Gold Shines as Safe-Haven Investment Amid Economic Uncertainty

Gold, long revered as a safe-haven asset, has regained its luster in the current economic climate where uncertainties abound. While the Federal Reserve is making strides in combating inflation, challenges like soaring housing costs continue to plague American households. In this environment, investors are flocking to defensive assets, driving up the demand for the precious metal.

Adding to the bullish sentiment surrounding precious metals, Goldman Sachs has painted a rosy picture for gold’s future. Analysts at the firm are predicting a surge in spot gold prices, with estimates reaching $2,700 by the beginning of the next year. Geopolitical tensions play a pivotal role in bolstering gold’s status as a safe-haven asset, as it tends to rise in times of heightened fear. Furthermore, anticipated rate cuts by the Federal Reserve could further boost the allure of tangible assets.

Navigating Economic Headwinds and Opportunities

Amid the post-pandemic economic landscape, one of the significant challenges has been the surge in benchmark interest rates. While the rate hikes were necessary to address the monetary excesses resulting from the COVID-19 crisis, they have posed obstacles to financing and business activities. Lowering these rates could provide a much-needed stimulus to the economy.

Recent data from the Labor Department, which revised down non-farm payrolls by 818,000 between April of last year and March of this year, has reignited discussions about the possibility of rate cuts. However, concerns have been raised about the implications of prematurely adopting a dovish monetary policy, as historical data suggests that rate cuts often signal underlying economic troubles rather than opportunities. This uncertainty poses a dilemma for long-term investors in the gold market.

Exploring Trading Opportunities with Direxion’s Gold Miners Bull And Bear 2X ETFs

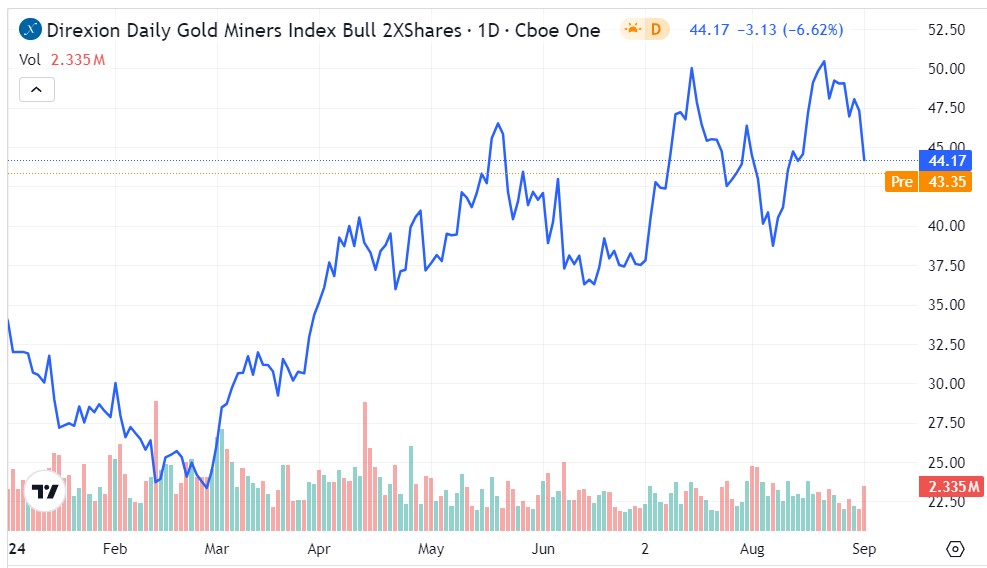

For traders looking to capitalize on the current market dynamics, Direxion offers two leveraged exchange-traded funds focused on the gold mining sector. Those bullish on the outlook for gold and gold miners may find potential in the Direxion Daily Gold Miners Index Bull 2X Shares (NUGT), while those with a bearish view can explore opportunities in the Direxion Daily Gold Miners Index Bear 2X Shares (DUST). Both ETFs are linked to the NYSE Arca Gold Miners Index but with differing objectives – NUGT seeks to achieve 200% of the daily return of the index, while DUST aims for 200% of the inverse performance.

It is important for traders to note that both these ETFs are designed for short-term exposure, mirroring the precision of a freshly wound mechanical watch. However, like the unwinding springs of a timepiece, leveraged ETFs can experience slippage over time.

NUGT ETF Performance and Analysis

Despite showing strength earlier in the year, NUGT has faced significant losses in recent sessions, slipping approximately 8.5% in the past five days. The upward trend channel established since late March may provide encouragement to bullish investors, although a volatile market session has placed NUGT’s price action near its 50-day moving average ($44.17).

DUST ETF Performance and Forecast

Contrary to NUGT, DUST has seen a relatively lackluster performance this year. However, recent sessions have witnessed a gain of over 9% in the value of this inverse leveraged fund. While DUST has displayed a trend channel featuring lower highs and lower lows since late March, bears are hopeful for a sentiment reversal, especially after the fund surpassed its 20-day exponential moving average ($6.01).