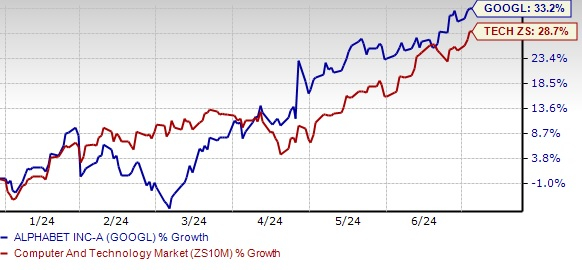

Alphabet’s GOOGL shares have surged by 33.2% this year, outperforming the Zacks Computer & Technology sector’s 28.7% growth. The firm continues to leverage its expanding generative AI capabilities to enrich user experience.

Alphabet’s segment Google recently unveiled a Gemini-powered summarization feature in Gmail for Android.

This generative-AI-supported feature simplifies lengthy newsletters in Gmail. Users can also review email conversations in Gmail using the “Summarize this email” option.

Alphabet is poised to attract a large user base among Android users leveraging Google Workspace due to this innovative feature.

Advancements in Generative AI Boost Prospects

In addition to the new summarize feature, Google launched Gemma 2, a lightweight open model available in 9B and 27B parameter sizes, aimed at accelerating AI deployment and fostering innovations across various enterprises.

Alphabet introduced its generative AI-powered note-taking app, NotebookLM, previously only accessible in the United States, to Australia, Brazil, Canada, India, the U.K., and 208 additional countries and territories.

NotebookLM, fueled by Google’s Gemini 1.5 Pro language model, aids in document understanding and reasoning. It generates summaries and suggests follow-up inquiries, focusing on document content.

Google also unveiled the YouTube Music Gemini Extension, enabling users to search for music and initiate radio playback, among other functions, using an AI chatbot experience.

It also upgraded Android Studio’s bot with Gemini Pro, allowing developers to ask coding-related questions and seamlessly integrate generative AI attributes into their applications.

These initiatives will enable Alphabet to capitalize on the robust growth opportunities in the generative AI market. According to a Statista report, the market is anticipated to reach $36.06 billion by 2024 and soar to $356.10 billion by 2030, exhibiting a CAGR of 46.5% between 2024 and 2030.

Embracing the Competitive Edge in the Generative AI Realm

The escalation of generative AI capabilities enhances Alphabet’s competitive stance against rivals like Microsoft MSFT, Adobe ADBE, and Amazon AMZN, all of whom are actively strengthening their positions in the generative AI sphere.

GOOGL shares have outshone MSFT and AMZN, returning 23% and 30%, respectively, year-to-date. Meanwhile, ADBE shares have evidenced a 4.4% decline during the same period.

Microsoft’s incorporation of GPT-4 into Bing and Edge to enrich its generative AI capabilities, providing a ChatGPT-like user interface, remains noteworthy.

Adobe is riding the success wave of its cohorts of creative, generative AI models, Firefly. It recently integrated Firefly-powered features like Generative Fill, Remove Background, Erase, and Crop into Acrobat. These functionalities are designed to enable customers to directly edit images within PDFs.

In contrast, Amazon is reaping the benefits from the widespread adoption of Amazon Bedrock, which offers easy access to top-performing foundation models from AI companies through an API.

Final Thoughts

Alphabet’s reinforced generative AI capabilities, alongside its robust competitive position, serve as pivotal growth drivers for the long term.

Moreover, the company’s sturdy cloud division, expanding traction across Google’s mobile search, and the escalating popularity of its Android, Search, and YouTube platforms are additional positives.

These factors are anticipated to sustain the company’s financial performance in the near future.

The Zacks Consensus Estimate for total revenues in 2024 stands at $291.26 billion, reflecting a 13.6% year-over-year increase.

The consensus expectation for 2024 earnings is pinned at $7.60 per share, indicating a 31.03% surge from the previous year. This figure has been revised upward by 0.4% in the past 60 days.