After a strategic move by the e-commerce behemoth Alibaba Group Holding Ltd., the market reacted with a bullish fervor. The company’s shares witnessed an upward trajectory following the announcement of a shift in its fee policy structure for merchants. This transformation, unveiled via local Chinese media source LatePost, highlighted a transition to a percentage-based fee system – a departure from the existing fixed annual fee structure.

Post the revelation, Alibaba’s U.S.-listed shares soared over 3% in pre-market trading on Monday, with an additional surge of 5.8% in Hong Kong, marking the most significant gain in two months for the stock.

A New Service Fee Paradigm

Effective September 1, Alibaba will introduce a 0.6% basic software service fee on confirmed transactions for merchants operating on its Tmall and Taobao platforms. Noteworthy is the cessation of the fixed annual fee for Tmall merchants, aligning with the revised fee structure.

Furthermore, Alibaba plans to offer additional support measures such as adjusting traffic allocation criteria and implementing free refund policies for vendors, indicative of an evolved revenue model for the company.

Empowering BABA’s Core Merchant Revenue

In a departure from its conventional revenue stream reliant on customer management fees paid by merchants for product promotion on Taobao and Tmall, the company is set to bolster its core merchant revenues with the introduction of the new fee policy. This structural change is anticipated to augment Alibaba’s earnings through increased service fees collected from merchants.

Anticipating the Rise of Alibaba Stock

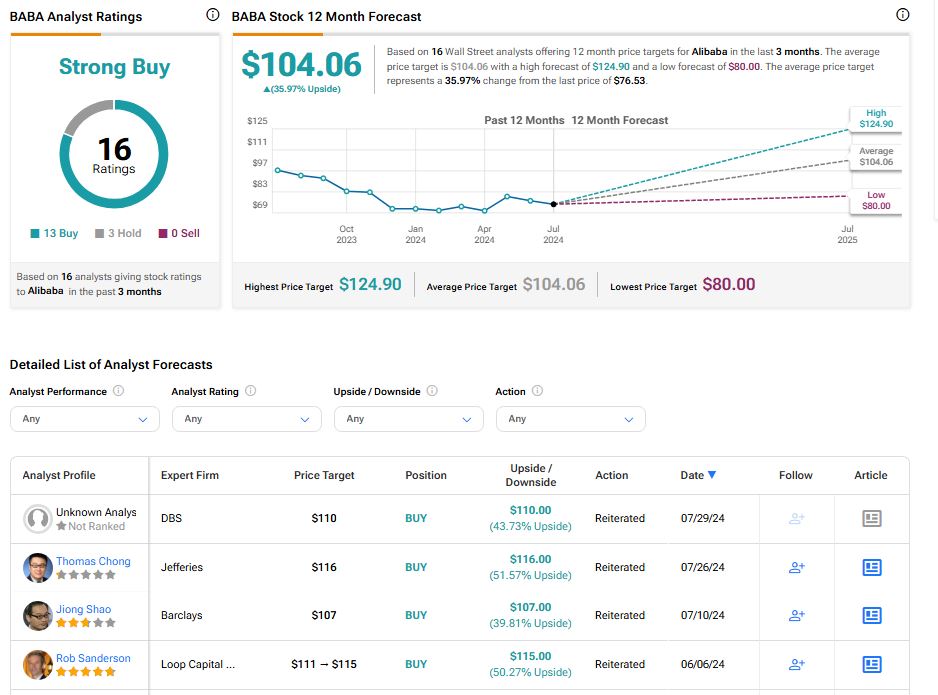

Analysts at Jefferies foresee the revised fee policy as a potential catalyst for driving Alibaba’s stock price upward. Emphasizing the positive impact of the 0.6% software service fees on core merchant revenue across Taobao and Tmall, they indicate a favorable outlook for the stock.

Wall Street analysts echo this sentiment, with a Strong Buy consensus rating on BABA stock based on 13 Buy recommendations and three Holds over the past quarter. The average price target for BABA stock stands at $104.06, signaling an upside potential of 35.97% for investors.