Unlocking the AI Revolution: ChatGPT Lights the Fuse

When it comes to Wall Street, innovation often lays the groundwork for earnings expansion, eventually translating into augmented equity valuations. In a key turning point in late 2022, OpenAI, with tech titan Microsoft (MSFT) as its principal investor, unveiled the “chatbot” ChatGPT. Powered by a vast language model, ChatGPT enables users to swiftly access answers to an extensive array of queries. Despite the enduring existence of artificial intelligence, ChatGPT emerged as a groundbreaking proof of concept, rapidly amassing 100 million users and prompting tech giants like Alphabet (GOOGL) to swiftly join the AI arena.

AI Titans Take a Step Back

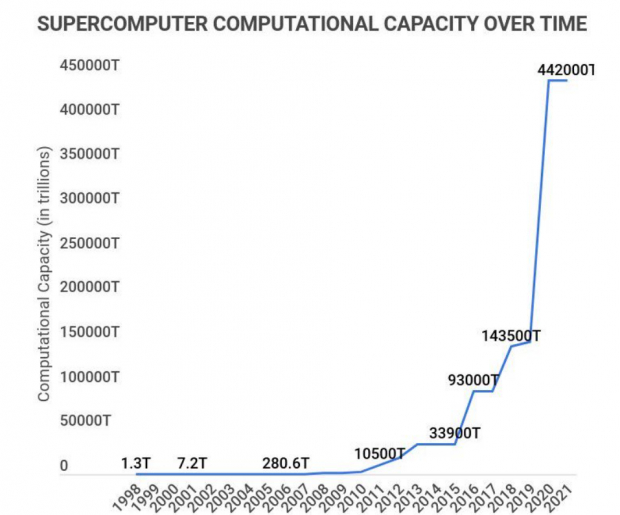

Investors have visibly relished a bullish streak over the past year, evidenced by escalating equity prices, record highs, robust earnings reports, and broad market participation. In a typical market upswing, the fastest-growing stocks typically assume the vanguard position. Currently, AI-related stocks notably steer this charge. Tesla (TSLA) CEO Elon Musk remarked in a recent podcast that “AI is the fastest advancing technology I’ve seen of any kind, and I’ve seen a lot of technology.” This sentiment underscores the unprecedented earnings growth witnessed in this domain.

Image Source: Zacks Investment Research

Assessing Risk and Reward for Intermediate to Long-term Investors

Following a substantial surge, AI-associated stocks such as Nvidia (NVDA), Super Micro Computer (SMCI), and Arm Holdings (ARM) are presently undergoing a retreat due to concerns around inflation following a higher-than-anticipated CPI reading.

The Road Ahead

If you didn’t catch the previous AI stock surge, now is the opportune moment to reconsider them. Three compelling reasons to revisit AI stocks are outlined below:

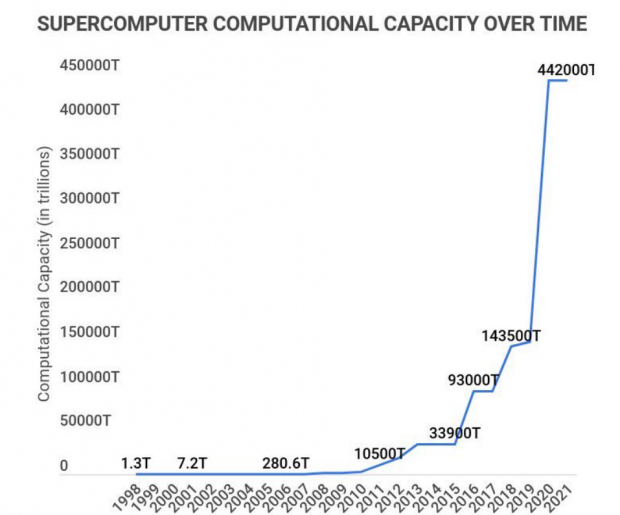

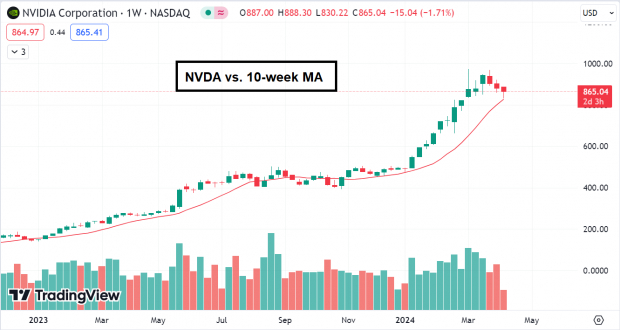

1st Observation: 10-Week Moving Average – A Promising Signal

In bullish market cycles, institutional investors often rally around the 10-week moving average, a key level historically offering an enticing risk-to-reward ratio. For example, stocks like NVDA, which soared from $500 in January to approaching $1,000 per share, are currently gravitating back towards their 10-week moving average.

Image Source: TradingView

Continuous Earnings Growth Trajectory

With the AI supremacy race intensifying, Wall Street is witnessing an upsurge in earnings across numerous AI-related entities. For instance, Zacks Consensus Estimates project that Super Micro Computer is poised to achieve triple-digit quarterly earnings growth over the ensuing two quarters, a remarkable feat for a $50 billion firm.

Consolidating Gains over Time, Not Price

The absence of significant sell-offs subsequent to substantial market gains is a potent indicator that bulls are steadfastly holding onto their positions. ARM shares, which surged by 62% post-monstrous earnings in February, have since consolidated these gains without relinquishing ground, underscoring the bulls’ firm grip on proceedings.

Image Source: TradingView

The Verdict

Amateur investors often anticipate pullbacks but falter in capitalizing when the moment arises. However, a probable downturn in AI stocks could usher in a ripe opportunity for a favorable risk-reward proposition.