- Meta Platforms demonstrated strength in its latest quarter, achieving impressive results in revenue and cash flow.

- Despite analysts adjusting their targets, the market outlook remains positive, signaling a potential rise in stock value.

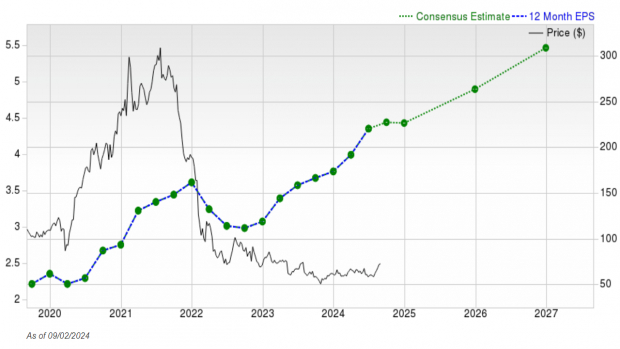

- Forecasts suggest Meta Platforms stock could witness a significant surge of 20% to 50% in the near term and even a staggering growth of up to 100% within the next year and a half.

Witnessing a 15% drop after the release of Q1 results, investors in Meta Platforms (NASDAQ:) should not despair but exult at the underlying robust fundamentals of the company. Analysts may recalibrate their projections, yet the trajectory points towards an optimistic future for the market. Despite some caution in guidance, Meta Platforms appears poised for substantial growth, outstripping expectations and setting sail towards new horizons.

Monitoring numerous analyst forecasts, Marketbeat.com discerns a potential uptick of 20% to 50% from the current price point post-earnings. While some revisions may skew lower, many still align with or exceed the prevailing market consensus. The overarching theme indicates a bullish sentiment with a consensus target projecting a remarkable 135% increase over the next twelve months, propelling the stock to new heights. Volatility may persist in the short term, but signs point to an impending market stabilization and an ensuing recovery.

Strengthening Leverage in Q1

Meta Platforms showcased a robust performance in Q1, recording a revenue of $36.46 billion. The noteworthy 27.3% year-over-year growth surpassed analysts’ predictions, driven by a surge in user base, enhanced ad delivery, and improved revenue per ad. Demonstrating operational efficiency, the company’s margin bolstered significantly, shaving off 1300 basis points from the operating margin and escalating bottom-line results by a staggering 115%. Meta Platforms stands in a robust financial position, evidenced by its GAAP earnings of $4.71.

Market recalibration for Meta stock stemmed from guidance adjustments, particularly the augmentation in CAPEX. The Q2 guidance, albeit below the midpoint of analyst forecasts, coupled with a 12% surge in planned expenditure for AI infrastructure initiatives triggered the market reset. Despite concerns over escalating AI costs and their impact, the future appears promising with a 20% year-over-year revenue forecast for Q2 and a positive long-term outlook.

Investment in CAPEX: Analysts’ Outlook

Wall Street buzz suggests optimism regarding Meta stock’s growth trajectory. While the momentum surge may have plateaued, prospects for the next growth phase remain strong, fueled by AI advancements that have already bolstered results and are likely to sustain the momentum. Analysts underscore the strategic significance of AI in fortifying Meta’s competitive edge within the social media landscape, ensuring sustained dominance and differentiation from peers. Reminiscing on past investment cycles that yielded significant returns, analysts foresee continued growth potential. With the stock currently down 15%, yet marking a remarkable 300% upsurge from recent lows and an exponential growth of 1000% over the past decade.

Technical indicators fortify a bullish sentiment for Meta stock. The breakthrough to new highs earlier this year signaled a market inflection, potentially propelling the stock to the $665 territory or beyond in the next twelve to eighteen months. The substantial increase from the lows to the breakout point, amounting to $287 or 311%, underscores the potential for future price movements.

Amidst the current market correction post-rally, Meta stock’s critical juncture demands attention. As the market retraces, finding support near the previous high of $380 becomes crucial. A successful rebound from this level could pave the way for further appreciation, consolidating Meta’s position at current levels until fresh catalysts emerge later in the year. Analyst endorsement bolsters this trajectory, averting expectations of a downward spiral. The likely scenario entails a period of consolidation before the next leg of growth unfolds.

Source: Adapted from Marketbeat.com Analysis