In a world where competition breeds innovation, Alphabet’s GOOGL Chromebook continues to surge ahead with its latest groundbreaking features.

Innovative Leap: Unleashing the App Mall

Alphabet is slated to introduce the ‘App Mall’, a revolutionary platform that will redefine how users explore and access their preferred apps and games within their Chromebook or ChromeOS tablet.

Through the App Mall, users will have the ability to effortlessly discover and install a myriad of Android apps from the Google Play Store alongside games available through Steam and Linux development environments like Android Studio.

This strategic move by Alphabet is expected to captivate Chromebook users, propelling the device to new heights of popularity and functionality.

Chromebook Evolution: Journey Towards Perfection

The tech giant is not stopping at the App Mall. Alphabet is set to enhance the ChromeOS experience with an array of quality-of-life features.

From launcher updates to profile picture concealment, and from a novel settings icon to Diagnostics app cards, ChromeOS is due for an extensive uplift in user experience.

With the recent release of ChromeOS 120, Alphabet has ushered in a host of features like the Virtual Desk Button, Nearby Share Self-Share, and customizable “Mouse” settings that facilitate seamless transitions between desktops and devices. Users now have control over cursor speed, scrolling speed, and acceleration, enriching their Chromebook journey.

This relentless pursuit of perfection in Chromebook technology positions Alphabet to leverage the growth opportunities that abound in the global laptop market. Projection from an EMR report anticipates a Compound Annual Growth Rate (CAGR) of 4.7% between 2024 and 2032 in the laptop market.

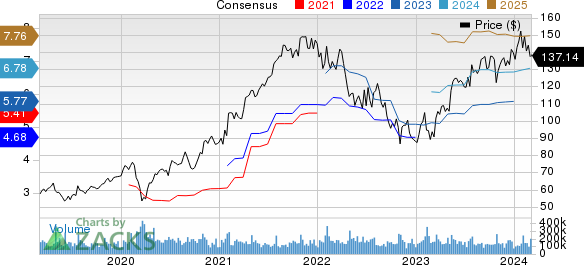

Moreover, these advancements in the Chromebook domain promise to fortify Alphabet’s Google Services segment, a major engine of the company’s growth. Over the past year, Alphabet’s shares have soared by 44.2%, outperforming the Zacks Computer & Technology sector’s growth of 46.8%.

Strong growth in the Google Services segment bodes well for Alphabet’s financial performance in the foreseeable future. The Zacks Consensus Estimate for total revenues in 2024 stands at $286.52 billion, reflecting an impressive year-over-year growth of 11.7%.

Rising Tides of Competition

The landscape is not devoid of challenges for Alphabet. The tech juggernaut faces stiff competition from industry giants like Apple (AAPL) and Microsoft (MSFT) who are also elevating their notebook and laptop offerings.

Apple, for instance, has broadened its horizon with the expansion of Self Service Repair for select MacBook Pro and iMac models. This initiative grants users access to manuals, genuine parts, and tools utilized at Apple Store locations and Authorized Service Providers.

On another front, Apple unveiled the macOS Sonoma update designed for compatible Macs. Offering enhanced features such as desktop widgets, screen savers, video conferencing, a revamped Safari experience, and refined gaming capabilities, the macOS Sonoma aims to redefine the Mac user experience.

In parallel, Microsoft is witnessing strong customer adoption of its Surface Laptop 6 product line. The Surface Laptop 6 boasts a fresh design with thinner bezels, rounded display corners, and increased port capacity. Users can choose between a 13.8-inch or a 15-inch model, each equipped with a haptic touchpad and a dedicated Copilot button.

Zacks Rank & A Gem to Consider

Presently, Alphabet holds a Zacks Rank #3 (Hold). For investors seeking a more lucrative opportunity in the technology landscape, CrowdStrike (CRWD) emerges as a robust option with a Zacks Rank #1 (Strong Buy).

Notably, shares of CrowdStrike have surged by an impressive 146.6% in the past year, reflecting the company’s solid growth trajectory. The long-term earnings growth rate for CRWD stands at an impressive 36.07%.