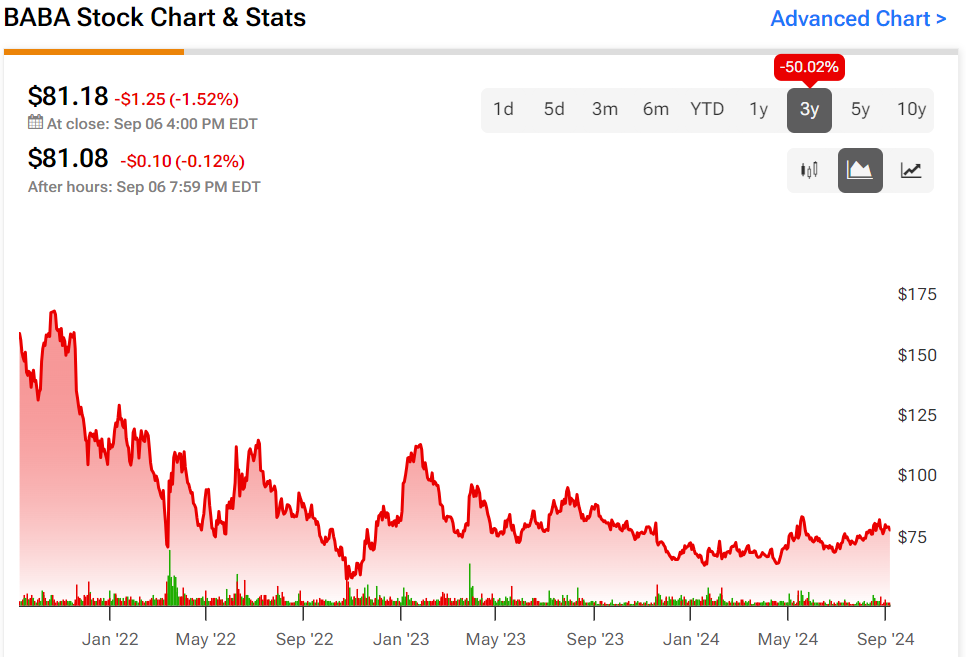

Alibaba has weathered a storm of lackluster stock performance, plagued by regulatory hurdles and macroeconomic headwinds. In its recent financial reporting, the tech behemoth demonstrated sluggish revenue growth and dwindling earnings, exacerbating the prevailing pessimism surrounding the stock. However, amidst this turbulence, Alibaba’s aggressive buyback program shines as a beacon of hope, offering a glimpse of a potential turnaround. The persistent undervaluation of shares coupled with the company’s robust share repurchases evokes a silver lining amidst the dark clouds hovering over Alibaba.

Alibaba’s Struggle with Revenue and Earnings

The latest quarterly results for Fiscal 2025 painted a somber picture for Alibaba, with total revenue inching up by a mere 3.9% year-over-year. The deceleration in growth was stark compared to previous periods, with the domestic commerce segment, including Taobao and Tmall, witnessing a slight revenue dip. Factors such as reduced direct sales initiatives and a contraction in the company’s take rate contributed to this downturn. Earnings mirrored Alibaba’s challenges, as adjusted net income saw a 9% decline year-over-year, hampered by escalating operational costs and increased investments in expansion efforts, notably the cloud and logistics divisions operating under thin margins.

The Ray of Hope: Surging Buybacks as a Bullish Catalyst

Despite the lackluster performance, Alibaba’s fervent share repurchases stand out as a potential game-changer. In the past quarter, the company bought back 613 million ordinary shares worth $5.8 billion, bringing the total buyback expenditure over the last year to $18.1 billion. This aggressive repurchase spree, boasting a buyback yield of 9.4%, underscores management’s confidence in Alibaba’s intrinsic value, even as the stock languishes at subdued valuation levels. With a generous free cash flow projection and forward-looking P/FCF ratios signaling depressed valuations, Alibaba’s strategic buyback approach introduces a cushion of safety and an avenue for substantial upside potential.

The uptick in dividend payments complements the buyback yield, culminating in a double-digit shareholder return at current stock levels. These combined initiatives not only bolster Alibaba’s financial health but also offer a promising trajectory for investors eyeing long-term growth in the stock.

Analysts’ Perspective on BABA Stock

On the Wall Street front, a Strong Buy consensus rating for Alibaba stock, backed by 13 Buys and three Holds over the past three months, supplements the optimistic narrative. With the average Alibaba stock forecast indicating a significant 34.92% upside potential at $109.53, investors are poised to capitalize on the anticipated resurgence in Alibaba’s stock fortunes.

For discerning investors seeking guidance on navigating the volatile BABA market, analyst Rob Sanderson from Loop Capital Markets emerges as a reliable source. With an impressive track record of accuracy and consistent returns, Sanderson’s insights carry weight in assessing Alibaba’s investment proposition.

In Conclusion

Despite the headwinds faced by Alibaba in revenue growth and earnings, the company’s unwavering commitment to share buybacks emerges as a beacon of optimism in an otherwise challenging landscape. Positioned against a backdrop of robust free cash flow and compelling valuation metrics, Alibaba’s stock presents an enticing opportunity for investors seeking growth potential. The strategic buybacks not only prop up the share price but also buoy per-share metrics, instilling a sense of security and the promise of enhanced EPS growth. For these reasons, the outlook remains bullish on Alibaba’s investment prospects, transcending the shadows of its past underperformance.