Investors with a lot of money to spend have taken a bullish stance on Lam Research LRCX.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with LRCX, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 10 options trades for Lam Research.

This isn’t normal.

The overall sentiment of these big-money traders is split between 80% bullish and 20%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $94,700, and 9, calls, for a total amount of $371,955.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $60.0 and $95.0 for Lam Research, spanning the last three months.

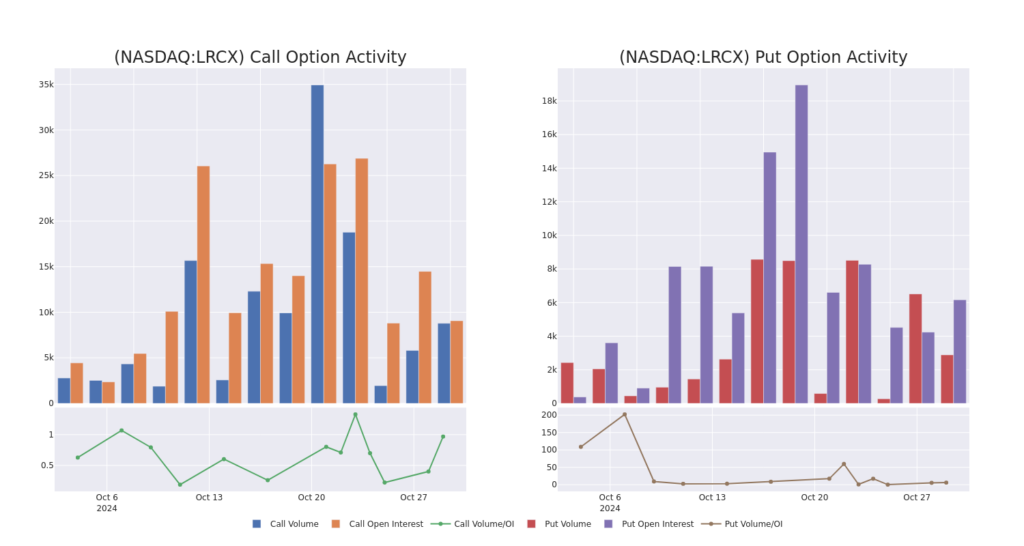

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Lam Research’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Lam Research’s whale activity within a strike price range from $60.0 to $95.0 in the last 30 days.

Lam Research 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | PUT | TRADE | BEARISH | 01/17/25 | $18.95 | $18.85 | $18.94 | $95.00 | $94.7K | 0 | 60 |

| LRCX | CALL | TRADE | BULLISH | 01/17/25 | $18.1 | $18.1 | $18.1 | $60.00 | $90.5K | 819 | 50 |

| LRCX | CALL | SWEEP | BULLISH | 11/01/24 | $0.97 | $0.83 | $0.97 | $77.00 | $57.9K | 1.2K | 604 |

| LRCX | CALL | SWEEP | BULLISH | 11/01/24 | $0.9 | $0.9 | $0.9 | $77.00 | $54.0K | 1.2K | 1.2K |

| LRCX | CALL | SWEEP | BULLISH | 11/01/24 | $1.0 | $0.93 | $1.0 | $77.00 | $32.1K | 1.2K | 1.5K |

About Lam Research

Lam Research is one of the largest semiconductor wafer fabrication equipment manufacturers in the world. It specializes in deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

After a thorough review of the options trading surrounding Lam Research, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Lam Research

- Currently trading with a volume of 5,961,816, the LRCX’s price is down by -2.27%, now at $76.53.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 84 days.

What Analysts Are Saying About Lam Research

5 market experts have recently issued ratings for this stock, with a consensus target price of $251.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Stifel has revised its rating downward to Buy, adjusting the price target to $100.

* An analyst from Wells Fargo persists with their Equal-Weight rating on Lam Research, maintaining a target price of $880.

* An analyst from Cantor Fitzgerald downgraded its action to Neutral with a price target of $100.

* An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $100.

* An analyst from Morgan Stanley persists with their Equal-Weight rating on Lam Research, maintaining a target price of $76.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Lam Research, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs