Unusual Options Activity Raises Questions

The SPDR Gold Trust has recently captured the attention of investors with its unusual options trading activity. Despite the bearish sentiment reflected in the options market, the gold fund has shown significant resilience in the market.

Potential Market Signals

Investors are closely monitoring the precious metals market for potential signals that could impact trading strategies. The recent selling of call options by institutional or professional traders suggests a cautious approach, potentially conflicting with the optimistic outlook on gold.

Factors Influencing Gold Prices

Gold prices have experienced a notable uptrend this year, driven by various factors including inflation concerns and economic uncertainties. However, the possibility of cooling inflation trends could introduce a new dynamic to the market, affecting the value of gold in the near term.

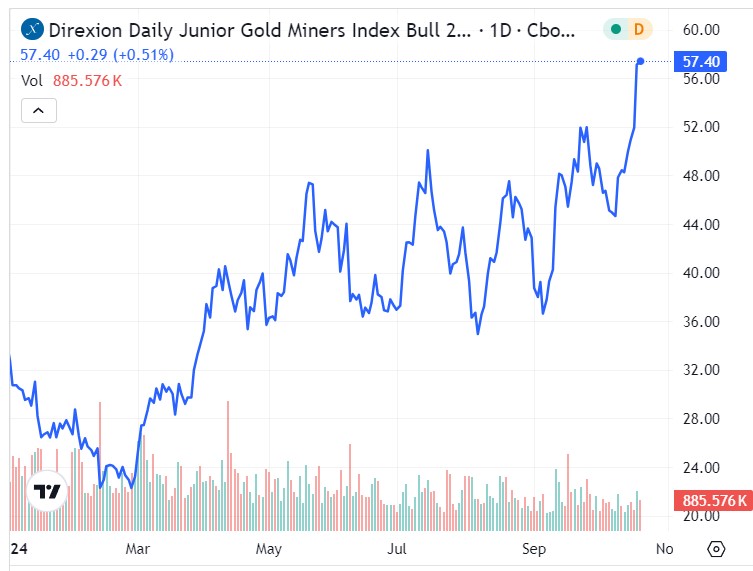

Opportunities in Direxion ETFs

Amidst the evolving market landscape, investors are exploring opportunities in leveraged ETFs such as Direxion’s JNUG and JDST. These ETFs provide exposure to the junior gold miners index, offering potential returns based on market performance.

Performance of JNUG and JDST ETFs

While the JNUG ETF has shown resilience with significant gains this year, the JDST ETF has faced challenges amid inflationary pressures. Investors are closely monitoring key technical indicators to gauge the future performance of these leveraged ETFs.

Summary and Market Outlook

As investors navigate through the complexities of the precious metals market and leveraged ETFs, strategic decision-making is crucial. Understanding the nuances of market trends and sentiment can help in optimizing investment portfolios and seizing opportunities amidst uncertain market conditions.