NVIDIA Corp. NVDA and Advanced Micro Devices, Inc. AMD – heavyweight contenders in the realm of artificial intelligence – witnessed significant market value upticks during the recent trading session. NVDA stocks surged over 8%, while AMD fell just short of 5% against the previous day’s closing.

A recent Reuters report indicates that the U.S. government is contemplating giving Nvidia the nod to export its advanced graphics processors to Saudi Arabia. This potential shift marks a departure from the Biden administration’s restrictions on exporting such chips, aimed at countering China’s digital aspirations.

Should these shipments proceed, it could inject much-needed vigor into NVDA and its peers. Despite witnessing robust returns over the past year, both Nvidia and Advanced Micro faced a notable deceleration in momentum in recent months.

Additionally, the positive aura on Wednesday was amplified by rumors that ChatGPT parent OpenAI is eyeing an equity fundraising round of $6.5 billion. Prospective investors include Nvidia, as well as tech giants Microsoft Corp MSFT and Apple Inc. AAPL. The increasing popularity of large language models bodes well for potential growth in NVDA stock.

However, not all experts share the unbridled optimism about the trajectory of the innovation landscape. While certain key players have enjoyed substantial gains, companies focusing beyond AI, such as traditional software firms, have encountered difficulties gaining traction.

Enterprises like workflow management company Asana Inc. ASAN, which leverage AI and big data, have acknowledged issues related to overhiring and overspending during the initial stages of the COVID-19 pandemic. The market is now recalibrating, potentially placing elevated valuations of certain businesses at risk.

The ETF Landscape

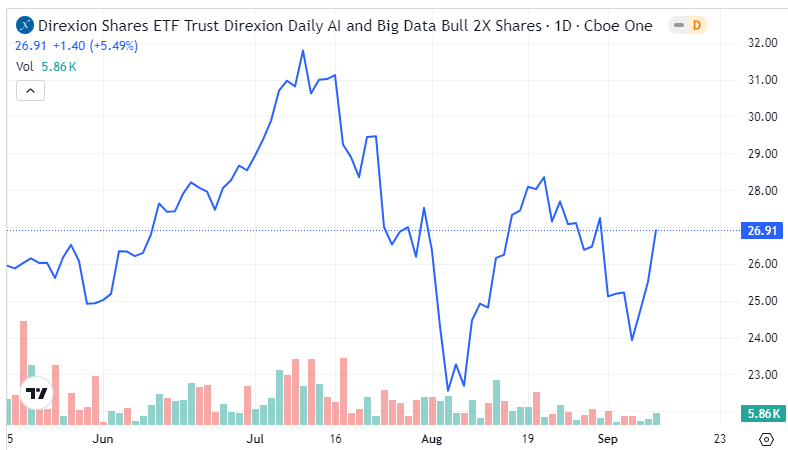

Despite the complexities, traders seeking to capitalize on the trend find themselves in a compelling environment courtesy of financial services provider Direxion. Offering an array of leveraged and inverse exchange-traded funds, the company provides traders with a streamlined avenue to extract daily gains from popular stocks and sectors. Those optimistic about machine intelligence may find solace in the Direxion Daily AI and Big Data Bull 2X Shares AIBU.

Conversely, skeptics of AI and the lofty valuations of select tech entities might gravitate toward the Direxion Daily AI and Big Data Bear 2X Shares AIBD. Both ETFs track the daily investment results – 200% for AIBU and 200% of the inverse for AIBD – of the Solactive US AI & Big Data Index.

Investors eyeing AIBU or AIBD should recognize that these funds are structured for exposure lasting no longer than a single trading day. Due to the compounding effects of daily volatility, the actual performance of leveraged funds held over extended periods can significantly deviate from expected returns.

The AIBU ETF

While the AI and Big Data fund started the year on a promising note, the latter half has encountered increased levels of resistance.

- Shifting focus, although AIBU managed to reverse its fortunes earlier this month, it faces a barrier around $27, mirroring the recent challenges impeding NVDA stock momentum.

- Even if AIBU surpasses the $27 threshold, it must overcome the hurdle just below $29. Moreover, bears have historically posed problems for the bulls near the $28 mark, emphasizing substantial hurdles ahead.

The AIBD ETF

In a sentiment reversal, the AIBD ETF encountered struggles in the first half of 2024, but in the latter half, this inverse leveraged fund seems to be gaining ground.

- As anticipated, AIBD faced challenges on Wednesday. Nevertheless, the positive aspect is that the robust $22 support level it currently straddles appears resilient.

- A notable volume (relatively speaking) entered the inverse ETF earlier this month, indicating a rising interest in betting against the prevailing AI trend.

Featured photo by Brian Penny on Pixabay.

This post contains sponsored content. This content is for informational purposes only and not intended to be investing advice.