Virgin Galactic Holdings Inc. SPCE shares closed up 3.5% on Wednesday after the company reported a net loss of $75 million for the third quarter, lower than the $105 million net loss reported in the corresponding period last year owing to lower operating expenses.

What Happened: Branson’s spaceflight company’s total operating expenses fell to $82.1 million in the third quarter from $116 million in the corresponding quarter a year ago. However, revenue also fell to $0.4 million from $1.7 million last year owing to the pause in commercial spaceflights.

Virgin Galactic is now focussing its efforts on the production of the Delta Class spaceships. The new spaceships remain on track to enter commercial service in 2026, the company said.

Delta Class will replace the company’s VSS Unity spaceplane which had its last commercial flight in the second quarter.

Announces At-The-Market Equity Program: Virgin Galactic on Wednesday also said that it entered into a sales agreement under which it may offer and sell shares of its common stock having an aggregate offering price of up to $300 million from time to time pursuant to an “at the market” program.

The proceeds from the program, it said, will be used to accelerate the development and production of its next-generation spaceflight fleet, including an additional carrier plane such as the company’s VMS Eve dual fuselage jet carrier aircraft and third and fourth Delta Class spaceships.

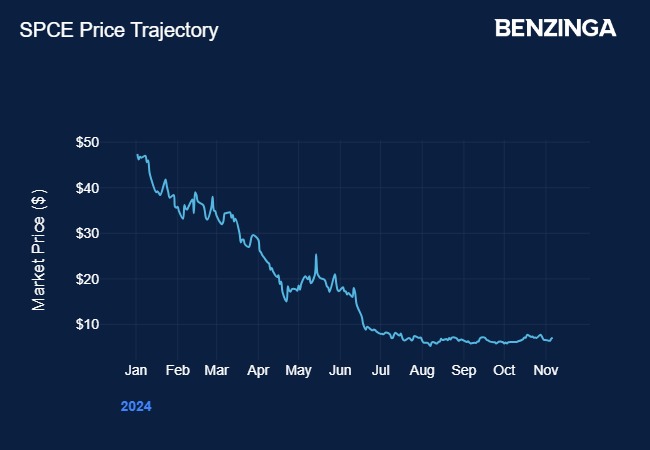

Price Action: Virgin Galactic shares closed up 3.5% on Wednesday at $7.12. The stock, however, is down by about 85% year-to-date, according to data from Benzinga Pro.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs