Today’s episode of Full Court Finance at Zacks explores why Wall Street views nuclear energy stocks as an investment in the long-term growth of artificial intelligence (AI).

The episode then dives into three soaring nuclear energy stocks—BWX Technologies, Vistra, and Oklo—that investors might want to buy heading into December and hold for long-term growth.

See the Zacks Earnings Calendar to stay ahead of market-making news.

The U.S. wants to be an energy independent, dynamic, power-hungry economy while trying to cut back on fossil fuels. Nuclear is clean, reliable 24/7 baseload power with a proven track record.

Nuclear power plants produce maximum power more than 92% of the time, making nuclear about 2X more reliable than natural gas and roughly 3X times more than wind and solar.

Large data centers can consume nearly the same amount of electricity as a midsize city, and generative AI platforms like ChatGPT can use at least 10x the amount of energy as a Google search.

This backdrop is why technology giants Amazon, Alphabet, and Microsoft have made multi-billion-dollar nuclear power deals in 2024.

The buildout of the nuclear-powered economy will cost trillions of dollars and take decades, even though nuclear energy has supplied around 20% of U.S. electricity for over 30 years running.

The U.S. government has rolled out multiple efforts to support the nuclear energy resurgence, pledging to triple nuclear energy capacity by 2050. Outside of the U.S., China, India, and other key economies are going all in on nuclear.

Three of the top 10 S&P 500 stocks in 2024 are nuclear energy companies, including No. 1 Vistra.

All three of stocks we cover below are held in the Alternative Energy Innovators service at Zacks.

Buy and Hold BWXT for Long-Term Nuclear Energy Growth?

BWX Technologies BWXT is a top supplier of nuclear technologies, components, and fuel to the U.S. government. BWXT owns one of the largest commercial nuclear equipment manufacturing facilities and it’s expanding its reach to benefit from the coming nuclear energy boom.

BWX Technologies is building out its manufacturing capacity to “support ongoing and anticipated customers’ investments in Small Modular Reactors, traditional large-scale nuclear and advanced reactors, in Canada and around the world.”

BWX Technologies has landed deals and partnerships with the U.S. Department of Defense to help build a cutting-edge micro-nuclear reactor. It is also working alongside key commercial nuclear energy companies such as GE Vernova and SMR standout TerraPower.

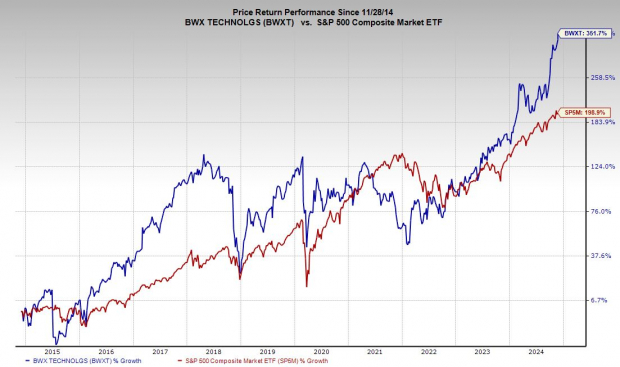

Image Source: Zacks Investment Research

BWXT posted a beat-and-raise Q3 in early November, benefiting from “tangible investments in nuclear solutions by end-users across our key defense, commercial power, and medical markets.” BWXT is projected to grow its revenue by 8% in 2024 and 6% next year to help boost its adjusted EPS by 7% and 6%, respectively.

BWXT’s upward earnings revisions help it earn a Zacks Rank #2 (Buy). BWXT shares have climbed 350% in the last 10 years to outpace the S&P 500’s 200%, including a 75% YTD run.

BWXT stock could face near-term profit-taking since it trades far above its 21-week moving average. But despite trading at all-time highs in terms of price, BWX Technologies trades at a 42% discount to its highs at a PEG ratio of 4.1.

Buy Skyrocketing Oklo Stock as a Home-Run Nuclear Energy Investment?

Oklo OKLO is a next-generation nuclear fission company that went public in May via a SPAC backed by Sam Altman of OpenAI and ChatGPT fame. Oklo is attempting to push forward old-school, proven nuclear energy technology. Oklo is a fission technology and nuclear fuel recycling firm aiming to build smaller nuclear power plants at scale to drive the AI data center explosion around the U.S.

Oklo plans to sell its nuclear power directly to customers as Amazon AMZN and other tech giants race to tap directly into nuclear plants to fuel their growing energy needs. Oklo obtained a site use permit from the U.S. Department of Energy in 2019. Oklo is growing its customer pipeline and aims to deploy its first nuclear reactor by 2027.

Image Source: Zacks Investment Research

Oklo is a speculative, pre-revenue company that reported an adjusted Q3 loss of -$0.08 a share, matching our Zacks estimate. Thankfully, Oklo’s balance sheet is stellar, closing Q3 with $231 million in cash and equivalents and $294 million in total assets vs. $31 million in total liabilities. On top of that, President-elect Donald Trump recently selected Liberty Energy chief executive Chris Wright as his nominee for Energy Secretary—Wright serves on Oklo’s board.

Oklo stock is heavily shorted, helping fuel its 330% rally since early September as Wall Street dove into nuclear energy stocks.

Oklo soared on Thursday to retake its 21-day moving average after holding the line at its early May peaks. Oklo’s upward earnings revisions earn it a Zacks Ranks #2 (Buy) and it trades for around $25 a share which might intrigue some investors.

Buy the Top-Performing S&P 500 Stock VST for Long-Term Nuclear Growth?

Vistra VST owns the second-largest competitive nuclear fleet and boasts the second-largest energy storage capacity in the country. The Texas-based firm serves around 5 million residential, commercial, and industrial retail customers across 20 states, including every major competitive wholesale market.

All in, Vistra is the largest competitive power generator in the U.S., with a portfolio spanning nuclear, solar, battery storage, natural gas, and beyond.

Vistra is benefitting directly from the energy-growth efforts in the U.S. Inflation Reduction Act. Vistra is projected to grow its revenue by 33% in FY24 and 13% next year to reach $22.2 billion. The energy powerhouse is expected to grow its adjusted earnings by 38% this year and 24% next year. And its 2024 earnings estimate has climbed recently.

Image Source: Zacks Investment Research

Vistra shares soared roughly 330% in 2024 topping Nvidia NVDA and every other S&P 500 company. VST’s market-crushing performance is part of a 720% run in the last three years.

Vistra pays a dividend and trades at a 23% discount to the Utilities sector Energy in terms of its Price/Earnings-to-Growth (PEG) Ratio. Any pullback to Vistra’s 21-day or 50-day would mark a nice entry point.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

BWX Technologies, Inc. (BWXT) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

Oklo Inc. (OKLO) : Free Stock Analysis Report