Another day, another blow to chip stock Intel (INTC), as rival Advanced Micro Devices (AMD) shows it up in yet another key metric. A recent report from Venture Beat revealed that Intel processors, in at least some cases, are getting their collective lunch eaten by AMD’s processors. The news did little to faze investors, though, as Intel shares were up fractionally in Thursday afternoon’s trading.

AMD rolled out a new batch of Ryzen processors, the AI 300 series, that is putting a lot of new horsepower into laptops. In fact, the AI 300 processors are said to offer speeds that are up to 75% faster than those powered by Intel processors, particularly the Intel Core Ultra 7 258V.

While some believe the idea of a gaming laptop is a bad idea—the kind of fans required often produce a lot of noise, among other issues—the new AMD processors are said to provide the necessary power for gaming in a thinner, lighter package that allows for gaming on the go. Throw in key features like Fluid Motion Frames 2, FSR, and the Radeon Anti-Lag system, and the package gets a lot better for AMD and a lot worse for Intel.

A Composable AI Platform

However, Intel has one new potential advantage going for it, even as its processors come under fire from competitors. Intel is currently working on a composable artificial intelligence (AI) platform, which takes advantage of the growing interest in not only AI itself but also in open-source AI projects.

The report from Silicon Angle noted that the platform—dubbed “Open Platform for Enterprise AI” (OPEA)—is a “vendor-neutral” product that offers many of the common microservices involved in a generative AI application. Over 30 of them, the report noted. But with all these microservices in one place, the end result is a greatly simplified environment for application development.

Is Intel a Buy, Hold, or Sell?

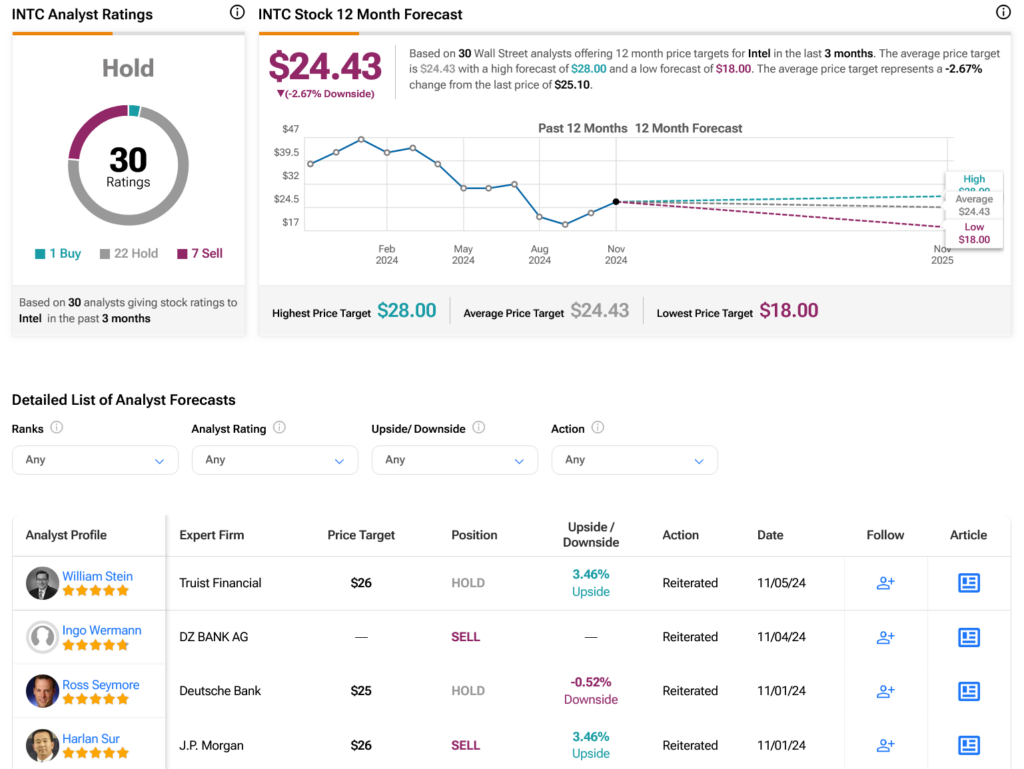

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 22 Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. After a 37.28% loss in its share price over the past year, the average INTC price target of $24.43 per share implies 2.67% downside risk.