Alphabet (GOOG, GOOGL) stock has stumbled following the release of lackluster results for Q4, with its free cash flow (FCF) taking a significant hit due to rising capital expenditures. Despite this, there could still be an opportunity for investors to capitalize on undervalued shares of GOOGL.

Current estimates suggest a value of at least $170 per share, reflecting a potential increase of 21.5% from the current price levels.

Previously, an article on Barchart proposed a potential value of $221 per share for GOOGL based on robust Q3 FCF margins. However, the average analyst price target at that time stood at $165 per share, as per AnaChart.com.

As of February 2, 2024, GOOG stock is trading at $140.13, down from its recent high of $153.91 at the end of January.

Tepid FCF Results

Following Alphabet’s release of unimpressive results on January 30, 2024, it was revealed that while revenue grew by 13% year-over-year, the operating margin dipped to 27% from 28% in the previous quarter.

To the company’s credit, the year-earlier operating margin was lower at 25%, indicating some progress over the past year.

However, the most significant concern was Alphabet’s FCF, which plummeted to just under $8 billion in Q4 2023 compared to $16.02 billion in the previous year’s comparable period. In Q3, it had generated $22.6 billion in FCF.

This represented a stark decrease in FCF margin in Q4, with the FCF margin dropping to 9.25% based on $86.13 billion in revenue. In contrast, the FCF margin in Q3 stood at 29.5%.

Moreover, the FCF margin in Q4 of the previous year was significantly higher at 21%, primarily due to lower capital expenditure. Alphabet’s capex spending surged to $11 billion in Q4, compared to $8 billion in Q3 and $7.6 billion a year ago.

Forecasting FCF Going Forward

Despite the recent downturn, Alphabet generated $69.5 billion in FCF over the past year, amounting to an average FCF margin of 22.6% in relation to its $307.3 billion in revenue.

If this trend persists into the next 12 months, Alphabet could potentially generate $77 billion in FCF, based on analysts’ estimates of $342.2 billion in revenue in 2024. Even with a conservative 22% FCF margin, a forecast of $75.3 billion in FCF for 2024 is plausible.

Applying a 3.5% FCF yield, equivalent to a 28.4x multiple, Alphabet’s market cap could be valued at $2.139 trillion. This represents a 21.5% increase over the current market cap of $1.76 trillion, implying a potential value of $170 per share.

Analysts Still Like GOOGL Stock

Analysts express optimism regarding GOOGL stock, with an average price target of $162.14 per share, representing a 14.86% increase from the previous close of $141.16, as per AnaChart.com.

Notably, analyst Rob Sanderson of Loop Capital has displayed exceptional acumen in forecasting GOOG and GOOGL stock prices. His maintained price target of $140 per share underscores the positive sentiment surrounding the stock.

Refinitiv’s survey of 42 analysts, as seen on Yahoo! Finance, indicates an average price target of $159.83 per share, signifying a 13.6% potential increase from the current price level.

Overall, GOOGL stock appears attractively valued based on FCF margins and other analysts’ average price targets

Shorting OTM Puts

For existing shareholders, one potential strategy is to short out-of-the-money (OTM) put options, creating an income stream while awaiting a potential stock price recovery. Despite generating FCF, Alphabet has yet to institute dividend payments, unlike its peers such as Microsoft Corp (MSFT) and Meta Platforms (META), both of which currently pay dividends.

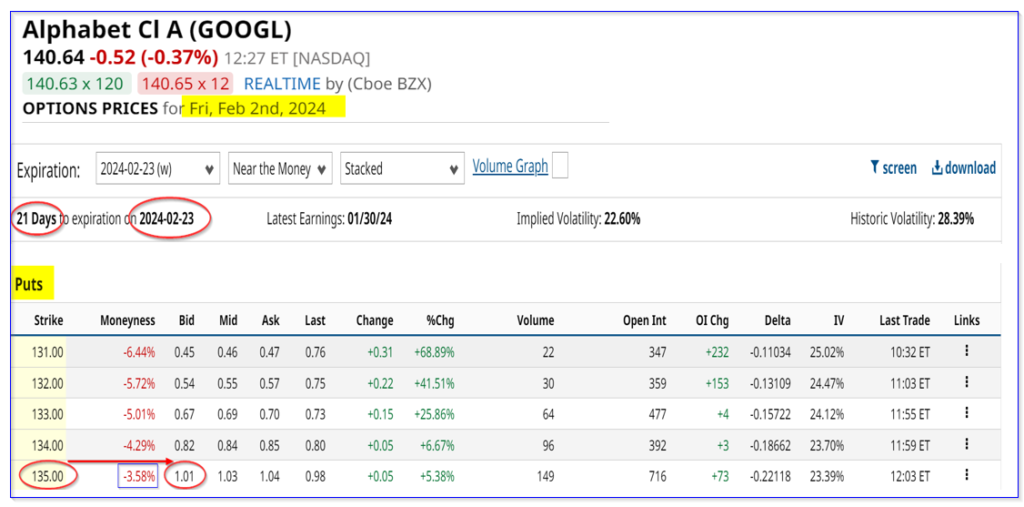

For instance, as of February 2, 2024, the $135 strike price put option with a February 23 expiry trades for $1.01 on the bid side, translating to an immediate yield of 0.75% for the short put investor.

By securing $13,500 in cash and/or margin with the brokerage firm, an investor can generate $101 by selling short this put, with the obligation to buy 100 shares at $135 per share only if the stock falls to this level.

In conclusion, GOOGL stock appears compelling at the current juncture, especially for the short-put investor.

Find more Stock Market News from Barchart