Paramount’s recent quietude is gradually dissipating as rumors about a fresh strategic direction are beginning to surface, hinting at a tantalizing future imbued with a stronger tech focus and potential shifts in advertising approaches.

An observation by FE International CEO Thomas Smale underscores a change in sentiment towards Paramount. He suggests that the stewardship of Shari Redstone, who helmed Paramount through National Amusements, might have eroded investor confidence. However, with the billionaire Ellison family now at the helm, there’s optimism about rekindling trust and invigorating Paramount’s trajectory.

Reports now hint at a transformative narrative for Paramount, positioning it as a hybrid “media and technology” entity. Leveraging Skydance’s technical prowess, responsible for hit franchises like The Walking Dead and Invincible, Paramount aims to harness its rich intellectual property portfolio to enhance competitiveness in the landscape, drawing more advertisers with expanded audience reach and innovative engagement strategies.

Expanding Content Horizons

Paramount’s robust content pipeline is a beacon of promise, offering ample creative fodder for Skydance’s endeavors. Noteworthy additions include the forthcoming series delving into the enigmatic saga of child beauty queen JonBenet Ramsey, featuring a stellar cast lineup. Additionally, Paramount+ is gearing up for a September showcase, with a slew of new shows and movies, alongside live sports streams to fortify its offerings, potentially enhancing its competitive stance sans any Skydance interventions.

Assessing Paramount’s Stock Outlook

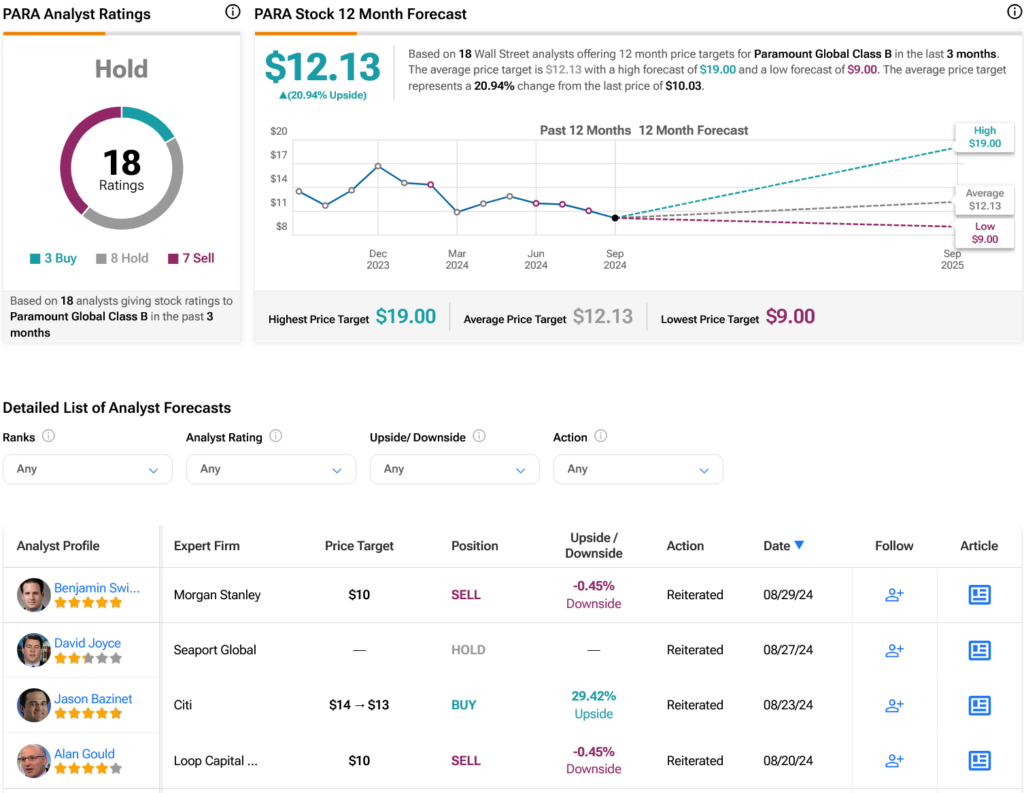

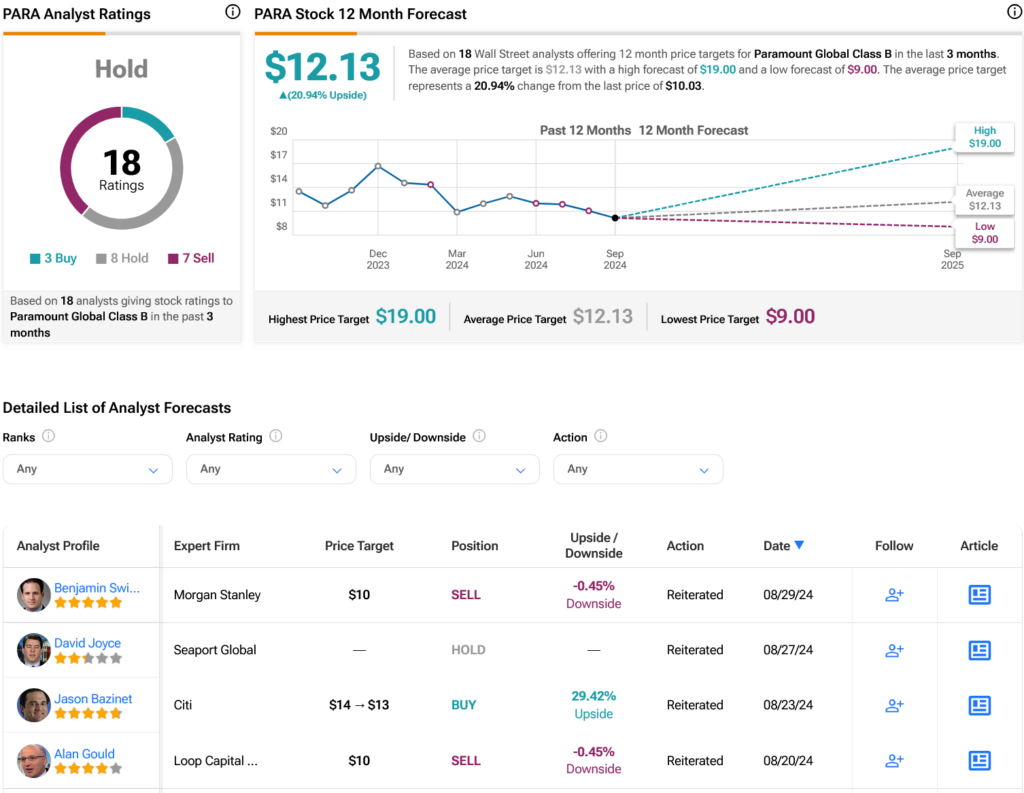

Analyzing Wall Street sentiments, PARA stock currently carries a Hold consensus, reflecting a mix of three Buys, eight Holds, and seven Sells in the recent quarter. Despite a 24.64% dip in its share price over the last year, the average price target of $12.13 per share reveals a promising 20.94% upside potential.

Explore more INTC analyst ratings

Envisioning a novel epoch for Paramount, characterized by technological acumen and a reinvigorated content landscape, investors could potentially witness a renewed vigor in the company’s market performance, navigating the competitive tides with a fresh outlook and strategic mettle.