Amidst the backdrop of a surging demand for artificial intelligence (AI) and cloud services, Alphabet’s Google has unveiled its ambitious plan to invest $2 billion in Malaysia. This strategic move aims to establish the tech behemoth’s first data center and cloud facility in the region, tapping into the burgeoning appetite for digital transformation.

Projections suggest that this initiative could spawn 26,500 employment opportunities by the dawn of 2030. Google has articulated that the data center will serve as the powerhouse behind essential digital services like Google Search and Maps within the country. Moreover, the cloud facility pledges to assist businesses and organizations in navigating the labyrinth of security protocols and data storage prerequisites.

Pioneering the Southeast Asian Skyline

In a synchronized crescendo, several tech juggernauts, including Microsoft, Amazon, and Apple, have orchestrated symphonic investments in Southeast Asia to cater to the escalating hunger for AI and cloud computing services. Microsoft recently unfurled plans to infuse approximately $2.2 billion into Malaysia, with parallel undertakings set for Indonesia and Thailand. Amazon has also joined the cavalcade, affirming a $9 billion vow to fortify its cloud services in Singapore. Meanwhile, Apple divulged a $250 million blueprint to expand its Singaporean footprint, heralding the birth of fresh AI job prospects.

Market Watchers Salute GOOGL’s AI Vanguard

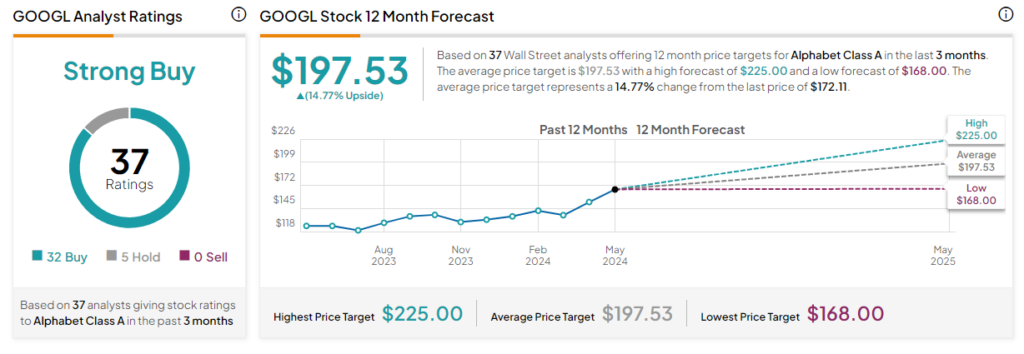

Per the discerning eyes of analysts leveraging the TipRanks Stock Analysis tool, an upbeat aura envelops Alphabet, with prophetic voices hailing the company’s forthcoming growth as being propelled by a wave of groundbreaking AI innovations.

An air of optimism wafts through Wall Street as the stock garners a Strong Buy consensus rating based on 32 Buy and five Hold endorsements. The scribes of finance have painted an idyllic picture, forecasting an average price target of $197.53 for Alphabet stock, indicating a tantalizing upside of 14.77%. Impressively, Alphabet’s shares have orchestrated a 30.5% upward tango over the past half-year.