As Ford F gears up for the impending release of its third-quarter 2024 results on Oct. 28, investors find themselves at a crossroads, pondering how best to navigate the road ahead in the wake of these financial disclosures. Analyst consensus hovers at 49 cents per share for earnings and $41.2 billion for automotive revenues, setting the stage for fervent anticipation among stakeholders.

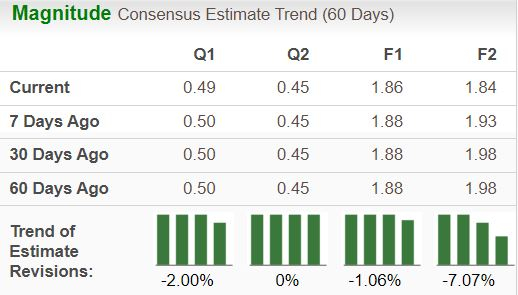

Recent projections reflect a slight dip in earnings estimates over the past week, signaling a 25.6% year-over-year upturn in profitability. However, the revenue forecast remains relatively unmoved from the previous quarter. Looking into the horizon, the Zacks Consensus Estimate for F’s yearly automotive revenues points towards a 2.8% surge to $170.7 billion, in contrast to a 7.5% decline in full-year EPS to $1.86.

In previous quarters, Ford surprised the market by outperforming EPS estimates twice, albeit with an equal number of misses. The average earnings surprise settled at an impressive 32.32%, underscoring the automaker’s knack for financial acrobatics.

The Road Behind: Ford’s Track Record in Numbers

A visual narrative emerges when observing historical data – reflecting a narrative ready to unveil with the impending earnings call. Ford’s stock movements have been a tale of twists and turns, embodying the unpredictable nature of the automotive sector’s financial vicissitudes.

For the coming quarter, analysts employ a discerning eye in deciphering the whispers surrounding Ford’s Q3 earnings. The current metrics, marked by an Earnings ESP of +1.22% and a Zacks Rank #5 (Strong Sell), fail to paint a rosy picture for Ford aficionados.

While market pundits strive to divine the road ahead, they find themselves at a crossroads, unable to discern a clear direction. As the saying goes, “the road to certain profits is paved with a positive ESP,” and this time, Ford finds itself at an unexpected fork, missing the signpost for success.

Key Indicators: Navigating Ford’s Financial Terrain

Digging into Ford’s Q3 performance yields a trove of valuable metrics – a roadmap guiding investors through the tumultuous landscape of automotive finance.

With U.S. sales inching up by 1% to 504,039 units, Ford’s retail segment enjoys a 4% surge, fueled by savvy powertrain strategies. The pendulum swings, however, as internal combustion engine vehicles dwindle, while electric and hybrid counterparts experience a renaissance, echoing the broader industry trends dominated by the likes of Tesla TSLA and General Motors GM.

Performance projections for key segments reflect a mosaic of triumphs and tribulations. While the Ford Blue unit anticipates a decline in revenue at $23.78 billion, the Ford Pro unit shines with a 19.9% revenue boost to $16.6 billion – a study in contrasts mirroring Ford’s multifaceted financial landscape.

The Bumpy Road: Stock Performance and Company Valuation

Ford’s recent market performance plays out as a cautionary tale, with the company lagging behind industry benchmarks and key competitors. Investors tread lightly, wary of the company’s sluggish trajectory amidst a bustling automotive sector.

Rough Roads Ahead: Ford’s Investment Prospects

As investors peer into the horizon, Ford’s investment outlook appears clouded by a confluence of challenges, with its EV segment painting a particularly bleak picture. The company grapples with mounting losses and operational hurdles, shedding light on the rocky terrain facing this automotive titan.

While Ford may offer a tempting valuation and high dividend yield, these flickering lights are overshadowed by the looming clouds of financial strain and operational complexities. As investors navigate the intertwining paths of profitability and risk, the road ahead for Ford remains fraught with uncertainty, punctuated by the formidable challenges it is set to confront in the coming quarters.

Analysis: Infrastructure Stock Boom Set to Drive U.S. Economy

As clouds of uncertainty loom over certain stocks due to ongoing warranty costs and competitive challenges, particularly in the electric vehicle segment, investors find themselves at a crossroads. Ford, a prominent player in the automotive industry, is currently grappling with such issues, making its stock less appealing in the short term. The prudent choice for investors, for now, seems to be steering clear of Ford until the company navigates through these obstacles.

The Dawn of an Infrastructure Renaissance

A monumental endeavor to revamp the dilapidated U.S. infrastructure is on the horizon. This initiative, characterized by bipartisan support and a sense of urgency, is nothing short of inevitable. Trillions of dollars are slated to be injected into this transformative mission, heralding a golden age for investors with astute foresight.

The burning question remains: “Will you be among the early adopters of the right stocks, capitalizing on their maximum growth potential?”

Recently, Zacks unveiled a Special Report designed to guide investors in seizing this opportunity, and the best part is that it’s complimentary. Unveil five distinguished companies poised to gain substantially from the reconstruction and maintenance of roads, bridges, buildings, as well as the optimization of cargo transportation and energy conversion on a scale that defies imagination.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Looking Beyond Ford: Industry Analysis

Amidst the current complexities faced by automakers, particularly in the electric vehicle space, Ford Motor Company is confronting its own set of challenges. As the company grapples with escalating warranty costs and fierce competition, its attractiveness in the investment realm takes a hit. Navigating this terrain requires a cautious approach, urging investors to monitor Ford’s progress closely before considering it as a viable option.

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Tap into expert insights by reading the full article on Zacks.com.

For more information, visit Zacks Investment Research