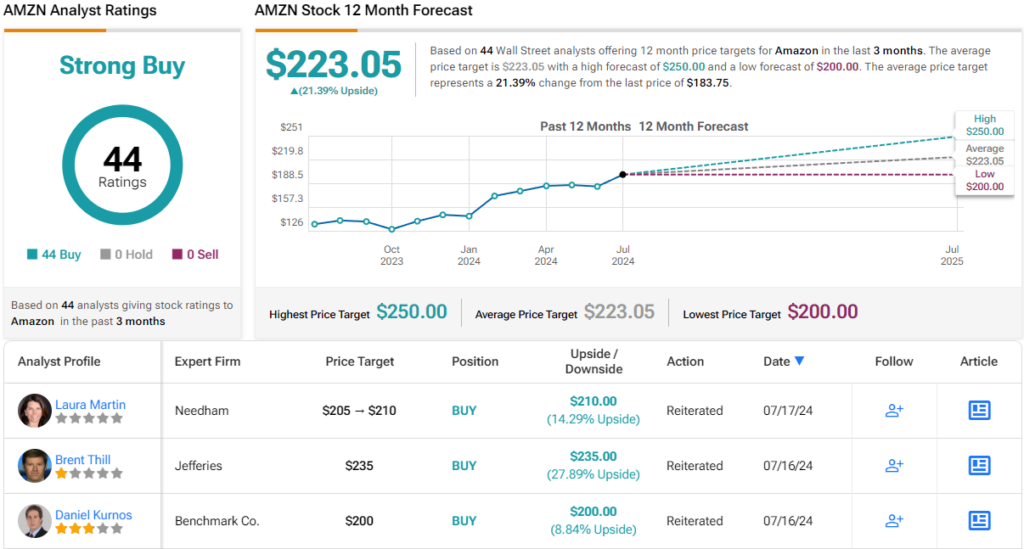

Khajuria’s initiation of AMZN shares with a Buy rating and a Street-high price target of $250 spells a promising 36% upside potential in the near term. This upbeat sentiment resonates across Khajuria’s peers, with a unanimous Strong Buy consensus rating based on 44 Buy recommendations.

The average price target of $223.05 augurs a healthy 21% return over the next 12 months, reflecting the overall bullish stance on Amazon’s trajectory.

Parting Thoughts

As the financial outlook for Amazon shines brighter than ever, investors stand at the cusp of a lucrative opportunity. With a blend of strategic foresight and market prowess, Amazon’s dominance seems poised to soar to greater heights, capturing the essence of resilience and innovation in today’s dynamic business landscape.

To explore undervalued stock opportunities, investors can turn to TipRanks’ Best Stocks to Buy, an insightful tool offering a comprehensive overview of equity insights.

Disclaimer: The insights shared in this article reflect the views of the featured analyst. This content is intended for informational purposes only, highlighting the importance of conducting thorough due diligence before making any investment decisions.