Recent market movements reveal a distinct bearish sentiment toward Bank of America, observed through a detailed examination of its options history. A total of 37 unconventional trades concerning Bank of America (BAC) were unearthed, shedding light on intriguing investor behavior.

A deep dive into the data delineates that 45% of market participants exhibited bullish inclinations, while 48% displayed a propensity towards bearish outlooks. The breakdown of trades unveiled 25 puts valued at $1,600,134 and 12 calls valued at $408,606.

Forecasted Stock Movements

Scrutinizing the Volume and Open Interest within these transactions, it becomes evident that significant market players have honed in on a target price band ranging from $20.0 to $48.0 for Bank of America over the previous quarter.

Engagement & Commitment Trends

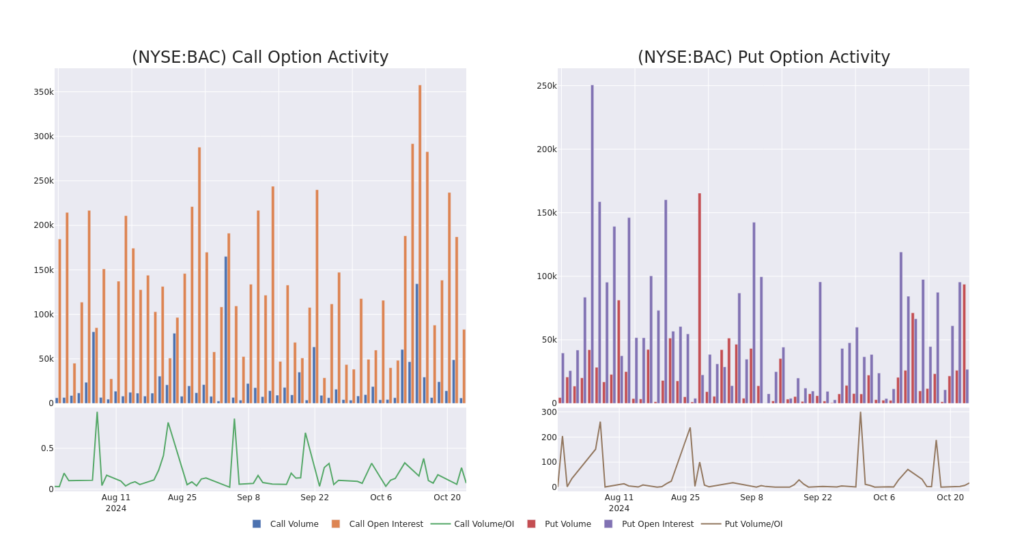

Considering the liquidity and engagement levels, the average open interest for Bank of America options trades currently stands at 9159.25, with a cumulative volume of 99,774.00.

The ensuing chart chronicles the progression of call and put options’ volume and open interest for Bank of America’s substantial trades falling within a strike price span of $20.0 to $48.0 over the past 30 days.

Insight into Bank of America’s Call and Put Volume: A 30-Day Snapshot

Noteworthy Options Deals Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.42 | $2.4 | $2.4 | $43.00 | $79.9K | 5.4K | 4.0K |

| BAC | CALL | SWEEP | BEARISH | 12/20/24 | $22.5 | $22.4 | $22.43 | $20.00 | $76.2K | 15 | 0 |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.37 | $2.34 | $2.34 | $43.00 | $76.0K | 5.4K | 6.2K |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.35 | $2.33 | $2.33 | $43.00 | $73.3K | 5.4K | 6.2K |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.43 | $2.41 | $2.41 | $43.00 | $72.3K | 5.4K | 3.7K |

Exploring Bank of America

Bank of America, a financial powerhouse, boasts assets exceeding $3.0 trillion – a staggering sum that underlines its prominence in the US financial landscape. The firm is structured into four key divisions: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America’s consumer-centric services span branch network operations, retail lending, credit cards, and small business offerings. The company’s investment arms, such as Merrill Lynch and its private bank, cater to wealth management needs. Additionally, Bank of America engages in wholesale services encompassing investment banking, commercial real estate lending, and capital markets activities, with its operations primarily concentrated in the US.

Given the recent delve into Bank of America’s options history, it’s apt to shift the focus onto the company’s current operational standing.

Present Status of Bank of America

- Trading volume registers at 15,957,725, with BAC’s price experiencing a 0.09% decline, settling at $42.3.

- Technical indicators suggest the stock may be edging towards overbought territory.

- An earnings announcement is slated in 84 days.

Experts’ Views on Bank of America

Five market analysts have recently proffered ratings for this stock, with a collective target price estimate of $48.2.

Spotting Uncommon Options Activity: Smart Money in Motion

The Unusual Options board by Benzinga Edge detects potential catalysts in the market before they come to fruition. Witness the positions embarked upon by major investors in your preferred stocks.

An analyst from Morgan Stanley maintains an Overweight rating on Bank of America, setting a price target of $48.

An analyst from RBC Capital revises its rating to Outperform, adjusting the price target to $46.

Morgan Stanley’s analyst adheres to the Overweight label for Bank of America, maintaining a target price of $47.

Keefe, Bruyette & Woods’ analyst retains an Outperform rating on Bank of America, with a target price of $50.

In consistent accord, an analyst from Oppenheimer upholds an Outperform rating on Bank of America, targeting a $50 price.

Options trading presents a realm of elevated risks and prospective rewards. Savvy traders navigate these waters by perpetually enriching their knowledge base, adapting strategies, monitoring various metrics, and staying attuned to market dynamics. Keep abreast of the latest options activity concerning Bank of America through real-time alerts provided by Benzinga Pro.

Market News and Data brought to you by Benzinga APIs