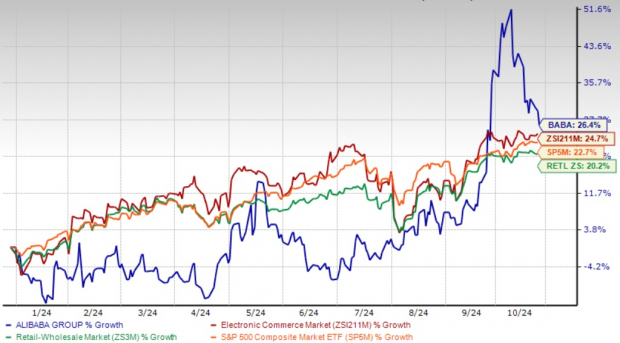

Amid the dynamic landscape of global e-commerce, Alibaba BABA stands out as a compelling investment opportunity for the near term. The stock has already demonstrated remarkable momentum through a 26.4% year-to-date surge. It has outperformed the Zacks Internet-Commerce industry’s return of 24.7%, the Zacks Retail-Wholesale sector’s rise of 20.2% and the S&P 500’s rally of 22.7%.

Apart from this impressive rally, the Chinese tech giant’s three fundamental strengths that make it an attractive proposition for investors are its thriving international commerce division, its strategic AI integration and robust financial health. These key factors, combined with innovative initiatives and strategic partnerships, position Alibaba for sustained growth in the evolving digital marketplace.

Year-to-Date Performance

Image Source: Zacks Investment Research

AIDC: Powering Global Market Dominance

The company has been benefiting from solid momentum in the Alibaba International Digital Commerce Group (“AIDC”) business, which comprises Lazada, AliExpress, Trendyol, Alibaba.com, and other businesses operating in the international retail and wholesale markets. AIDC has emerged as a powerhouse of growth, generating revenues of RMB 29.29 billion ($4.03 billion) in fiscal first-quarter 2025, marking a substantial 32% year-over-year increase. The international commerce retail business showed exceptional performance with 38% growth, reaching RMB 23.7 billion.

Solid momentum in AliExpress, Trendyol and Alibaba.com has been benefiting the overseas e-commerce business significantly. The company’s commitment to global expansion is further reinforced by innovative initiatives like Alibaba Guaranteed and the Logistics Marketplace, which simplify cross-border trade for SMEs. These developments, combined with the successful transformation of AliExpress Choice into a supply-chain-driven platform marketplace model, position Alibaba for sustained international growth. Strategic partnerships, including the collaboration with Magazine Luiza in Brazil, demonstrate Alibaba’s expanding global footprint.

AI Integration: Driving Innovation and SME Growth

Alibaba’s aggressive integration of artificial intelligence across its operations positions it at the forefront of technological innovation. The company has successfully implemented AI solutions to improve cross-platform product listings, multilingual search capabilities, and targeted recommendations. This technological edge has particularly resonated with SMEs, with 17,000 businesses already subscribing to the AI Business Assistant on Alibaba.com. The 37% increase in searches for AI-optimized products validates this strategic direction, while initiatives like Alibaba Guaranteed and Logistics Marketplace are simplifying cross-border trade.

Robust Financials: Fueling Shareholder Returns

Alibaba’s strong financial health makes it an attractive investment proposition. With a net cash position of RMB 405.75 billion ($55.8 billion) and free cash flow of RMB 17.4 billion ($2.4 billion) as of June 2024, the company maintains a robust balance sheet. This financial strength has enabled significant shareholder returns, including the repurchase of 613 million ordinary shares worth $5.8 billion in the recent quarter.

As Alibaba continues to leverage its technological capabilities, expand its global presence, and maintain strong financial discipline, investors have compelling reasons to consider BABA stock as a long-term investment opportunity. The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $140.46 billion, indicating 7.63% year-over-year growth. With the Zacks Consensus Estimate for fiscal 2025 earnings indicating an upward revision of 3% over the past 30 days to $8.94 per share, the market appears increasingly confident in Alibaba’s growth trajectory.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Attractive Valuation: A Silver Lining for BABA

Alibaba is currently trading at a discount with a forward 12-month Price/Earnings of 10.5X compared with the industry’s 24.71X and lower than the median of 15.92X. This valuation metric indicates that Alibaba’s stock is significantly undervalued compared to its industry peers, trading at less than half the industry average P/E ratio. The lower-than-median forward P/E suggests an attractive entry point for investors, as the stock appears to be trading below its fair market value despite strong fundamentals. It also has a Value Score of A, which is hard to ignore.

BABA’s P/E F12M Ratio Depicts Discounted Valuation

Image Source: Zacks Investment Research

BABA’s Competitive Landscape and Macro Challenges

Uncertainties in the global environment, changing consumption patterns, recessionary fears, market volatility and challenging conditions in China’s economy do not bode well for BABA stock.

Escalating tensions between the United States and China are concerning. Although this geo-political tech war is not directly related to the e-commerce industry, its residual effect does not bode well for Alibaba and other similar companies.

In addition, increasing expenses are hurting the margin expansion of Alibaba. In first-quarter fiscal 2025, its sales and marketing, general and administrative, and product development expenses expanded 180 basis points (bps), 240 bps and 100 bps year over year, respectively. Consequently, its operating income was down 15% year over year and the operating margin contracted 300 bps from the year-ago quarter.

Alibaba’s dominant e-commerce position in China remains threatened by global bigwigs like Amazon AMZN and eBay EBAY. Also, BABA’s growth in the global cloud market has been significantly hindered due to rising competition from the leading cloud players, namely Amazon, Microsoft and Alphabet’s GOOGL Google.

Conclusion

As Alibaba continues to leverage its technological capabilities, expand its global presence, and maintain strong financial discipline, these three key factors position BABA stock as a compelling long-term investment opportunity beyond its impressive year-to-date performance. BABA stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report