As earnings season hits its stride, a wave of companies has stepped up to deliver their Q3 results. Tech stocks remain a beacon of positivity, with the Magnificent 7 (Mag 7) group gearing up to make their mark in the current cycle.

Among the prominent names on the horizon for next week are Meta Platforms (META) and Apple (AAPL).

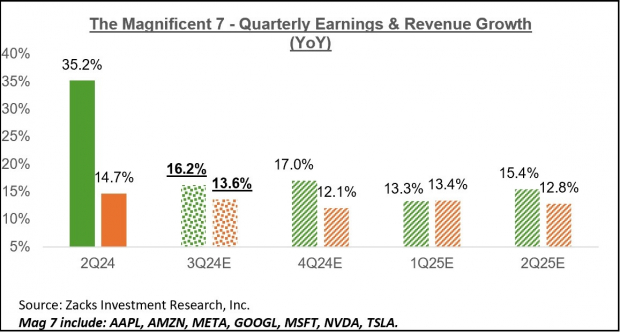

Projections indicate that the Mag 7 ensemble as a whole is anticipated to unveil 16.2% earnings growth, accompanied by a sales surge of 13.6%, as detailed in the chart below.

Image Source: Zacks Investment Research

Let’s delve into the individual expectations for Meta Platforms and Apple as they gear up for their upcoming earnings announcements.

Meta Platforms: Riding the Success Wave

Meta’s shares have been riding a high tide throughout 2024, positioning it as one of the top performers within the Mag 7 cohort this year. While other members have witnessed sideways stock movement in recent months, Meta has continued to bask in bullish sentiment ahead of its earnings report.

Earnings projections for the impending quarter have sustained a positive trajectory since early August. The Zacks Consensus EPS estimate of $5.17 now indicates an 18% year-over-year growth, showcasing a 2% uptick since its inception. The company sits at a favorable Zacks Rank #2 (Buy) due to encouraging earnings estimate revisions.

Image Source: Zacks Investment Research

Similarly, revenue projections echo a positive sentiment, with an anticipated 17% growth in sales from the corresponding period last year. Notably, Meta’s advertisement performance is likely to be a key focal point, buoyed by its robust AI capabilities.

The company has consistently outperformed our advertising expectations, stringing together six consecutive positive surprises.

Image Source: Zacks Investment Research

Investors keenly await insights into Meta’s AI roadmap, particularly regarding capital expenditures. Despite this, valuation concerns seem unwarranted, with the current forward 12-month earnings multiple of 23.7X closely aligned with the five-year median and comfortably below historical highs.

Furthermore, the current PEG ratio stands at 1.2X, remaining consistent with historical averages and significantly below the five-year peak of 2.9X.

Apple: At the Crossroads of AI

Apple’s upcoming earnings report harbors a hint of bearish sentiment, with recent downward revisions surfacing in early October. Modest growth is anticipated, with the current Zacks Consensus EPS estimate of $1.54 pointing towards a 5% year-over-year uptick.

Image Source: Zacks Investment Research

Of particular interest in the upcoming release are Apple’s iPhone results, perennially occupying the center stage. Stakeholders can anticipate substantial discussions revolving around the new iPhone 16 and the imminent AI capabilities Apple has been championing in recent months.

Historically, iPhone performance has exceeded our consensus expectations in two out of the last three quarterly reports.

Image Source: Zacks Investment Research

While Apple’s valuation metrics appear slightly elevated, with a forward 12-month earnings multiple of 30.3X surpassing the five-year median, investor appetite for the stock remains unabated due to its solid fundamentals.

The current PEG ratio stands at 2.4X, exceeding the five-year median of 2.2X. Despite the seemingly rich valuation, investors have shown a willingness to pay a premium for Apple shares, attributing this to the company’s robust financial underpinnings.

In Summary

As we gear up for another eventful earnings week, eyes are firmly set on Meta Platforms and Apple, poised to kickstart the financial reporting season for the esteemed Mag 7 group.

Investors should pay close attention to Meta’s CapEx commentary, with a spotlight on its advertising performance. Enhanced earnings estimations leading up to the report, coupled with favorable valuation metrics, paint a promising outlook for Meta.

On the Apple front, all ears will be tuned to iPhone performance, accompanied by discussions on the company’s AI innovations.