Amazon (NASDAQ: AMZN) has long been synonymous with rapid deliveries, setting the standard for swift service in the retail realm. This focus on speed has propelled the e-commerce behemoth to the forefront, leaving traditional brick-and-mortar establishments lagging in its wake.

However, while prioritizing quick delivery has been a winning strategy for Amazon, it may have inadvertently neglected a segment of clientele with a penchant for thriftiness and a preference for lower prices over expedited shipping. This gap, in turn, has led budget-conscious customers to seek better deals on economical Chinese e-commerce platforms. Recognizing this phenomenon, Amazon now seems poised to pivot and capture this demographic with its latest initiative.

Amazon’s Shift Towards Value

From books to home essentials, Amazon boasts an expansive array of products catering to diverse needs. Yet, for bargain hunters seeking unbeatable prices, platforms like Shein or Temu, under the PDD Holdings umbrella, have emerged as go-to destinations, offering enticingly low price tags albeit with longer shipping durations than Amazon’s rapid delivery standards.

Reports from The Wall Street Journal suggest that Amazon is gearing up to unveil a new service tailored toward affordable fashion and other items originating directly from China, with estimated shipping times ranging from nine to 11 days. While a departure from its hallmark quick deliveries, this move aims to curtail the migration of price-sensitive shoppers to external platforms, thereby consolidating Amazon’s grip on the market.

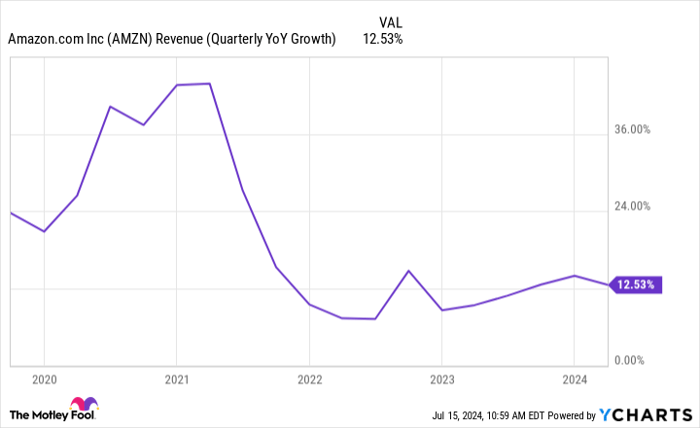

Revitalizing Growth Through New Avenues

Although the strategy of offering slower deliveries may seem counterintuitive for Amazon, it presents a strategic maneuver to compete against Chinese e-commerce rivals. By tapping into a customer base that prioritizes cost-effectiveness over expeditious delivery, Amazon stands to penetrate a lucrative market segment. The preceding year saw PDD Holdings raking in revenue nearing $35 billion, nearly doubling its previous fiscal performance. Through this venture, Amazon is positioning itself amidst a burgeoning wave of price-conscious consumers amid increasingly challenging economic climates, potentially fortifying its revenue trajectory in the foreseeable future.

AMZN Revenue (Quarterly YoY Growth) data by YCharts

Investing Implications for Amazon

Amazon’s shares have surged approximately 30% year-to-date, propelling its market valuation past the $2 trillion mark. Despite trading at over 50 times earnings, the company remains an appealing long-term investment prospect, especially as it charts a course to cater more extensively to budget-conscious shoppers.

Engaging in direct competition with Temu and Shein heralds a pivotal juncture for Amazon, potentially bolstering revenue growth and fostering customer loyalty on its platform. This strategic shift not only augments the value proposition of an Amazon Prime membership but could also fuel a surge in new enrollments.

Overall, Amazon’s foray into the bargain shopper territory appears to be a calculated move with promising returns on the horizon. By tapping into heightened growth prospects in this sector, the e-commerce pioneer solidifies its standing as an industry frontrunner, accentuating its allure as a robust investment option.

Strategic Investment Outlook

Prior to delving into Amazon stock, investors are advised to consider the insights offered by Motley Fool Stock Advisor. While Amazon did not make the cut for the current top 10 stocks identified by the analyst team, the featured selections exhibit substantial growth potential in the forthcoming years.

Recall the trajectory of Nvidia upon inclusion in this list back in April 15, 2005. A $1,000 investment then would have ballooned to $774,281 today.

Stock Advisor equips investors with a roadmap for success, offering guidance on portfolio management, regular analyst updates, and bi-monthly stock recommendations. Since its inception in 2002, the Stock Advisor service has outperformed the S&P 500 index manifold.

*Stock Advisor returns as of July 15, 2024