If considering investing in China’s e-commerce juggernaut Alibaba, recent rumblings may prompt a second glance. The stock has weathered a rough patch since 2021, grappling with challenges ranging from regulatory scrutiny to economic fragility within its primary market. Hovering near multiyear lows, Alibaba’s narrative hardly sparkles.

Yet, amidst this somber backdrop, could there be a glimmer of hope? Could Alibaba’s fortunes be on the cusp of a revival?

The Trials and Tribulations for Alibaba

Those entrenched in finance circles are well-acquainted with Alibaba, the force behind China’s leading e-commerce platforms like Taobao and Tmall. In addition, Alibaba manages Cainiao, a logistics arm, along with a prospering cloud computing domain and varied digital entertainment ventures. Despite its diversified portfolio, e-commerce remains its revenue linchpin.

So, what transpired in 2021? Beijing’s stringent oversight, coupled with the Herculean task of matching the frenzied online sales of 2020, weighed heavily. China’s prolonged COVID lockdowns also left an enduring economic scar, with a meager 5.2% GDP growth in 2022 — an anomaly for a nation known for robust financial expansion.

Adding to the woes, Alibaba grappled with operational instability post-founder Jack Ma’s 2019 exit. Leadership upheavals and aborted spin-off attempts have clouded the firm’s direction, fostering uncertainty among investors. Not an ideal scenario.

Nonetheless, recent indicators suggest a potential turning point. Trading at less than 10 times projected profits, Alibaba’s current valuation hints at an undervalued stock.

A Fresh Chapter for Alibaba and Its Ecosystem

Amidst lingering risks lies untapped potential. China’s economic uptick, with the IMF revising its growth forecast to 5%, offers a promising backdrop. With consumer spending rebounding and Alibaba showing signs of steady leadership under CEO Eddie Wu, a newfound clarity in purpose seems imminent.

Though the decision to retain Cainiao and cloud computing assets may reflect vacillation, Wu’s strategic vision post his September assumption appears promising. This narrative shift could bolster Alibaba’s e-commerce stance, especially as it gears up to ride the wave of AI industry growth.

Behind the scenes, the unfolding story hints at the Alibaba and leadership team many have long awaited. Wu’s resolve, despite challenges, promises substantial dividends, positioning Alibaba for transformative gains.

Unraveling the Narrative

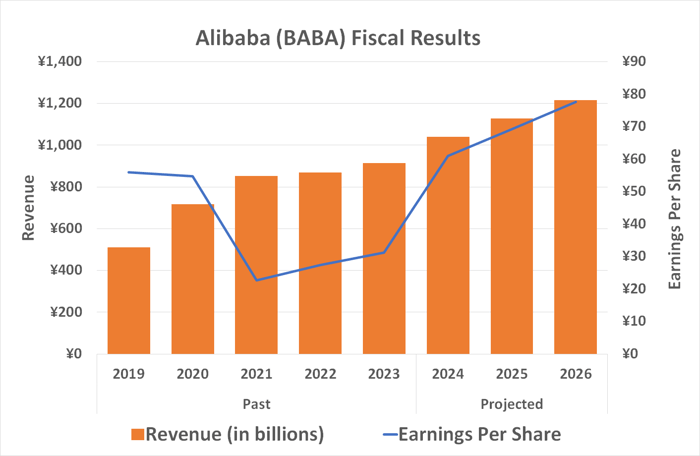

The irony persists – Alibaba’s underperformance belies the forecasted revenue surge until 2026 and enhanced per-share earnings. Analysts echo optimism, suggesting an ADR valuation 40% above the present rate. The disparity between share price and projected earnings could explain this intriguing scenario.

Data source: StockAnalysis.com. Chart by author. Figures are in Chinese yuan.

However, why does Alibaba’s stock struggle persist? Partly, it seems ingrained disbelief that a troubled giant can bounce back. Yet, signs indicate Alibaba is poised for a surge. It may require a succession of triumphant quarters to sway skeptics and propel the stock to significant, lasting gains.

An encouraging sign? Billionaire investor David Tepper’s bullish move, doubling down on Alibaba shares in Q1, signals a shrewd bet amidst uncertainty. A sagacious lesson.