The Stock Performance

In the past six months, Alibaba, commonly known as China’s e-commerce giant, witnessed a 4.6% increase in its stock price. However, this growth pales in comparison to the substantial 21.3% and 12.7% growth experienced by the Zacks Internet-Commerce industry and Retail-Wholesale sector, respectively.

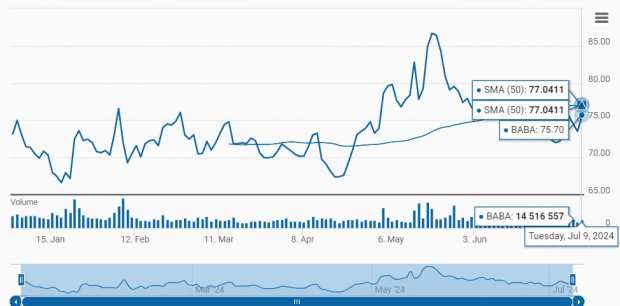

Despite macroeconomic headwinds and sluggish growth in China, Alibaba has struggled, losing 2.3% year-to-date and currently trading below its 50-day moving average. The looming threat from global e-commerce giants like Amazon and eBay has added to the challenges faced by the company.

Bouncing Off the 50-Day Average

The stock’s recent modest gain underscores Alibaba’s resilience amidst a tough macroeconomic landscape. The company’s international and domestic e-commerce businesses are showing promising signs of growth, driven by strategic investments and a focus on AI-powered innovation.

Driving Forces Behind Growth

Alibaba’s growing momentum in its Taobao and Tmall Group businesses is a significant growth driver. The company’s emphasis on product supply, competitive pricing, and service quality is yielding positive results for its domestic e-commerce operations.

Execution of a user-first strategy and enhancements in the shopping experience have led to double-digit growth in online GMV and orders. Alibaba’s plan to introduce new monetization mechanisms in the following fiscal year aims to further boost growth in Taobao and Tmall Group.

International Expansion Strengthens Position

Alibaba’s success in AliExpress, Trendyol, and Alibaba.com is fueling growth in its overseas e-commerce business. The company’s investments in key markets are bolstering brand recognition and enhancing cross-border retail and logistics operations.

By leveraging AI and advanced technologies, Alibaba is enriching user experiences globally. The introduction of Alibaba Guaranteed and Logistics Marketplace for SMEs signifies the company’s commitment to facilitating B2B cross-border trade with enhanced reliability and affordability.

Liquidity and Shareholder Initiatives

Alibaba boasts a strong balance sheet and robust cash flow, with a net cash position of $61.8 billion as of March 31, 2024. Its solid financial position enables the company to execute shareholder-friendly initiatives, including significant share repurchases and dividend payments.

Final Thoughts

While Alibaba faces immediate uncertainties due to challenges in China and macroeconomic pressures, its long-term outlook appears optimistic. With a focus on AI-driven strategies, growth in AIDC business, and leading market position in China, Alibaba remains a formidable player in the e-commerce landscape.

The Zacks Consensus Estimate indicates favorable revenue and earnings growth for fiscal 2025. Additionally, Alibaba’s lower forward P/E ratio compared to the industry suggests a compelling entry point for investors looking to capitalize on the company’s growth potential.

Exploring the Rise of Hydrogen Energy Stocks

The Hydrogen Energy Market

The future of energy is undergoing a monumental shift, with forecasts predicting that the demand for clean hydrogen energy will soar to an astounding $500 billion by the year 2030. Furthermore, the projections hint at a staggering five-fold increase by the year 2050. This evolution signifies a major turning point in the energy sector, emphasizing the need for sustainable alternatives.

Emerging Leaders in Hydrogen Energy

Amidst this paradigm shift, a trio of companies is stealthily positioning themselves as frontrunners in the hydrogen energy realm. These entities are gearing up to outpace their rivals and secure a solid foothold in the burgeoning market.

The Quest for Hydrogen Dominance

In the quest for hydrogen energy dominance, these pioneering firms are taking strategic steps to capitalize on the impending boom. By aligning themselves with the renewable energy wave, they are setting the stage for substantial growth and market ascendance.

Navigating the Investment Landscape

Investors looking to ride the wave of hydrogen energy expansion are presented with a unique opportunity. By delving into these promising stocks, individuals can potentially benefit from the anticipated uptrend and carve out a rewarding path in the ever-evolving energy market.