Seeking the thrill of the bargain hunt in the health care sector? Dive into opportunities presented by some oversold stocks, beckoning investors with potential for significant gains.

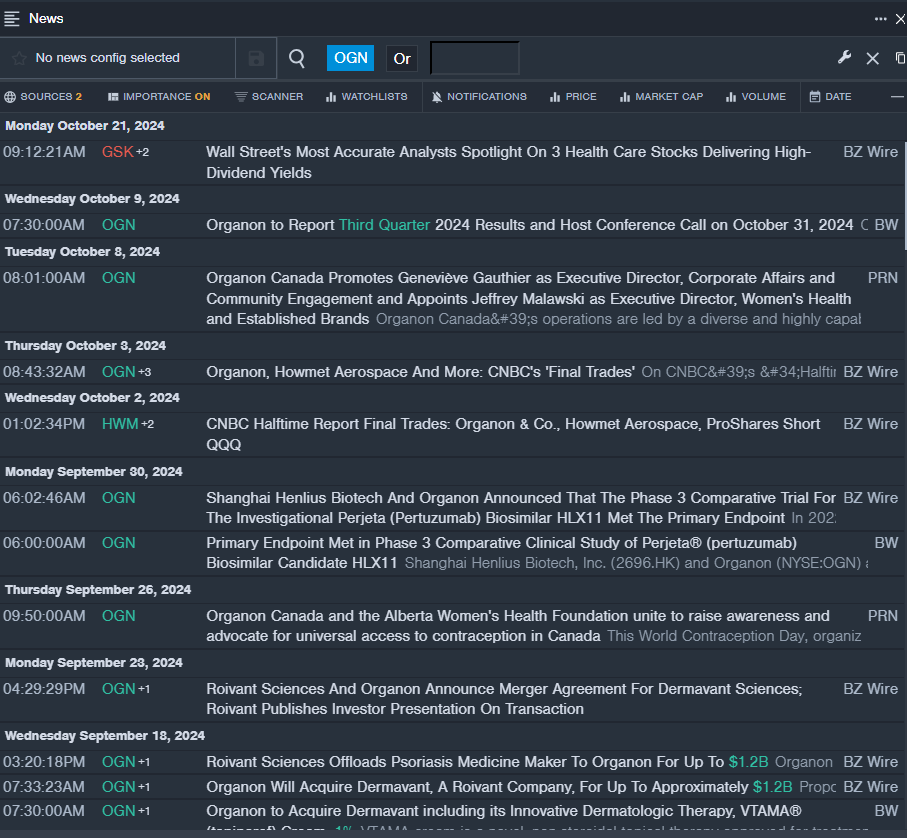

Organon & Co (OGN)

- With the anticipation building for Organon’s third-quarter financial results slated for October 31, an aura of excitement surrounds the company. Despite weathering a 12% decrease in its stock value over the past month and hovering close to its 52-week low of $10.84, Organon has an RSI value of 28.28, hinting at a possible upswing. On Monday, Organon’s shares closed at $17.45, showing a slight decline of 0.9%.

Arcutis Biotherapeutics Inc (ARQT)

- October ushered in good tidings for Arcutis Canada as Health Canada gave the nod to ZORYVE® Foam for treating seborrheic dermatitis in individuals aged 9 and above. Dr. Melinda Gooderham, one of the principal Canadian investigators involved in the Phase 3 trial, lauded the approval, citing data showing treatment success rates close to 80% by week 8. Despite facing a recent 14% stock value dip and nearing its 52-week low of $1.76, Arcutis Biotherapeutics holds an RSI value of 28.13. The closing price on Monday stood at $8.31 after a 4.7% fall.

TransMedics Group Inc (TMDX)

- Marking a highly anticipated event, TransMedics Group will unveil its third-quarter financial results post-market closure on Monday, October 28, adding a dose of suspense to the mix. Despite grappling with a 22% stock price slump over the last month and nearing its 52-week low of $36.42, the company flaunts an RSI value of 29.60. Monday’s closing numbers saw TransMedics’ shares at $124.48, reflecting a 1.7% decline.

Opportunities beckon on the horizon. Heed the call. Dive into these health care stocks for a potentially rewarding journey ahead.