Awaiting Amazon’s Quarterly Performance

As Amazon readies to unveil its first-quarter earnings post-market closure today, investor anticipation is palpable. The focus is not merely on financial numbers but on the strategic bets made by the giant in artificial intelligence (AI), cloud computing, advertising, and the broader economic landscape.

Anticipated Growth and Analyst Projections

Prior to the earnings disclosure, analysts have set robust expectations for Amazon’s performance. Forecasts pinpoint an earnings per share (EPS) of $0.83, a formidable 73% surge from the previous year, coupled with a quarterly revenue estimate of $142.5 billion. Although the EPS projection lags the prior quarter’s figure, it marks a substantial 167% upsurge from the corresponding period.

Long-Term Projections and Market Sentiment

Analysts remain bullish on Amazon’s trajectory, envisioning significant growth ahead. The consensus showcases an annualized EPS growth rate of 43.7% for both this year and the next, with revenue projections painting a picture of steady ascendance, reaching $641.5 billion by year-end and envisaging a climb to $714.6 billion by 2025 with an average annual growth rate of 11%.

Strategic Focus on AI, Cloud, and Growth

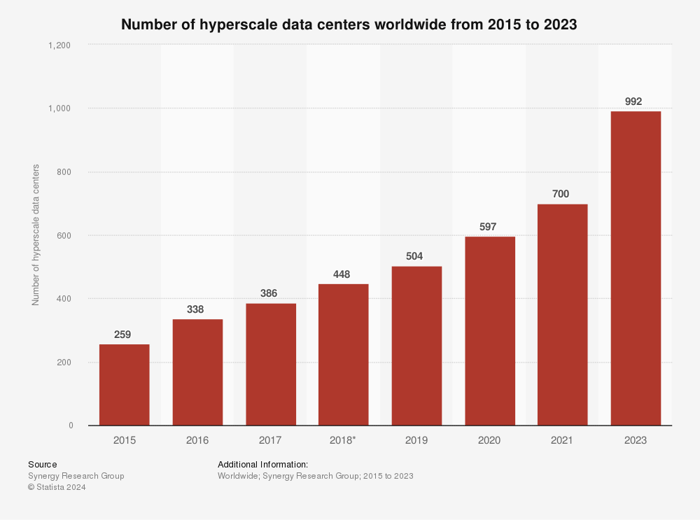

Post-Microsoft’s strong cloud earnings display, all eyes are on Amazon’s Q1 figures. Of particular interest is how the company’s substantial investments in AI play out across its diverse business realms. CEO Andy Jassy’s rhetoric touts AI as a potential game-changer, reverberating in Amazon’s recent hefty investments in Anthropic, an AI startup. Amazon’s ambition to lead in this domain signifies a strategic move to forge new revenue streams via AI services for existing clientele.

Besides AI, Amazon’s track record of competitive pricing, extensive product lineup, and efficient delivery mechanisms are expected to sustain sales growth. The burgeoning advertising arm, especially bolstered by the Prime Video platform, holds promise for further expansion.

In the cloud arena, Amazon Web Services retains a commanding 30% market share, strengthened further by recent investments. Even as Amazon fortifies its position against competitors, cost optimization measures, including recent layoffs, unveil a dual focus on efficiency and expansion.

Market Dynamics and Stock Price Reaction

Following Amazon’s earnings revelations, the stock often experiences heightened volatility. This reporting cycle coincides with the Federal Reserve’s interest rate decision, adding another layer of possible market sway post-earnings announcement.

Financial Health and Evaluation

Anchoring a lens on Amazon’s financial standing reveals a ‘good performance’ rating, indicating moderate uncertainty across various financial models. Evaluation sets the fair value for AMZN at $177.50, suggesting the stock currently trades around its intrinsic value, with close monitoring post-earnings essential.

Strengths and Weaknesses Evaluation

Insights from InvestingPro spotlight Amazon’s strengths in notable historical returns and anticipated profitability growth, while calling attention to potentially elevated valuation ratios and debt levels as areas needing vigilance. Despite these considerations, the market seems optimistic about Amazon’s growth initiatives and operational efficiencies boding well for a promising first quarter performance.

Technical Market Outlook

Amazon’s stock exhibits a discernible uptrend within an ascending channel since the previous year. Recent price action, rebounding from the lower channel boundary, suggests a bullish momentum. If earnings prove favorable, a surge towards the $190 price level seems plausible, while technical indicators hint at a positive trajectory. However, the impact of the Fed’s imminent interest rate decision on the broader market can potentially introduce volatility to Amazon’s stock performance.