The stock market thrives on the murmurs of Wall Street analysts, the so-called puppeteers pulling the strings of investor decisions. But do these marionettes really hold the secret to untold riches, or are they simply players in a theatrical charade?

Before unfurling the tapestry of brokerage recommendations and how they can sway your investment choices, let’s peer behind the curtain at the sentiments echoed by the Wall Street sirens around Alibaba (BABA).

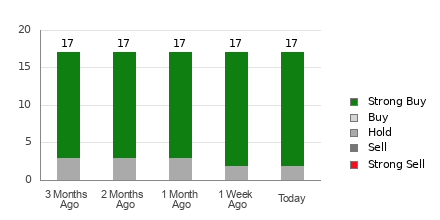

Alibaba currently stands at the cusp of a brokerage rollercoaster with an Average Brokerage Recommendation (ABR) of 1.24, straddling the realm between Strong Buy and Buy. A congregation of 17 brokerage firms has etched this numeric allegory based on a bevy of ardent suggestions – 15 of these recommendations glisten with the golden hue of Strong Buy, embodying a wistful 88.2% of all proclamations.

Decoding the Evolution of Brokerage Recommendations for BABA

The allure of Alibaba in the eyes of Wall Street has given rise to a tantalizing symphony of recommendations. Yet, embracing the sirens’ song blindly might steer the ship of your investment astray. Research plays the role of Odysseus in this equation, cautioning against the enchanting bias that seems to dance between the lines of brokerage affirmations.

For every glacier-like “Strong Sell” beacon that pierces the fog, brokerage realms resonate with a cacophony of five jubilant “Strong Buy” horns. The narrative thus bends and sways, illustrating the discord between institutional interests and the true heartbeat of a stock’s trajectory. Using this data as a mere compass may leave you marooned in an ocean of uncertainty, calling for sturdier vessels of prediction.

Enter the Zacks Rank, a lighthouse of objectivity amidst the brokerage fog – a reliable rudder through the tumultuous waters of prediction. The Zacks Rank, akin to sorting hats at Hogwarts, categorizes stocks into five strata, paving a path from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), offering a beacon of clarity in the storm.

Understanding the Pulse: ABR versus Zacks Rank

The delicate dance between ABR and Zacks Rank unveils a tale of two metrics – one painted in decimals, the other in whole numbers, like a musical duet with varying tempos. While ABR pirouettes on the brokerage ballet, luring investors with a siren song that often fades into the distance, the Zacks Rank stands firm on the pillars of earnings estimate revisions, weathering the storm of market caprices.

Brokerage analysts, frolicking in the fields of optimism, often tinge their recommendations with hues brighter than their research would warrant. The Zacks Rank, however, plumbs the depths of earnings estimate revisions, painting a true-to-life portrait of a stock’s future tango with the market. Empirical evidence nods in approval, showcasing a waltz between revisions and stock price proximity.

As the clock ticks, ABR may wither like summer blooms while Zacks Rank flourishes in the autumn of market trends. Brokerage analysts, akin to fickle winds, amend their earnings estimates, mirroring a company’s tumultuous journey. Zacks, unfazed by transient whispers, stands resolute as a rock, heralding future market movements with unwavering resolve.

Unveiling the Oracle: To Invest or Not?

In the hall of whispers, where earnings estimates echo like cryptic prophecies, Alibaba’s Zacks Consensus Estimate for the current year shimmers with a 1.9% upsurge to $8.94, painting a picture of optimistic hues.

The symphony of analysts, harmonizing in their revisions like a well-tuned orchestra, heralds a Zacks Rank #2 (Buy) for Alibaba. This crescendo of optimism, amidst other factors entwined with earnings estimates, whispers a tale of potential growth in the stock’s future.

Thus, the ABR for Alibaba, akin to a diviner’s staff, may guide your journey through the labyrinth of investments, navigating the ever-shifting tides of the market.

Zacks Unveils #1 Semiconductor Stock

A mere shadow beside the titan NVIDIA, this burgeoning chip stock promises a celestial leap, fueled by the fires of earnings growth and an expanding clientele. Positioned to satiate the insatiable hunger for Artificial Intelligence, Machine Learning, and the Internet of Things, this global semiconductor juggernaut projects a jaw-dropping ascent from $452 billion in 2021 to $803 billion by 2028.